For over seventy years, India’s labour laws have promised security but delivered it to barely ten percent of the workforce. The Four Labour Codes consolidated statutes, but left the core tensions unresolved—litigation, rigidity, contract labour exploitation, and employer hesitation to scale.

Prologue: The rationale for OLC

In a previous article (which may be viewed at https://gfilesindia.com/labour-law-reforms-a-lost-opportunity/) I had stated why I believe that the Four Labour Codes (FLCs) are unlikely to resolve the difficult issues we face with our labour laws and had lamented that we had not been brave and made a paradigm shift in our approach to them. In this one I suggest a radically different model and propose that we try this at least as an experiment.

As noted, the FLCs seek not to reform but mainly to consolidate 29 labour laws into 4 codes. While they do raise the threshold for permissions for retrenchment / closure from 100, but only to 300 workers. This is not enough for making manufacturing competitive at global scales. Yet, legal challenges to all retrenchments / closures would continue as before.

Even this effort of consolidation has presented several difficulties. For instance, the attempt to standardise the definition of “wages” has made the new definition extremely complex, and the mechanism for its recovery is ridden with difficulties. In some respects, the changes would even apply retrospectively. Rather than reduce, they are likely to lead to a lot of fresh litigation.

But on a more fundamental level, what do these FLCs indicate to be the future of employment and industrial relations? The two main new ideas in them are to expand the scope of contract labour and to permit employers to hire employees on fixed term contracts (there are some proposals to expand the scope of these laws to cover certain other workers also but until we know how and when they are proposed to be implemented it is not useful to consider them).

It was to get over the problem of not being able to easily fire workers, that employers resorted to contract labour. However, contract labour is poorly treated, and their engagement leads to enormous litigation between the employer, the contract labour, and the PF and ESI departments. Why expand this exploitative system, to fight which employers engage auditors, managers, and lawyers at substantial cost? And what about the cost that all this adds to every product?

On the proposed fixed term contracts, there are no guidelines on their implementation. Consequently, there will likely be enormous litigation over them, and most employers will likely resort to contract labour until there is greater clarity.

Hence, the FLCs will not solve the problems that stop us from becoming a manufacturing powerhouse. For that we will need to resolve the issues that discourage manufacturing at scale by boldly reimagining our labour laws.

The OLC is such an attempt. While it imposes some higher initial costs, employers may think of them as offset by the savings from having to hire auditors, managers, lawyers, and the margin of the contractor with GST thereon, and the cost of litigation. Since they forbid an employee who works for such an employer from litigating over most issues, they will also remove a huge burden from our legal system.

This article seeks to radically reimagine our labour laws into One Labour Code which secures and exceeds, all the minimum conditions of service currently prescribed by all the labour laws, in a manner that is easy of administration, inspires confidence in all parties and makes most disputes redundant. The trade-off for the workers is security of service that the law currently seeks to give but which, for most, is just a chimera. The big payoff for management is the unquestioned right to hire and fire which they have always desired but never had.

It is not necessary to list all the laws that currently apply to various establishments (and they are already mentioned in the FLC, but in addition to them are the Shops and Establishment Acts that almost each State has and which also apply to several establishments, and which would also be subsumed by the Code proposed hereunder) but to examine the major benefits conferred by them and which may be summarized thus:

A. security of service,

B. minimum wage,

C. provident fund (social security for retirement),

D. bonus,

E. notice pay and compensation on retrenchment (social security on being rendered unemployed),

F. gratuity after 5 years of service (social security),

G. medical treatment and payment of compensation during illness (health insurance),

H. compensation for employment injury, disease, or death (insurance),

I. maternity benefit to female employees,

J. conditions of service such as age of retirement, definition of misconduct and procedures for domestic enquiries etc.,

K. minimum leave and holidays, weekly rest day, overtime payment etc.,

L. some minimum benefits for contract and migrant labour,

M. imparting training to apprentices without any obligation on the employer to give employment thereafter,

N. protection against victimisation for union activities.

Except for the first, the proposed law seeks to ensure all these conditions of service through one administrative machinery. (Under the proposed mechanism, the last, i.e. protection against victimisation for union activities, would be rendered unnecessary.) It would leave nothing in the hands of the employer, thereby making it unnecessary for the employee to have to pursue him during or after his employment has ended. It will be shown that this law would effectively also ensure security of service for the vast majority, not as a compulsion for the employer, but as an incentive, and since workers’ rights would have been secured, unions would not be required (to fight for them).

COVERAGE

Employers and employees who would be covered

In the first instance, this law would be applicable only by choice of parties (and the FLCs would apply only to those that choose not to be governed by this law). It would apply when an employer makes a declaration to that effect to the statutory authority prescribed thereunder.

Effective immediately, he would have to hire all new employees only in accordance with this law (even those belonging to very senior management), and all other labour laws (i.e. now the FLCs and the respective Shops and Establishment Acts of all States, as also certain judicially developed principles such as on withdrawal of resignation, retirement during disciplinary enquiry, abandonment of service) will cease to apply to these new employees. However, all existing employees would continue to be governed by the old set of laws (FLCs and the Shops and Establishment Acts) and the original contract of service. (A mechanism has also been proposed later herein for applying the proposed new law to existing employees also.) Therefore, only those persons who agree to be employed on such terms would get employed by such an employer. Since even very senior management employees would be covered, it would be unnecessary to define a “worker”.

Consequently, disputes over whether someone is or is not a “worker” that would vanish. Here it may be mentioned that the Code on Wages (which is part of the FLCs) introduces some doubt whether employees other that “worker(s)” could file claims for wages / benefits thereunder, and this is purely due to poor drafting.

Such an employer may employ workers through contractors who are covered under this law and who depute only those persons who are covered under it. Since it is the same conditions of service that they would receive under the “principal employer” also as they would receive from the contractor, there would be no need for such persons to seek employment under him. Consequently, these workers would not be allowed to raise any issue with the “principal employer”.

