For the past three decades, it proved to be the dreaded ‘D’ word. Disinvestment ensured that the cash-rich public sector undertakings (PSUs) remained the milking cows for the political elite, either directly or indirectly. Earlier, they were inefficient because their earnings were religiously siphoned off by politicians, civil servants, senior managers of the companies, and private contractors. Post-privatisation, they were used to cook the government’s books, and to further crony capitalism. Thus, the PSUs remained the sacred placed where the powers-that-be offered prayers of corruption, and receive illegitimate blessings.

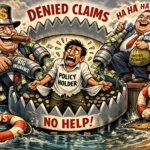

Critics said that the country’s ‘Crown Jewels’ and ‘Family Silver’ were sold either for pennies, or at high prices, depending on who they were sold to. The former was the case if the buyer was a private business person, and the latter when PSUs were sold to other PSUs. When the governments forced profitable state-owned entities to use their bulging cash reserves to buy the shares in other similar companies, it was a clear case ‘Rob Peter to Pay Peter’. That is, only the shares changed hands, and the money was transferred from one pocket, the buyer PSU, to the other one, government exchequer.

The proceeds were used to finance, or manage, the growing fiscal deficits, which were the result of governments’ profligacy. They were also used in meaningless acts of throwing money to ‘buy’ vote banks through welfare schemes, like subsidised housing, electricity, food, and fuel, and other freebies like loan waivers, which themselves became sources of corruption. Hence, disinvestment, whose ostensible aim was to make the PSUs more efficient, and whose underlying objective was to raise money to fund large infrastructure projects to fuel growth, became a source of colossal wastage.

More importantly, the disinvested PSUs didn’t benefit much. In most cases, the government retained ownership and management control over them. In a sense, the ‘Temples of Modern India’ further creaked and cracked. The traditional prayers and blessings continued, and the political and business pilgrims became richer. Genuine privatisation took a back seat, apart from a short period of few years. But this too was a scam as the state-owned firms, which had huge tangible assets like real estate and cash, were deliberately or unknowingly sold to private players for pittance.

From left pocket to right one

From the beginning, i.e. 1991-92, government sold its stakes in PSUs in a piecemeal fashion to state-owned financial institutions such as public sector banks, state-owned insurance firms, and other agencies like the now-defunct Unit Trust of India (UTI). For example, in 1991-92, the government-held stakes in several PSUs were dubbed ‘very good’, ‘good’, and ‘average’, and clubbed together in various ‘bundles’. The UTI was the largest buyer of these bundles, coughed up over 50% of the proceeds. One hand of the government, UTI, gave money to the other hand, the exchequer.

This process continued over the next three decades in various forms and formats. It reached its zenith with the much-hyped merger of the two state-owned oil giants, explorer ONGC and refiner-marketer Hindustan Petroleum, in 2018. The latter became the subsidiary of ONGC, which paid a humungous Rs. 37,000 crore to government for the acquisition. This merger seemed like a logical extension of what happened in the late-1990s when the Atal Bihari Vajpayee- and BJP-led regimes of 1998 and 1999 introduced the concept of ‘cross-holding’ among the oil and gas PSUs.

Cross-holding implied that oil majors would hold minority stakes in each other. For instance, ONGC bought a stake in Indian Oil which, along with the gas company, GAIL, held shares in ONGC. Critics felt that cross-holdings and mergers were aimed to merely enrich the governments. Nothing changed on the ground. In the case of cross-holdings, the investment was only financial in nature, and not strategic. This is because the minority PSU shareholders didn’t have any say in management and operational decisions. They were only used to bolster the revenues in the government’s annual budget.

Critics said that the country’s ‘Crown Jewels’ and ‘Family Silver’ were sold either for pennies, or at high prices, depending on who they were sold to. The former was the case if the buyer was a private business person, and the latter when PSUs were sold to other PSUs

In the case of the ONGC-HPCL merger, the government touted it as the beginning of the formation of giant, global-size, and mega Indian oil giants, which could compete with the other global majors for international oil and gas reserves. Such an Indian player would have the financial clout, management bandwidth, and political power to achieve this objective. In addition, there would synergies, which would cut costs, and enhance profits. Nothing like this happened. Both ONGC and HPCL continued to be run as separate companies, although the latter was technically a subsidiary of the former.

