THE wheel spins, swings, and sweeps in a frenzied manner. The economic ball jumps, bobs, and moves—up and down, straight and back, sideways, and diagonally. No one knows where it will rest on the virus-infected uneven surface with jagged edges, deep holes, and giant walls of separation. The roulette wheel itself is something unique—it has several numbers but, in this case, some are positive, some are negative, some are about hope, and others are about depression.

Billions of people across the world just stand, paralysed, around this giant wheel—shocked, perplexed, scared, and unsure. Like in our lives, and in this universe (both the cosmic one and the quantum one), there are no certainties, no guarantees. The future is as random as it is completely uncertain. There are only possibilities and probabilities. Will the global economy be decimated by COVID-19? Will this new, strange, and fearsome virus kill with vengeance? Or will we recover, even if it takes a few quarters, even years?

At present, the news is dismal. There is no hope lurking on the horizon, no silver lining, or even a speck of white, amidst the dark wayward clouds. The IMF says this will be worst since the Great Depression of the 1930s, when global economies witnessed a decade of negative growths, until Adolf Hitler’s Second World War rescued them for a few years, then destroyed them again, and led to another cycle of optimism. Despite waves of socialism and communism, we did witness the thrills of the 1960s.

The developed world—North America and Europe—may be gripped by recession, even as it seemed to come out of the clutches of the Financial Crisis of 2008. The new breed of potential superpowers, or mini-ones—China, India, South Korea, Taiwan, and others—may enter an era of slow, laborious, and stunted growth for several years

The developed world—North America and Europe—may be gripped by recession, even as it seemed to come out of the clutches of the Financial Crisis of 2008. The new breed of potential superpowers, or mini-ones—China, India, South Korea, Taiwan, and others—may enter an era of slow, laborious, and stunted growth for several years. The Third World, Africa, may linger on, as it did for the past few decades in a roller-coaster of pessimism and buoyancy. Be rest assured, our world will never be the same again.

Here is a stark and naked truth. The present pandemic will lead to a situation in which 170 countries may witness a reduction in per capita individual incomes. To put it in perspective, the United Nation recognises 195 sovereign nations, of which two, the Holy See and State of Palestine, are non-members and “observer states”. Thus, almost 90 per cent of the countries, and a higher percentage of the world’s population, will be impacted. The virus is democratic, and will hurt the rich and poor, and those in the middle.

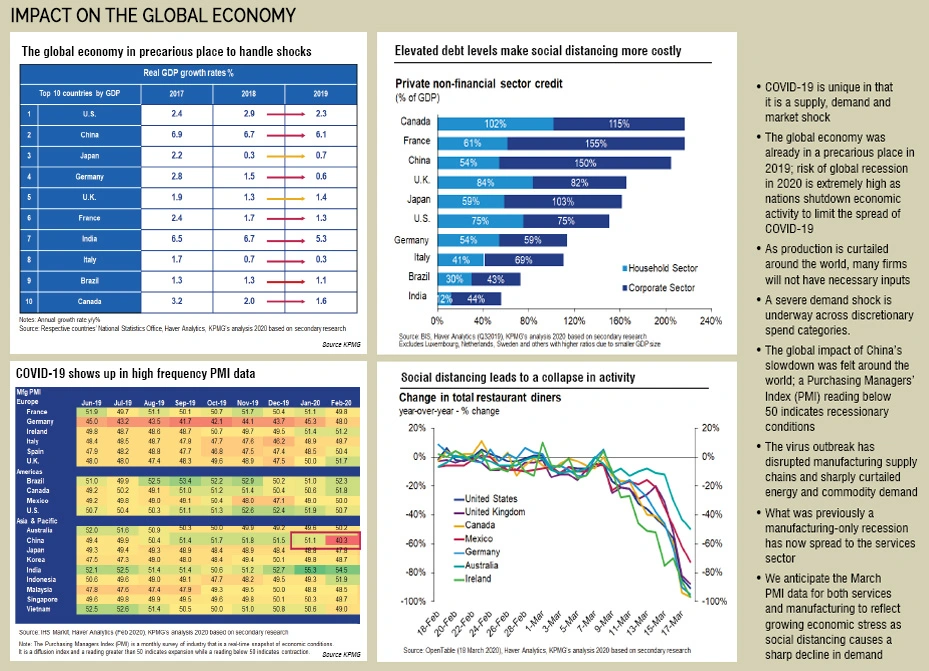

Of the 19 nations considered in a recent KPMG report, the Purchasing Managers’ Index (PMI), which hints at how the economic elite feels about a country’s state, in nine of them was below 50 per cent, which indicated “recessionary conditions”. The latter did not include India (54.5, the highest among all the nations), the US, and the UK, but had powerhouses such as China, Germany, France, Japan, Korea, and Singapore. Only the four surveyed nations in North and South Americas seemed to be safe with individual PMI of over 50.