This would eliminate all disputes between “principal employers” and “contractors” and their “workers”.

By the same logic, since the “principal employer” would not have to give any additional benefits to new employees (than what the contractor would give), there would be no financial incentive to employ them through contractors. Consequently, most such employers would choose to employ new employees directly (and such employees would have no occasion to even have to seek employment under it). Thus, the pernicious practice of employing workers through contractors in order to keep them at arm’s length would die out.

REMUNERATION AND OTHER CONDITIONS OF SERVICE

Fair Wage

The starting point is a Fair Wage which would be 20% above the minimum wage. There would be only one Fair Wage for each region which would not vary according to the “appropriate government”, and it would be announced at least one month in advance and be revised every six months to be co-terminus with the calendar month. So as not to duplicate this work across legislation, the minimum wages notified by the central government for unskilled workers can be adopted with the caveat that it would be notified one month in advance to be co-terminus with the calendar month. The caveat would also help establishments that come under the FLCs to plan their transitions.

Remuneration

Except as stated later, the employer would pay all benefits on the full amount of the “Fair Wage”. For the purpose of illustration, let us take a minimum wage for unskilled workers notified by the central government for a region as 10,000 Units per month. The Fair Wage would be 12,000 Units per month. The employer would pay three months’ Fair Wage towards notice /notice pay to those workers who have completed at least three years in service and pro rata to those who have completed less. (Three months’ notice is presently required by those undertakings that employ 300 or more workers and are required to obtain permissions for closure / retrenchment and is the highest prescribed under any law. While this benefit is extended across the board to all establishments, the caveat is that workers who have not completed even three years would not receive the full three months’ notice pay.) He would also contemporaneously pay amounts to cover his highest liability towards all presently prescribed statutory benefits.

Hence, the employer would tender the following annual payments:

- 144,000 – Fair Wage

- 28,800 – bonus (@20% i.e. maximum bonus)

- 17,280 – PF contribution (@12%) – the employee’s contribution of 17,280 will be from his own wages

- 6,923 towards gratuity (Fair Wage x 15/26)

- 6,923 towards retrenchment compensation (RC)

- 12,000 towards notice pay (in each of the first three years) (NP)

- 12,000 towards Fair Wage in lieu of 30 days leave (all kinds combined)

It would be observed that the amount of bonus has been pegged at the highest prescribed by law. Thus, there would be no dispute over whether there was “available surplus” / “allocable surplus” to justify a higher payout, and how much it should have been. Furthermore, there would be no dispute over whether a particular undertaking was entitled to compute its liability independently of the entire organisation.

Thus, what an employee would get from his employer during the full year is a total 227,926 Units for the first three years and 215,926 Units/ year thereafter.

Benefits (bonus, PF, gratuity, RC, NP and leave encashment)

These amounts would be paid proportionately every month (18,994 Units per month for the first 3 years and 17,994 Units per month thereafter) into the employee’s designated bank account (linked to his Aadhar card) by direct transfer and would be separated by the bank into separate sub-accounts for Wages, PF, Bonus, Gratuity, Leave, Notice Pay (NP) and Retrenchment Compensation (RC).

Only the Wage sub-account would be drawn by the employee. The rest of the amounts would accumulate and earn interest during the tenure of his employment and may be withdrawn at their appointed times (as indicated later).

Having been paid for leave, the employee will not get any paid leave. He may, whenever he so chooses, take such number of leave as he wishes, subject to a limit (suggested at 60 days which would mean 30 days more than the normally permitted 30 days of leave, inclusive of intervening off days and holidays but not those at either end) Beyond such limit the employer would be permitted to draw a presumption of abandonment of service by the employee without the necessity of giving notice. (The requirement of notice / enquiry introduced by the courts is unsuited to our conditions. Employers are unnecessarily burdened with procedural requirements that increase administrative and legal costs. We should instead encourage practices that obligate employees to also maintain some level of discipline.) For the number of days that he stays on leave, the employee would lose his salary (consequently also benefits) pro rata. The procedure for availing leave would be prescribed in the Rules and would require a minimum notice (unless it is for sick leave). Once applied for, if the employer wishes to reject the application he must do so within a prescribed period.

These accounts would be administered only by Scheduled Banks. The cost of administration is estimated to not exceed 2% of the monthly Fair Wage (2,880 Units per year) and would be paid by the employer and shared between the employer’s Bank and the employee’s Bank in a prescribed manner.

With these payments the employee’s bonus (@20%), PF, gratuity, RC, NP and leave encashment would have been secured at the highest levels currently prescribed by law, thereby insulating him from fluctuations in the employer’s fortunes.

Insurance and annual health check-up

The employer would be required to compulsorily procure an insurance policy covering all accidents, injuries, and diseases (and not only those arising “out of and in the course of employment”) that would assure to each worker the sum as prescribed under the Employees’ Compensation Act / Employees’ State Insurance Act on the Fair Wage. Under the ESI Act the total (employer + employee) contribution used to be 6.5%. On the Fair Wage this comes to 9360 Units per year. This insurance policy would also cover an annual health check-up (prescribed for the first time under the FLCs). Thus, the expense towards insurance is estimated as 10,000 Units per annum.

In the event of a claim the payment would be made by the insurance company into the employee’s bank account (or of the nominee). If there is a dispute, it would be between the employee and the insurance company and the employer would, at best, be required to give evidence. Furthermore, at the most the dispute would be about whether an injury / disease had indeed been caused, and its effect, and not whether it was arising “out of and in the course of employment”. Thus, a major point of dispute would be removed.