Unfortunately, the cash with the profitable PSUs was misused in other ways too. One of these was the huge special and one-time dividends that were paid by a few PSUs to their majority shareholder, the government. During the UPA-2 regime, which was a coalition headed by Manmohan Singh that ruled for five years between 2009-10 and 2013-14, the Centre earned almost Rs. 114,000 crore as overall PSUs’ dividends. The figure zoomed to almost Rs. 206,000 crore over the next five years (2014-15 to 2018-19).

Even the Reserve Bank of India (RBI) coughed up huge dividends. The unprecedented trend to milk the country’s central bank reached a historic low in recent times. In 2018-19, the government received more than Rs. 74,000 crore from the RBI and other nationalised banks, the bulk of which came from the former. In 2019-20, the figure is expected to jump to Rs. 106,000 crore, of which Rs. 90,000 crore is expected to be the central bank’s contribution. As a comparison, this figure is more than thrice the amount paid in 2009-10.

Each regime finessed this skill, and enlarged the booty. Under Narendra Modi, an impressive Rs. 290,000 crore was mopped up between April 2014 and March 2019. The combined figure for the past two years (2017-18 and 2018-19) was Rs. 180,000 crore, and the target for 2019-20 is Rs. 105,000 crore. Another way to look at this data is that the disinvestment earnings between April 2014 and March 2019 were way higher than the cumulative figure for the period between December 1991 and March 2014.

From a pocket to wasteful expenses

A 2015 study by industry association FICCI said, “India’s experience with disinvestment so far shows that it is primarily driven by the compulsion of financing the fiscal deficit. This is in sharp contrast to the developed countries’ experience(s) where privatisation and disinvestment were primarily driven by a conscious recognition that this improved efficiency (of the PSUs).” It gave credence to the popular belief that ‘Family Silver’ was sold to meet the short-term fund shortages that arose from high government expenditures.

Heated debates between experts, and within the governments, centred on how to best use the privatisation proceeds. UPA-2 experimented with a short-term policy to put the money aside, and use it to build infrastructure and finance social schemes. However, the money was shown as capital receipts, and came in handy to lower fiscal deficits. The regime gave up the infrastructure objective. An unintended consequence of this myopic and lopsided mindset, revealed the FICCI study, was that it “forced the government to pursue disinvestment in bad markets”.

This happened from time to time, when the governments sometimes rightly pursued selling their shares to the general public, i.e. retail investors, and private and foreign institutions. Such actions were driven by the fiscal and revenue scares and, hence, they were enacted in a great hurry to mop up the money. The state of the stock market was unimportant; the timing was of great essence. Sometimes, shares were sold when the markets moved southwards. At other times, the market turned out to be smarter. It realised the government’s desperation, and discounted the prices.

Obviously, as the FICCI report pointed out, these decisions created “huge losses to shareholders”. Unfortunately, the “shareholders” in these cases were not just the respective regimes, but also the retail investors, who purchased the stocks earlier, and the taxpayers, whose money was used in the first place to build the PSUs. The governments needed to use the proceeds, which were essentially the earnings of the public, to compensate for the “blood, sweat and toil” of the people, and to build better infrastructure and provide adequate living standards to its citizens. Sadly, they didn’t.

Strategic scandalous sales

To be fair to the politicians, there was a period during Vajpayee tenure, when the government experimented with genuine privatisation. This was through the so-called “strategic sales”, i.e. outright sales, auctions of majority holdings, or offers of minority stakes with management control, to the private players. Unfortunately, the process was non-transparent, certain bidders were blatantly favoured, and the PSUs were deliberately sold at hugely discounted prices. Let us consider the cases of VSNL, IPCL, and hotel properties.