THE respective PMIs were for February 2020. As the crisis deepened in the US, Europe, and Japan, eased in China and Taiwan, and hurtled towards dangerous levels in India, the figures for March and April will be worse. “We anticipate the March PMI data to reflect growing economic stress,” says the report. In February, the PMI in China’s case was the lowest, at 40.3, among the 19 nations. So, despite its recent recovery, it has a long way to go before it shows signs of healthy economic growth in the near future.

Social distancing, and complete lock-downs in most nations, including India, will sharply curtail global consumption over the next few months, or may be the next two-three quarters (up to December 2020). Hence, the KPMG report concludes that a V-shaped recovery, i.e. a sharp downfall followed by a quick, sharper, and spiked bounce-back, or even a U-shaped one, with a sharp recovery after some time, will depend on how governments, corporate entities, market, and investors “cope with the lower demand”.

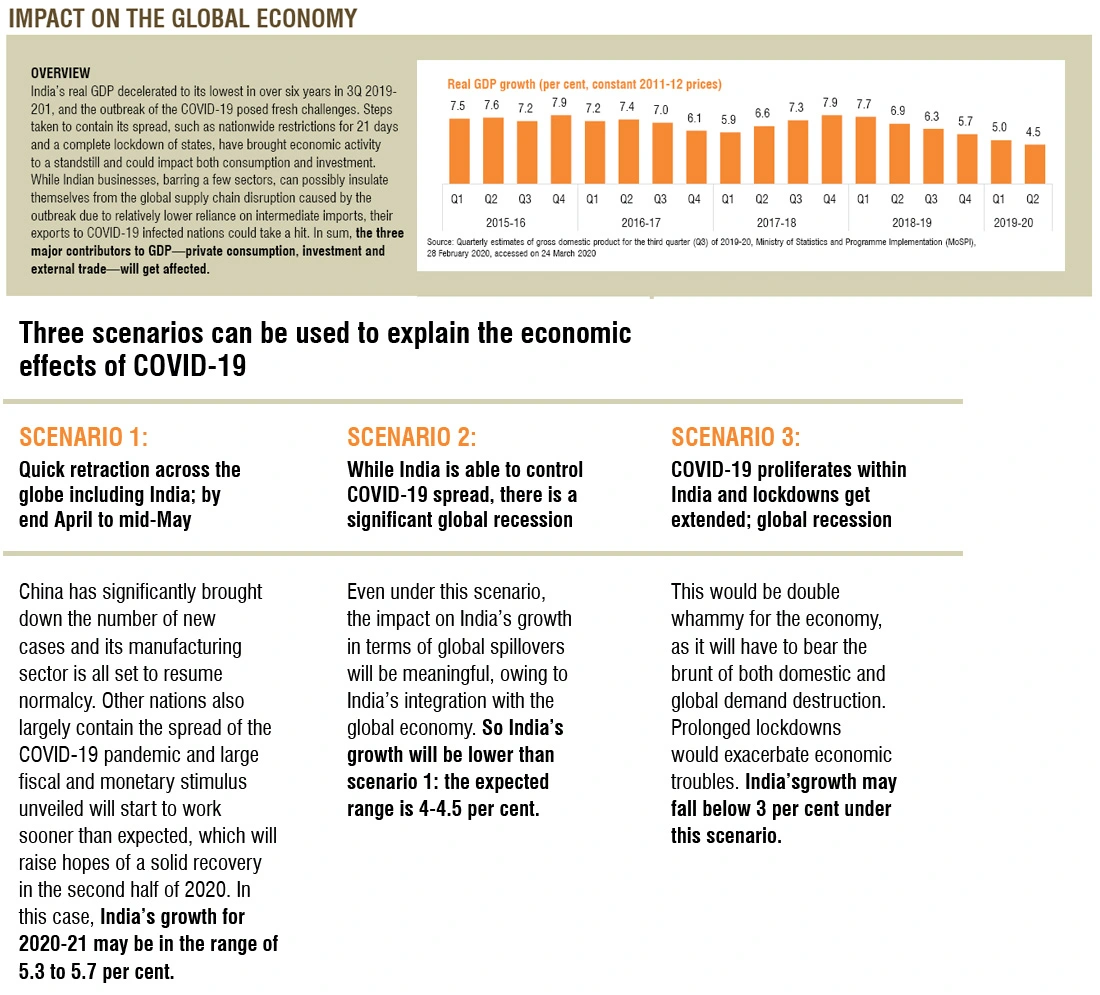

What one may witness can be an L-shaped economic growth curve. It will be better than the Great Depression, when the graph kept plummeting, but it will entail long periods of flat growth at a much lower level. For example, in the case of India, the growth may taper from 5 per cent to 3 per cent or less, and remain at those levels until December 2020, or even March 2021. The same may be true for China; hence, it will be unable to emerge as the global engine for growth, the way it did after the Financial Crisis of 2008.