If the employer terminates the services of an employee before the coverage period is over, the employer will lose the amount paid towards insurance for the remaining period while the insurance cover to the employee would continue for the balance period. An employer who takes into employment a worker whose policy has already been partly paid for by a previous employer need not pay any amount towards insurance for the balance period of coverage. (To encourage them to offer employment, perhaps employers could be allowed to pay insurance premiums for new hires for the first year on monthly basis.)

A case can be made out for increasing the insurance cover for employees based on their total compensation, instead of on the Fair Wage. While that is eminently desirable, in this article that is not considered so that a comparison can be made with existing provisions, as also because what is being recommended are minimum benefits. It will always remain open to employers to extend better benefits if they so choose. It is also hoped that if this model works out, a higher cover would be provided at some stage that better reflects the true loss of earnings of a worker to their families.

Here it may also be noted that insurance companies examine the history of their clients while fixing premiums. Consequently, a good safety record would help the employer keep their premiums down and this of itself would encourage better safety practices. It would also be eminently desirable that employers are permitted to obtain such policies from private insurance companies instead of paying contributions to the ESI Corporation which does not enjoy a very good reputation. Perhaps standard insurance policies could be developed and all insurance companies mandatorily required to make them available as options for employees to choose, and in which case even employees could choose their own insurance companies.

Bonus

At the appointed time every year (Diwali / Christmas / Eid or other time as indicated by each employee), whatever money is in the Bonus sub-account would be transferred to the Wage sub-account permitting the employee to withdraw it. Consequently, the employee would receive bonus proportionate to the period he has served. He would be permitted to instead transfer it to his PF account (and hence to take it at retirement).

Gratuity

At the end of every five years, whatever money is in the gratuity sub-account would be transferred to the Wage sub-account permitting the employee to withdraw it (which they may instead transfer it to their PF account and to take it at retirement). Consequently, the employee would receive gratuity no matter how long he remains in service (and he would not have to be in service for five years with the same employer) and there would be no ceiling on the sum he may receive. Hence, someone who works all his life with the same employer would not be at a disadvantage.

Leave

Having already been paid for leave, the employee can withdraw the money in this sub-account at a fixed time of year as per his choosing (or to transfer it to his PF account and to take it at retirement).

Treatment of NP and RC

An employee whose services are retrenched would forthwith become entitled to receive all the money in the NP and RC sub-accounts. Thereupon, monthly amounts equal to the then prevalent Fair Wage would be transferred from these sub-accounts into his Wages sub-account which he can withdraw. After these sub-accounts have been exhausted (if he is still unemployed) the other sub-accounts (such as bonus, PF, gratuity) can be used to transfer to his Wages sub-account to allow him to survive. At the point that he finds employment the balance in the NP and RC sub-accounts would be transferred to his PF account.

However, if the employee retires from service on reaching the age of retirement, the money in the NP and RC sub-accounts would be paid back to the employer. This would therefore be an incentive for the employer to retain the employee till his normal date of retirement.

Age of retirement

Under most Model Standing Orders the age of retirement is presently 58 years. While this may be reconsidered given the progress in human life expectancy and nutrition, since this article also has a proposal for the re-employment of retired persons, whether it would be better to allow employers to retire employees and re-hire them may also be considered. Given that this is a time when we can leverage our demographic dividend, perhaps it would be better to adopt a policy that encourages a younger workforce while providing avenues for the re-employment of older people. However, the computations in this article are based on an age of 58 years and if this age is increased, the accumulations at retirement would be even higher.

Pension

Currently pension is paid by taking a portion of the Provident Fund contributions to the pension account. This is counter-productive since it adds to administrative costs thereby reducing the real benefit. It is suggested that all employees be given an option of either receiving in lumpsum all PF accumulations (with interest earned thereon) at the age of 58 years or to receive from that time onwards a sum equal to the then prevalent minimum wage until the accumulation in that fund is exhausted. This also insulates the government from having to pay unreasonable sums towards pension if the interest earned on this money does not meet up to expectations due to the slowing down of economic growth (which is bound to happen as we approach a developed economy status).

Maternity benefit

The Maternity Benefit Act requires employers to pay maternity benefit to employees who have worked only 80 days. This is sometimes abused by women. Naturally, this dissuades employers from employing women who are expecting or are likely to do so.

The better course seems to be to make maternity benefit neutral to the employer. This could be achieved by requiring 2% of the monthly Fair Wage of each employee (whether male or female), to be deducted and paid into a separate maternity fund to be managed by an Authority that would determine and pay these claims.

A woman who has worked a minimum period of 750 days (or about a little over two years), would be entitled to maternity benefit at the rate of the then current Fair Wage. This minimum period (of 750 days) would be counted for all her previous employments under different employers (who are all under this law) put together and regardless of whether or not she is then in employment. Having put in at least 750 days she would also have contributed about 50% of one month’s wage before availing the benefit.

Maternity benefit would be payable for a period of up to nine months before and after delivery. She may take the entire benefit once if she so chooses. This will encourage smaller families and ensure that the child gets the mother’s care for a substantially longer period. However, if someone prefers to have two children, they could use only part of the entitlement during the first birth and the rest later. Since an average person works about 30 years in her /his life, she / he would contribute about 7.2 months’ wages to this maternity benefit fund (someone who works continuously from the age of 18 to 58 years would have worked even 40 years and contributed about 9.6 months’ wages).

A benefit of up to three months’ wages would be given for miscarriages and this period would be reduced from the maternity benefit on successful pregnancy.

Some exceptions will need to be developed for those women who already have children so that when they come under this law for the first time, they could be given this benefit after they have worked and thus contributed for at least 3000 days (or about 10 years). To encourage them not to have more children, a condition could be placed that this entitlement would be for only those women who don’t have more children if they already have two.

Since this measure is neutral to the employer, he will not care if a woman joins his service in an advanced stage of pregnancy.