In the case of VSNL, which was then the world’s largest international wholesale telecom carrier, most decisions seemed to be in the favour of the Tata Group, its new owner. In order to compensate for VSNL’s loss of monopoly in international telecom traffic, the government said that the state-owned BSNL and MTNL, the two domestic telecom companies, would use VSNL as their international carrier. In addition, VSNL was promised two lucrative domestic licences for national calls and Internet.

This wasn’t it. In a quirk of decision-making, the government maintained that four properties of 773 acres, worth hundreds of crore of rupees, would be disassociated from VSNL, and sold separately. However, this transfer was to happen after the government sold a 25% stake, and transferred management control to the new owner. For some reason or the other, the properties remained with the Tata Group, although their worth wasn’t included in the overall bid price. Either the government was too lazy and slow to react, or the new owner was reluctant to let go of the properties.

In July 2018, i.e. 16 years after the sale, and after Tata Communications (earlier VSNL) was bankrupt, there was some traction. The National Company Law Tribunal decided that the 773 acres would be demerged into Hemisphere Properties India, a state-owned company. To gauge the value of these four properties, one must remember that they were located in New Delhi, Chennai, Kolkata, and Pune. Another indicator: VSNL had other properties of 457 acres, which were valued at Rs. 1,200 crore in 2002.

Many hotels were bought and resold within a short period at hefty profits. For example, the Batra Group, which purchased the Airport Centaur Hotel in Mumbai, re-sold it within four months to the Sahara Group, and earned a profit of Rs. 32 crore, which was over and above the Rs. 83 crore it paid

Reliance Industries possibly overpaid for a 26% stake, along with management control, in state-owned petrochemicals firm, IPCL. The former’s price of Rs. 231 per share was more than Rs. 100 higher than the next bidder, Indian Oil (Rs. 128 per share). But there were hidden reasons why Reliance Industries did so. The first was that the IPCL acquisition made it a powerful player in several petro-products – 60-70% market share in some segments. Hence, no price was high enough to achieve this kind of market control.

Second, Reliance Industries didn’t want IPCL to fall into a competitor’s hand, worst of all a state-run refiner-marketer. For years, the Reliance Group built a near-monopolist presence in several products. It wished to consolidate on those, and didn’t want to lose IPCL. In addition, the acquisition came with several lucrative and profitable financial and operational sops. A Rs. 600 crore excise duty claim was withdrawn, ONGC and GAIL, two state-owned companies, signed long-term contracts with IPCL for fuel supplies, and sovereign guarantee was extended on a World Bank loan. These were worth every penny, possibly more, that Reliance paid.

Unlike IPCL and VSNL, hotel properties were sold on “as is” basis. The value of these hotels lay not in their operations, but in the real estate that they owned in prime locations in large cities, including Delhi and Mumbai. But they were sold as ongoing concerns, which were loss-making because of inefficiencies, corruption, and wasteful use, by politicians and civil servants. Worse, these hotels held licences that allowed them to expand and add, and this too wasn’t taken into account during the valuation process.

In the smaller towns such as Khajuraho, Hassan, and Bodhgaya, three hotels, which were part of the government’s Hotel Ashok’s chain, were sold for about Rs. 2 crore each. In more tourist spots like Agra and Manali, the prices were up to Rs. 4 crore each. They were peanuts of prices; just the plot of these hotels could have fetched 10-100 times more. Experts believed that the market price of Ashok Kovalam beach Resort, which fetched Rs. 43.68 crore “could have fetched up to five times more than its sale price… if the 380-room hotel, with 64 acres of prime beachfront, had been sold for its premises”.

Many hotels were bought and resold within a short period at hefty profits. For example, the Batra Group, which purchased the Airport Centaur Hotel in Mumbai, re-sold it within four months to the Sahara Group, and earned a profit of Rs. 32 crore, which was over and above the Rs. 83 crore it paid. As Priya Ranjan Dasmunsi said in Parliament in December 2002, “The property of the nation cannot be treated in this manner which, in my view, is a loot and a plunder. This is not only a scandal but also rocking of the nation.”