SOME of the sectors may be devastated. Already, social distancing has shown its menacing impact. Restaurants can be a “useful proxy” to judge “person-to-person retail activity”. Across the globe, diners were down by almost 90 per cent and this is expected to go up to 100 per cent over the next few weeks. In some countries like Canada, this has already happened. Many restaurants will shut down, and lay-off employees. Even online suppliers of food are affect-ed because they are unable to deliver food that isn’t cooked.

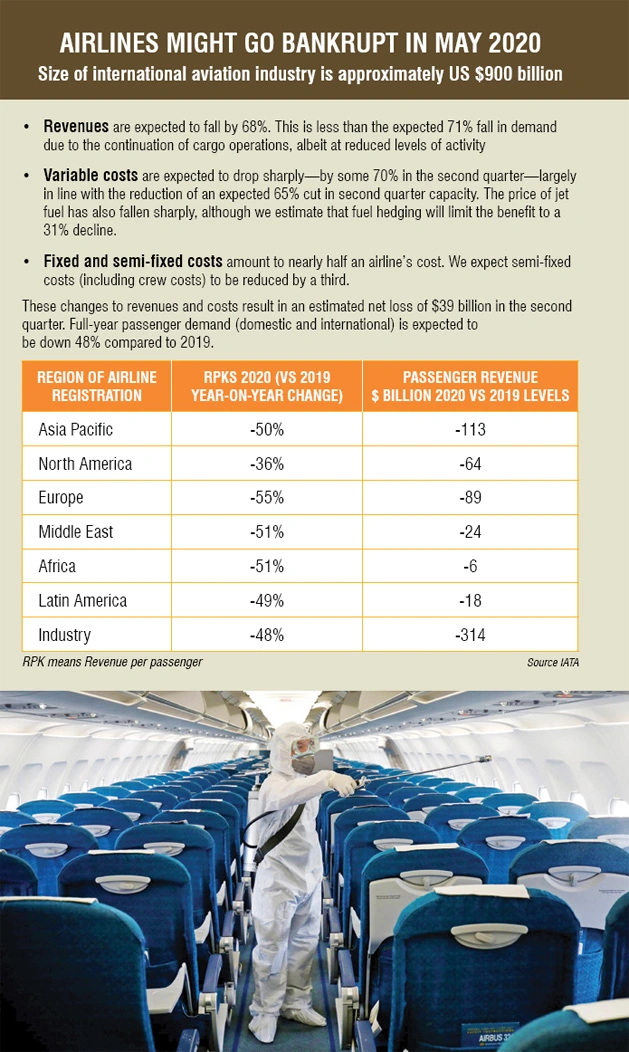

The same is true about the travel, tourism, and the hospitality sectors. According to the World Travel and Tour-ism Council, the crisis will “cost the tourism sector at least $22 billion, the travel sector shrinking by up to 25 per cent in 2020, resulting in a loss of 50 million jobs”. IATA says that the “global revenue loss for passenger business is estimated between $63 billion (11 per cent) and $114 billion (19 per cent)”. In the case of India, the losses will be higher than the “earlier ones such as 9/11 and the financial meltdown of 2008-09”.

The KPMG report looks at three scenarios for India. Its optimistic viewpoint, i.e. “a quick retraction by end-April to mid-May”, which seems impossible now, estimates annual growth at over 5 per cent in 2020-21. The scariest one, i.e. “extended global recession”, says that the growth rate “may fall below 3 per cent under this scenario”. The mid-way estimate—India is able to control the virus spread, even as there is a “significant global recession”—is a growth rate of 4-4.5 per cent. The last one seems to be the most likely scenario.

Like in the case of other nations, the problem are related to both demand and supply, which are equally affected. The consumption of non-essential goods and services has already tanked. An extended lock-down in April, or possibly May, will affect the consumption of even the essential commodities. Such “essentials” comprise a large chunk of the overall private consumption—food and non-alcoholic beverages (26.3 per cent); housing, water, electricity, gas and other fuels (13.7 per cent), and; transport (17.6 per cent).