Transfer to other sub-accounts

As mentioned earlier, the employee would be permitted to transfer his bonus, gratuity, and leave sub-accounts accumulations when they become due to the PF sub-account (to be taken at retirement), and any balance left in the notice pay and / or retrenchment compensation sub-accounts would be mandatorily transferred. The employee would also be permitted to make an additional contribution from his wages sub-account to his PF account.

Overtime

Let each person decide whether they want more personal time or career progress. Hence, refusal to do overtime work should not constitute misconduct.

Many employers do not pay overtime at twice the normal rate (though they are required to) but at the normal rate. They also often do not pay overtime to their managerial and professional staff because it is often difficult to monitor it as also because they fear that their overtime bills would go out of control.

What is therefore proposed is that if an employee works overtime, the employer should be required to pay for the overtime hours at twice the rate of the minimum wage (and not twice the Fair Wage or twice the rate of his total wage), and without benefits on the overtime so paid. Since what the employer would in effect be paying for the normal hours of work done is twice the minimum wages (after accounting for benefits), what the employer would in effect pay is the same rate for overtime as well.

To simplify computations, we can assume that a month has 200 working hours (8×25 working days). Hence, the minimum wage would always be divided by 200 to arrive at the hourly rate whether the establishment is working 5 days a week or 6 days or even 5 ½ days. (In our example this would come to 12,000 Units / 200 = 60 Units per hour.) Since it is computed on the minimum wage, for management cadre the amount of such compensation would be comparatively small (even if the employee logs long overtime hours). All payments towards overtime would go to the Wage sub-account.

It is proposed that the law should place limits on overtime hours at four hours a day and there would be a prohibition from claiming any overtime beyond that. Thus, the maximum that any employee could claim is another amount equal to the monthly Fair Wage. Several employers would readily agree to pay this sum to all their management cadre employees, even prescribe it as part of CTC and not bother to monitor it. That might be a lost less costly than having to bother about creating the processes to monitor them.

Employers may yet prescribe higher overtime if they wish to do so, but that would be according to the enabling provisions for better terms as hereinafter indicated.

APPRENTICES, DISABLED / PHYSICALLY CHALLENGED, RETIRED / AGED PERSONS

There is a lot of scope for providing training to young persons and gainfully employing old persons, and the disabled / physically challenged. We merely need to come up with solutions that would be readily accepted by all parties and to enable a legal mechanism to make it happen at scale.

Apprentices

It is proposed that employers who have a minimum of 100 employees (who are under this law) be allowed to engage 50% of employee strength as apprentices, provided they are paid at least 50% of the Fair Wage, without benefits but with insurance. (Providing insurance is important to young persons who have long lives ahead of them, and to their families. They will have long years ahead to provide for their retirement.) Those who employ less than 100 persons could be allowed a smaller proportion. The duration of the training can be expressly limited according to the trade.

The Bank Account would be an “apprentice account” that will distinguish him from employees. A person who has completed such apprenticeship training would receive a certificate from the employer based on which his Bank Account would change to “employee account” whereafter it would be impermissible for another employer to employ him otherwise than as an employee. An apprentice who does not successfully complete his training within such period would not be permitted to continue it under the same employer and an employer who does not give certificates in at least 66% cases would be debarred from taking apprentices or would be permitted to take fewer apprentices (to dissuade the practice of showing employees as “trainees”).

Large employers will thus be able to employ young promising unskilled persons at very economical rates and skill them. This will build up a pool of trained manpower. Over time employers will also build a reputation that would distinguish the good trainers from others, and certificates from certain employers would become a sought-after qualification.

Disabled / physically challenged persons

The physically challenged person is, by definition, unable to perform at the same level as others who are otherwise similarly circumstanced. In a country where there is no dearth of unemployed able-bodied persons, reservation for the physically challenged appears to be inappropriate. In any case, reservations for them are mostly an illusion for they can only be provided to a very small fraction of such persons. A better way would perhaps be to encourage employers to offer employment to physically challenged persons for their own selfish reasons, while ensuring proper compensation to a person who gets disabled.

For instance, in a case where an employee has suffered 40% loss in earning capacity, an employer should be permitted to employ him at 60% of the compensation of an able-bodied person i.e., 60% of the Fair Wage + Benefits at 60%. The reduction in wages is at least partly offset since the employer is paying @20% higher than the minimum wage and all other benefits are also being ensured. The disadvantage is only vis-à-vis his colleagues under the same employer, not vis-à-vis other workers in industry as a whole. Hopefully, the employee has also received compensation for his injury to make up for the loss in compensation due to “loss of earning ability”.

There is also greater dignity in earning what one is able to than asking only on the basis of a disability. We must learn to accept that life is unfair and not try to equalise misfortunes by placing a part of it on the rest of us, especially when that is not the best use of our resources.

Retired / aged persons

There should be a statutory mechanism to encourage the employment of aged persons. In the view of the author, advancing age should be recognized as a form of disability and provisions should be enacted that encourage employers to give employment to such persons for their own selfish reasons.

Let us say that after the age of 45 a person becomes 2% less-abled every year until he reaches a maximum less-ability of 26% i.e., after about 13 years or at the age of 58 i.e., the age of retirement. Thus, an employer who employs a person above the age of 45 should be required to pay him such percentage of Fair Wage + Benefits as applicable to his age though, upon being given employment, the percentage of his less-ability will remain fixed as at the date of his appointment. Consequently, an employer who employs a 55-year-old person will have to pay 80% of Fair Wage + Benefits for the entire duration of his employment.

At the age of 58 years the employee retires. As per this formula he is at a 26% less-ability. Employers should be permitted to employ persons beyond the age of 58 years by paying them only the full amount of the prescribed Fair Wage but without benefits. This would effectively mean that the employer is able to pay about 60% of what he is paying a young able-bodied person. All the money that he is to receive from such employment he must receive in hand for such a person does not need to plan for another future and just to find employment at Fair Wage should be enough. If he has not already provided for his future, then he would need such a job more than ever. If he already has a retirement fund, he would also be receiving a pension from it or a return on the lumpsum amount to make up for any shortfall.