Under-the-table undervaluation

Clearly, the extent of the undervaluation was enormous. This happens in other emerging markets also. An IMF report (2013) stated that the largest untapped resources of any government lay in ‘land, building, oil and gas, and “non-financial” (plant and machinery, and parts) resources’. On an average, these accounted for 75% of GDP in advanced economies, and ranged from 40-50% in Germany to 120% in Japan. Said the IMF report, “In most countries, they are worth more than the financial assets, like stakes in listed companies, sovereign-wealth, and securities holdings, and the like.”

Even if we assume that the seller(s) found that it made more sense to get rid of the PSUs as ‘running concerns’, rather than physical assets, it is logical to ‘beautify’ their balance sheets before they are sold. Rather than put a financially-weak firm on the block, why not clean up its balance sheet first? Any balance sheet can be legally cleaned up by, say, a transfer of its debt into a separate company, so that the original company on the auction block becomes debt-free or has less debt, and can be sold at higher prices.

Heated debates between experts, and within the governments, centred on how to best use the privatisation proceeds. UPA-2 experimented with a short-term policy to put the money aside, and use it to build infrastructure and finance social schemes. However, the money was shown as capital receipts, and came in handy to lower fiscal deficits

This was demonstrated by China. Outright sale was the route for the smaller, less-leveraged and profitable state-owned firms. Rather than assets, shares were sold in larger enterprises, especially those where the government intended to own 50%. But before that happened, the companies were restructured. The excess workers, obsolete plants, and debt burdens were transferred to holding companies, which were specifically created. According to the FICCI study, China sold shares to investors only in the entities that had the most sellable and profitable assets.

This is a smart way to sell, where the best assets are showcased, and balance sheets are cleaned up before the sales. India did neither. Most companies were auctioned on an ‘as-is’ basis. Pre-sale restructuring was rare. Such seemingly-illogical decisions in several strategic sales prompted criticism that “political compulsions” played a role to ensure that the PSUs were “sold cheap to preferred parties”. Such political impulses included the government’s desire to sell to select private players, and the latter’s attempts to “game” the entire disinvestment process in their favour.

Such allegations were common in other nations, like Russia, which sold public assets to a few oligarchs that led to “extreme concentration of wealth”. The fact remains that despite disinvestment, the government continued to own majority shares, even in cases of strategic sales. In the 2000s, the state of the PSUs remained as bad as it was in the 1980s. The idea was to make them efficient, and take them out of the hands of the corrupt governments, which treated them as personal fiefdoms. But the PSUs remained sources of both legal (money into government coffers) and illegal (corruption) wealth.

Post Script: As usual, there is a flip side to the coin. The nub of the argument that PSUs are inherently loss-making, inefficient, and corrupt can be questioned. As on 31 March, 2017, of the 257 operating centrally-owned enterprises, 174 made profits, and the remaining 82 incurred losses. Combined annual profits of the profitable companies were Rs. 153,000 crore, and the combined losses of the loss-making firms were Rs. 25,000 crore. Hence, the overall profits of the 257 firms were Rs. 128,000 crore. Their contribution to the exchequer in 2016-17 was Rs. 386,000 crore.

However, how do the investors value the PSUs compared to the private sector? As on March 31, 2017, the combined market capitalisation, i.e. the number of shares multiplied by their respective stock prices, of the 50 listed centrally-held enterprises was Rs. 1,776,000 crore, or 14.61% of the total market capitalisation of the listed companies, or the combined value of all the shares, on the Bombay Stock Exchange.

Alam Srinivas is a business journalist with almost four decades of experience and has written for the Times of India, bbc.com, India Today, Outlook, and San Jose Mercury News. He has written Storms in the Sea Wind, IPL and Inside Story, Women of Vision (Nine Business Leaders in Conversation with Alam Srinivas),Cricket Czars: Two Men Who Changed the Gentleman's Game, The Indian Consumer: One Billion Myths, One Billion Realities . He can be reached at editor@gfilesindia.com