AS jobs shrink in both the formal and informal sectors, demand will plunge further. According to the KPMG report, 37 per cent of the regular wage/salaried employees in urban India are informal workers (non-agriculture), who will face uncertain income following the stalling of urban activity”. The government’s stimulus package in the form of cash transfer and food security will help, but may not be adequate enough if the lock-down persists. More important, even the recovery may be accompanies by wage cuts.

On the supply side, a prolonged crisis, including longer lock downs, will force companies to declare bankruptcies, which will rupture future availability. But those that survive may quickly commence operations after the crisis, and even work extra hours to make up for the production losses of the entities that close down. The ‘China factor’ may not be a major bottleneck in terms of imports due to two reasons. The first is obviously that China is back in action, and Indians can source intermediate products.

At the same time, India’s economy is relatively “insulated given its low reliance on intermediate goods from China, as well as the common practice in Indian firms of stockpiling inventory”. Only some sectors, such as electrical machinery, organic chemicals, plastics, and fertilisers have an undue dependence on China. Imports from the Red Dragon comprise 18 per cent to 40 per cent of the total imports in these segments. It will be tough to change supply sources, as the rest of the world continues to grapple with the virus.

SOME experts feel that low global prices of crude oil and other commodities will help countries like India, which imports 80 per cent of its annual requirement. However, the government has not passed on the fall in prices to the domestic consumers. It has used the situation to “improve

its fiscal position”. The dip in global prices was followed by a hike in local excise duty on petrol and diesel, “which could create additional revenue to the tune of Rs 390 billion”. This can help the government to spend more to revive growth.

However, the fall in global prices can prove to be a double-edged sword. India will save money because of the fall in oil prices, but the local demand for fuel has plummeted because of the shutdowns. Only a complete economic recovery can ensure higher revenues. More importantly, the global conditions will negatively impact exports and, hence, the trade deficit, i.e. the difference between imports and exports, may remain on the higher side. In addition, the consumers may not gain much over the next few months.

The most crucial aspect to the Indian economy over the next few months will be the impact of the virus on agriculture. There are several factors to consider here. One, the Rabi crop needs to be harvested and distributed. Farmers in many Indian states may not get migrant labour for the purpose, and access to buyers like the government, middlemen, and mandis is curtailed. At the same time, the government is loaded with huge buffer stocks, and may not wish to buy too much. Farm incomes may fall dramatically.

Perishables like vegetables need to be quickly distributed. Seasonal industries like fruits and fruit-processing—the season for mango and other fruits like lychee is just ahead—need migrant labour on an urgent basis. If these do not happen, additional incomes may tumble. Thanks to rumours and “fake social media propaganda”, there is “no or low demand for poultry products”. So, yet another source of farm income is affected. The combined impact could be colossal, and more long-term than the virus.

If the farmers are unable to sell the Rabi crop, as well as seasonal ones and poultry, apart from milk whose de-mand has gone down, they may get into debt crises. They will be unable to repay the loans they took for the Rabi crop, and they will need to take fresh loans for the Kharif crop and seasonal crops like mango and other fruits that come on the market in the summer months. Only after the next crop will they be in a position to repay but, by then, fresh loans will be required. Unless there is a massive loan waiver, the debt cycle can continue for a few years.

Similar predicament will be faced by migrant labour. It cannot move out and, hence, will lose the additional in-come. This will prove critical after the Rabi crop is harvested, and the workers are in a position to seek new temporary jobs. The government stimulus will help in a limited manner. Once the economy recovers, the workers will face a piquant situation—should they immediately venture out, and take health risks, or remain in their villages? This will especially unnerve those who move around with their families.

As we said earlier, we have always lived in uncertain times, but now the uncertainties have exponentially multiplied. As the virus spreads dangerously, and in numbers that are inexplicable and especially large, we are in a situation that no one in the past three-four generations has seen. As someone aptly remarked, “I have seen the trains stop during the nationwide strike in 1974. But I have never seen trains, buses, cars, two-wheelers, planes, and ships, all come to a complete standstill”. This is the true nature of the virus.

Alam Srinivas is a business journalist with almost four decades of experience and has written for the Times of India, bbc.com, India Today, Outlook, and San Jose Mercury News. He has written Storms in the Sea Wind, IPL and Inside Story, Women of Vision (Nine Business Leaders in Conversation with Alam Srinivas),Cricket Czars: Two Men Who Changed the Gentleman's Game, The Indian Consumer: One Billion Myths, One Billion Realities . He can be reached at editor@gfilesindia.com