This matter of less-ability could also be linked to the question of misconduct and a person whose performance falls below, say twice the quantum of this less-ability with reference to his age, could be said to be deliberately underperforming and hence guilty of misconduct entitling the employer to terminate his services. In other words, if a person aged 50 years were to perform more than 20% below (twice his 10% less-ability) that of an able-bodied person, the employer would be entitled to terminate his services for misconduct. In jobs where productivity can be so measured, we would have an objective criterion to measure such misconduct by.

PAYMENT BEYOND THE MINIMUM PRESCRIBED

Since reasonably decent conditions of service have been secured for them, these workers would not be permitted to raise any dispute about their wages or other conditions of service with their employer. However, they would be free to negotiate them individually with him.

When the parties negotiate and agree upon better terms, they would be required to expressly state which of the terms would be “permanent” and which would be “temporary”. The “permanent” benefit would be permanent over and above the relevant statutory benefit (for the rest of his employment with that employer) whereas the “temporary” one could be withdrawn by the employer in accordance with the contractual terms (which could prescribe the duration of the benefit or the occurrence of some event; for instance, it could be till a particular work order is to be executed).

When the Fair Wage is revised, the “permanent” additional benefit would have to be carried over and above the revised relevant term. The consequence would be that if an employer wishes to reduce an employee back to the statutory emoluments, he can do so only where the additional emoluments are temporary, else he must retrench him. On the other hand, if an employee who has received a “temporary” increment decides not to continue working with that employer upon such benefits being withdrawn, then he would have to resign (and thereby forgo the retrenchment compensation and notice pay). Employers would then feel comfortable giving additional benefits to either good individuals or incentives to all or certain employees to persuade them to work harder to meet a time-bound work order, without compulsion on either side.

All disputes relating to any such other terms (additional salary and / or benefits) would be contractual and would be litigated under the civil law i.e., the Indian Contract Act (although a separate Authority could be prescribed for the expeditious resolution of such disputes). The non-payment of any such additional salary or benefit would entitle the employee to claim damages / penalty at pre-determined rates.

NOTICES

All notices to be given under this law that can have prescribed formats would. Thus, a notice of resignation, of retrenchment, leave, rejection of leave application, would all have specified formats and would be required to be sent electronically to the other party and to the Banks that hold the employer’s and employee’s accounts. Any money that is required to be transferred thereupon would then occur without any other action being required by either party. If a notice is to be given placing an employee under suspension pending enquiry, it would also go to the prescribed Authority under this OLC and the Labour Court that would conduct the enquiry (as suggested later herein). It is only when for instance an employer wishes to terminate for misconduct that a different notice may be given, and in that event, it would also be sent to the prescribed Authority under this OLC.

It is suggested that these notices should be sent electronically so that the prescribed forms only enable certain types of applications and certain actions taken within defined periods or by giving certain minimum notice.

RESIGNATION, ABANDONMENT OF SERVICE AND TRANSFER

Resignation and abandonment of service

The principles governing resignation and abandonment of service have been largely judicially developed but some of them are cumbersome and need to be legislatively corrected.

Employees often quit without giving notice or tendering pay in lieu thereof, thereby compelling employers to follow a cumbersome process (of giving notices) before striking their names off their rolls or holding enquiring and terminating their services. These often lead to disputes and if the correct procedures have not been followed, can result in the employee being reinstated, often with backwages. The employers often also don’t receive the notice pay and it is usually not worth their while to litigate over it. This is onerous and promotes dishonesty.

Hence, the employee must be required to give a one -month notice of resignation to his Bank and the employer. If the notice is short, then the salary towards the balance period would automatically stand transferred from the employee’s account to the employer. If the employer does not want the employee to serve out the notice period, he can write to him and the Bank and pay off the remaining notice period. The employee will not have the right to withdraw his resignation without the consent of the employer. In all cases of resignation, the employer would receive the NP and RC components back.

An employee who remains absent for 10 consecutive days without intimation or for a total of 60 days in a year inclusive of leave (without prior written permission) would be deemed to have resigned and his name would automatically stand removed from the register of employees and the NP and RC amounts would be credited to the employer along with 1-month notice pay. Since the employee would need to give intimation of leave in a prescribed manner there would be no dispute whether he had applied for leave.

Transfer

Transfer is often used to harass employees to have them resign while many employees resist even genuine transfers. It is proposed that firstly an employer should have an indefeasible right to transfer employees with a notice of one month to locations that are within a radius of five miles of the place of his first posting with that employer. However, if due to an emergency the employer wishes to transfer the employee with immediate effect, then he must also pay him one month’s Fair Wage as applicable at his current location or at the new location, whichever is higher.

Upon transfer the employee must receive compensation in accordance with the prescribed Fair Wage and benefits applicable in the region where he was first employed or the region to which he is now transferred, whichever is higher (alongwith the permanent / temporary additional benefit as applicable). The difference would be protected as “personal pay” at all relevant times thereafter until he continues at the new location. (If the employee has been transferred from a city where the Fair Wage was Rs.7000 to a place where it is Rs.6000, he would receive Rs7000 at the new place as also all benefits computed thereon and revisions thereof at all times thereafter as long as he continues there, alongwith a onetime sum of Rs.7000.)

An employee who has been transferred once would not be permitted to be transferred again within one year. In the event that an exception has to be made, the employer must pay three months’ Fair Wage. The radius of five miles would always be measured from the place of the first posting of that employee and irrespective of where he has worked subsequently.

Where the employer transfers an employee beyond such a radius, the employee would have the right to forthwith put an end to his employment without giving notice /notice pay and he would retain the amounts in his NP and RC accounts. This right would continue to remain in effect for a period of up to 3 months after he has joined at the new place of posting. The employee would therefore have the opportunity to consider his options both before as well as for a reasonable period after he has joined at the new place.

If an employee wishes to be transferred to a different location, this rule will not apply, and he would give a written request as per a standard format whereupon the employer will decide and communicate his decision. Likewise in cases where the employee has agreed to a transfer, though proposed by the employer. Such communications would also go to the Labour Court to record that this is indeed at the request of the employee / by agreement.

LAY-OFF

When an employer declares a lay-off, he would pay the concerned employees their full minimum wage and keep their insurance policies active, but all other benefits would cease. A lay-off would be for minimum one week and during this period the employee would not be required to mark his attendance and would be permitted to seek employment elsewhere. The money earned in the alternate employment would be retained by the employee.

The lay-off could continue up to a period of three months (during a period of 12 months), after which the employer would have to either resume payment of full remuneration or retrench the employee.

If the employer resumes work, he could require the employees to put in overtime work to make up for the lost hours of work. Such overtime would be paid at half the rate of the minimum wage plus the full benefits that had not been paid during the period of lay-off. The employee would not be permitted to refuse to perform such overtime work except if he returns the payment he received during the lay-off.

TERMINATION AND ENQUIRY

Right to hire and fire

The employer would be allowed to terminate the services of an employee at any time. If he were to do so without pressing charges, he would do so by an order in a prescribed format (non-stigmatic) whereupon the worker would take all the amounts in his sub-accounts.

Misconduct and Enquiry by Court

If an employee misconducts himself and the employer considers it serious enough to warrant the termination of his services, he will send notice to the employee, the prescribed Authority under the OLC, and to the Labour Court which would hold the enquiry and decide whether or not the employee was guilty. If the employer is able to prove the charges, he would be able to collect from these sub-accounts (except PF) to the extent of loss caused. If no monetary loss has been caused, the Labour Court may still forfeit the amounts (or part thereof) to a special fund (maternity benefit).

If the employer cannot prove the charges the Labour Court would direct him to pay the costs of the worker and damages. However, even if the employer cannot prove the charges, he would not be obliged to take the worker back. The employer would also be required to pay to the Court a sum of money (defined in terms of the prevailing Fair Wage) for the conduct of such enquiry.

During this process, the employee would be debarred from resigning, and the proceedings would go on even if he reaches the age of retirement. Except for the employee’s wages sub-account, all other sub-accounts would be frozen. The Court may direct the payment of subsistence allowance from the worker’s own sub-accounts subject to conditions while requiring the employer to pay all the monthly sums into another escrow account so that it is secured and is available should the employer fail.

However, if the employer does not intend to terminate the services of an employee (i.e., but only impose a minor penalty), he may himself hold the enquiry. The employer could also conduct preliminary or fact-finding enquiries on its own.

So that there is greater transparency and fairness, the damages / compensation that may be awarded to an employee should be prescribed to the extent possible. For example, if an employee is accused of a misconduct and is held not guilty, depending on whether he was completely innocent or was acquitted because of lack of evidence, the Labour Court would award compensation, three years wages in the first case or one years wages in the second one, provided the employee was below 50 years of age. Of course a lot of discretion would have to be left to the Labour Court but it should not be difficult to prescribe at least a broad range for the computation of compensation in different situations.

Criminal charges

Where the charges are related to his employment, the procedure as above would apply, except that all these questions would be decided by the criminal court (which would also have the power to decide all questions related to employment). There would then be no need for stay of any proceedings. The criminal Court would decide whether the charges are proven based on the standards of criminal law but, if he is not guilty by those standards, then by the comparatively lesser degree of proof required at a domestic enquiry. If the employee is still found not guilty then (and since it was the employer who had levelled these charges), the employer would pay damages.

During the period that the case is being decided, the employer would be required to pay half the fair wage without benefits (and the rest of the fair wage and benefits would be deposited in a separate escrow account to be available to the court to determine how they should be disbursed). In cases where the charges are related to employment, the employer would have the option to pay prescribed sums and seek the expediting of the case.

However, where the charges are not related to his employment, the employer would have the option not to continue such person in employment, and in which case he would make an application to the Court declaring such intention. The same procedure would be followed to determine his guilt, but the employer would no longer be responsible for paying any money. If the employee is held not guilty, the employer would not have to pay any damages but would either have to offer to reinstate him in service without backwages or retrench him.

SEXUAL HARASSMENT

Like other cases where criminal charges might lie, sexual harassment cases can also lead to an internal enquiry and / or criminal charges. However, these are unique in that they leave the choice of forum to the employee (complainant) rather than to the employer. Consequently, that choice would be left to the complainant. However, if she wishes to also press criminal charges, it would be mandatory for her to file charges only before the Sexual Harassment Court (SHC) which would be a criminal court. The SHC would also have the power to decide whether the complainant should be charged for levelling false allegations and, where that is proven, what the punishment for that should be. The SHC would also decide whether in the interim to suspend or transfer the accused (after also hearing the employer).

PAYMENT AND WITHDRAWAL

Payments by employer

At the end of each month the employer would give a statement to his Bank stating the days on which each employee had worked as well as the overtime performed. The Bank would then automatically credit the employees’ respective sub-accounts by electronic transfer. Any additional payment made by the employer (towards benefits payable under contract) would be to a separate sub-account.

The employee may dispute any such statement within a period of three months by filing a claim before the Labour Court. Depending upon whether or not the claim is correct, the Court would direct the employer or the worker to also pay damages and court costs. (It is high time that appropriate costs are fixed to discourage frivolous litigation.)

Certifying payments and insurance

The employer’s Bank would be required to ensure and certify that the employer has obtained and maintains insurance policies as required and that the employer has paid the statutory sums into the employee’s accounts.

Withdrawals by employee

The employee would be permitted to withdraw on monthly basis only from the Wages sub-account. The employee can choose the month of the year in which he would withdraw his Bonus. He can avail leave encashment twice in the year whenever he chooses (which would be paid into the wages account upon his leave commenting as per his notice). At the end of every five -year period the worker would be able to withdraw his gratuity. He would get PF upon retirement.

TRANSITIONING EXISTING EMPLOYEES

Employers could transition those existing employees who are willing to be transitioned to this law upon payment into their sub-accounts the liability towards past years’ service. While computing this past liability the minimum wage prevailing at the respective periods of time would be taken into consideration (and factoring in the enhancement of 20% for fair wage) and the various benefits as above computed with the interest they would have earned had they been paid at the relevant time. However, the wages already paid would not be retrospectively enhanced and benefits already paid (PF, bonus) would be taken as final. If the retrenchment compensation on present wages is higher than the amount calculated under this formula, then the higher amount would be paid into this account.

For those employees who currently receive more than the Fair Wage, the net sum above the Fair Wage would be computed and prescribed as a “personal pay” which would be paid over and above the Fair Wage as prevailing at any given time. Same with benefits. This “personal pay” would be “permanent”, and it would not be permissible for the employer to take it away. The employee would also receive some neutralization of the increase in cost of living in respect of this “personal pay” and different scales can be prescribed for this purpose.

WHY EMPLOYERS WONT HIRE AND FIRE DESPITE THE POWER TO DO SO

Though the employer gets the right to hire and fire, the fact that he would have to pay the replacement of any given worker a little more for the first three years and that he would receive the NP and RC back if he retains the employee till retirement would dissuade him from firing one without good cause. Employer may yet wish to retrench employees if for instance they want a younger workforce.

NATIONAL DATABASE

Since the Bank accounts of such employees would be designated accounts, the authorities would remain updated on the current employment status of all such employers and employees, the health of such employees, as also how much there is in their accounts and that would lead to a building up of a national database.

TOTAL COST TO EMPLOYER

The total annual cost to the employer had earlier been determined to be 227,926 Units for the first three years and 215,926 Units thereafter, 2,880 Units towards administration costs (i.e., 230,806 Units for the first 3 years and 218,806 Units thereafter) and 10,000 Units towards insurance. Hence, 240,806 Units for the first three years and 228,806 Units thereafter. However, 2% of the Fair Wage of the employee are to be deducted from his Wages and sent to the Maternity Fund. Therefore, if for a given region the minimum wage is Rs.10,000, then the actual cost to the employer would be Rs.240,806 for the first 3 years and Rs.228,806 thereafter.

Though the cost of administration has been taken in these computations to be 2% of the monthly Fair Wage, it is quite likely that Banks would not have to spend very much to administer such accounts because much of it can be automated. Consequently, they could offer to charge lower or not at all to secure business and, in which case, this would also become available, perhaps to increase the insurance cover.

What the employee receives in his various sub-accounts is Rs.240,806 – Rs.10,000 (insurance) – Rs.2,880 (maternity deduction) = Rs227,926 per year (Rs.18,993 per month) for the first 3 years and Rs.228,806 – Rs.10,000(insurance) – Rs.2,880 (maternity deduction) = Rs215,926 per year (Rs17,994 per month) thereafter, or:

- 103.2% of the minimum wage in the Wage (W) sub-account

- 24% of the minimum wage in the Bonus (B) sub-account

- 28.8% of the minimum wage in the PF (PF) sub-account

- 5.77% of the minimum wage in the Gratuity (G) sub-account

- 5.77% of the minimum wage in the retrenchment compensation (RC) sub-account

- 10% of the minimum wage in the Notice Pay (NP) sub-account (in each of the first three years)

- 10% of the minimum wage in the Leave (L) sub-account

The entire liability of the employer towards the employee has therefore been reduced to a determined figure which will change only according to the prescribed minimum wage and the number of days that the employee actually works in any given month. The employer merely has to pay this sum to the employee’s account every month and be free to hire and fire him and the employee’s statutory benefits have been secured for the entire period of his service.

TOTAL RETIREMENT SAVINGS FOR EMPLOYEE

Presuming that someone works continuously from the age of 20 years till retirement at the age of 58 years and presuming that he accumulates not only the Provident Fund but also all the bonus, gratuity, leave encashment, and presuming that these amounts have earned interest at an effective rate (after adjusting for inflation) of 3.04% per annum compounded monthly (0.0025% per month), at the end of his career he would take away total Social Security accumulation of about Rupees 58 Lakhs (on a minimum wage is Rs.10,000pm). On placing this sum in interest bearing securities (at the effective rate of 3.04% per annum), he would thereafter receive interest of above Rs.14,000 per month at constant consumer price index.

Hence, the retirement of the worker would have been adequately funded. If he is also able to find employment on the terms indicated herein, he would receive another Rs.12,000 per month as wages.

INVESTMENTS IN INFRASTRUCTURE

With minimum wages at Rs.10,000 per month, the social security amount coming into the banks is Rs.8,433 per person per month ($90 per person per month), if a 100 million people can be covered under this legislation, that would provide the government with $9 Billion a month (or over $100 billion a year) from these sources for investment in infrastructure and for which it can guarantee interest at an effective rate of 3.04% per annum. (The average real interest rate for India during the period 1978–2019 was 5.86%: Source theGlobalEconomy.com). This will keep increasing as the enrolment under this legislation expands and as, with a prospering economy, the minimum wages rise.

A further sum of Rs.10,000 would go to insurance companies per person per year. Since this includes the coverage towards illness, part of it would get spent every year. Presuming that only a sum of about Rs.3,000 ($32) would go towards life insurance, for 100 million people the insurance industry would receive $4 Billion per annum towards life insurance premium alone. Since this is typically invested in infrastructure, this too would augment the government’s infrastructure push. Furthermore, the amount spent on the workers’ health (almost $10 Billion) would show up as increased productive time and lead to household savings on what would otherwise be spent in an ad hoc manner on healthcare (and which is often spent on quacks), and in investment in health infrastructure.

OTHER CONDITIONS OF SERVICE

Definition of misconduct, procedure for enquiry (for minor misconduct), working hours, spread-over, prohibition of employment of women and young persons during certain periods, rest day, safety, procedure for leave, and hygiene etc can all be covered under the rules. Special provisions for migrant labour can also be made if considered necessary.

CONCLUSION

The main challenges posed by our existing laws are that employers cannot easily fire workers, that beyond a certain size they need government permissions to retrench / shut down, and that litigation with employees / labour departments go on forever, even where the employer had acted within the law. All this adds cost to their operations and hence, to their products and services, often making them uncompetitive in world markets. We therefore lose the leverage that we have because of our low labour costs.

Even if we ignore their many flaws, essentially what the FLCs have done is to consolidate 29 labour laws into 4 codes (and the Shops and Establishments Acts of each State would still apply).They do not reimagine these laws or even address the main concerns of employers to give them confidence to start labour intensive industries. Rather, they seek to expand the scope of contract labour and to permit employers to hire employees on fixed term contracts, thereby reducing security of service while giving little in return. This will not enable the skilling of our workforce or employment at scale.

If we bear in mind that

(a) it was to get over the problem of not being able to fire workers (whether individually or in large numbers) and the fear that regular workers could demand better conditions of service on the threat of union action, that employers increasingly resorted to contract labour, and hence, this is the main problem that needs be addressed to make manufacturing at large scale possible,

(b) contract labour is often badly treated and do not receive the benefits that the principal employer has paid the contractor for being passed on to them, due to which they seek employment with the principal employer in the first place,

(c) their engagement leads to litigation between the employer and the contract labour and the PF and ESI departments to fight which, employers engage auditors, managers, and lawyers at substantial cost,

the question is : Why expand this exploitative system with all the ills that it brings? The very fact that what has been done by the FLCs is mainly to consolidate such outdated laws therefore amounts to throwing up our hands in resignation at ever resolving the more fundamental problems to the satisfaction of all parties.

The OLC seeks to achieve these purposes by passing on to the workers the money that would otherwise be spent on auditors, supervisors, managers, lawyers, and the 10-20% margin of the contractor with GST thereon and using it for paying workers at a rate 20% above the minimum prescribed rates and placing all their service dues in their own escrow accounts on a monthly basis. It ensures them a decent standard of living with the assurance of a decent retirement without having to litigate over anything. The daily drudge of workers living at a minimum wage would be gone and their retirement would be secured. Then the right to collective bargaining would not be needed. There would then be no employer-employee conflict for, why would such an employee commit misconduct and put all this in jeopardy? Would not such a person work better? And all that all these benefits cost the employer is less than twice the minimum wage, much of which he is already paying the contractor though the full benefits are often not passed on to the workers. There are several employers in India who are likely to be willing to pay what is suggested herein so that they might have the freedom to hire and fire at will. We need to encourage them to do so at scale.

The OLC will not benefit the 10% of the workforce that already receives all benefits and more. However, it will benefit the 90% others who often even lose to the contractor much of what has been paid by the principal employer for their services. Under this mechanism employers can compute the total cost of an employee (CTC) and pay it ongoingly without leaving any future liability uncovered and can hire and fire at will while being assured that the employees could not make any further demands. In such an environment, employers are more likely to set up employment intensive industries which would, in turn, lead to the workers being in a better position to negotiate better terms of service on an individual basis, by providing higher quality work. It is also likely to end the increasing tendency among employers to contract out large parts of their workforce. For, why would an employer engage workers through contractors when he can hire and fire at will?

A RECOMMENDATION FOR A TRIAL RUN

India is still building its infrastructure, and these projects employ huge numbers of people (before Covid the construction industry was estimated to employ about 70 million). Requiring undertakings that bid for such government projects to engage contractors that only employ personnel under this Code could be a start. If successful, it could be easily expanded to progressively cover the entire construction industry, which employs the most marginalised sections of our society, most of whom don’t receive any social security benefit, and often, not even a minimum wage. That alone would give an enormous boost to employment in this sector, and if the experiment is successful, also to the construction industry. It would no longer remain the employment of last resort. Workers who can be retained in the same jobs for years would also develop better skills thereby delivering better products and services.

If these changes come to pass, the onus will lie squarely on industry to show that it can rise to the occasion and take us to new heights.

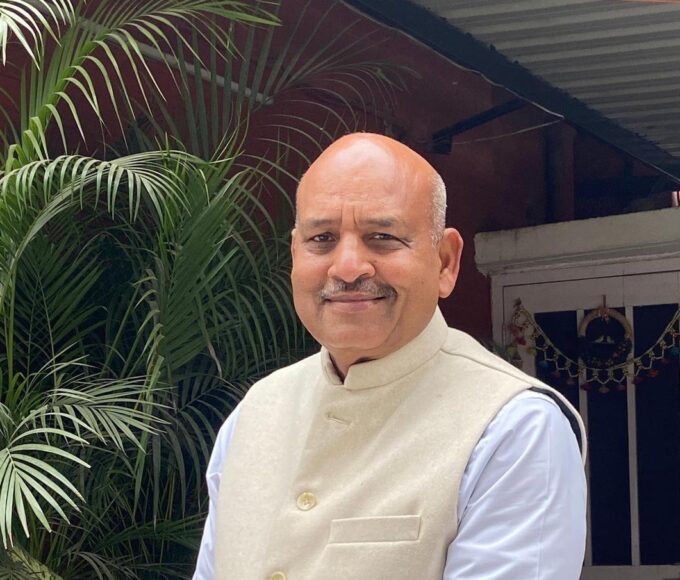

SAURABH PRAKASH (The author is a lawyer based in Delhi.)