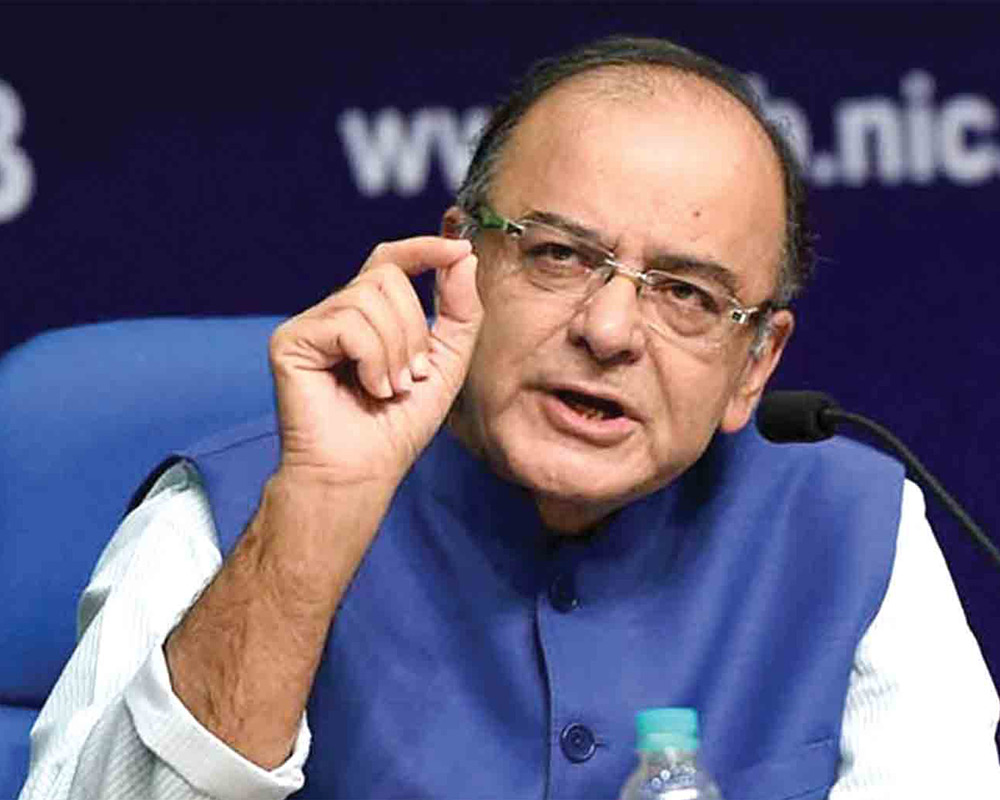

THE Indian legal system is a live organism responding to the changing needs of time and the people and making amendments in the law when required to address the same in a timely fashion, taking into account the problems faced in implementation and the aspirations of the people. The GST Council, a constitutionally appointed body comprising of Finance Ministers of various States headed by Finance Minister Arun Jaitley, has been doing so since the enactment of the Central Goods and Services Tax (CGST) on July 1, 2017 which is based basically on its recommendations. Being a new law for the country, it is having teething troubles like a newly born child which are being looked after well by the GST Council by suggesting reforms in law and rates from time to time. Based on the experience gained in the working of the Act & Rules of CGST, several changes have been made. The most recent and wide sweeping changes have been suggested by the Council in its recent meeting on December 22, 2018 and suggestions made by the Council are summarised in later paragraphs. The suggestions relate to both law and rates.

Changes in tax brackets

The CGST has five tax brackets prescribing rates from zero per cent to 28 per cent. The main demand of taxpayers was to make changes in the 28 per cent bracket, which was considered to be high in view of the conditions in the country. So the main emphasis of the Council has been on this bracket where major changes have been suggested and items have been moved to lower brackets. The items currently falling within 28 per cent bracket (including cement) have now been reduced by 23 and only 28 items now remain in this bracket.

In a short article like this, it is not possible to mention the details of all movement of goods from one bracket to another. The future scenario regarding the same is: The 18 and 12 per cent slabs can be combined into one rate in a new slab called standard rate. This may be 15 per cent or near about this rate. There could be one separate exception rate for ‘sin’ and luxury goods.

The highlights of changes consequent to movement from one bracket to another are briefly stated as under:

- GST rate on cinema tickets above Rs. 100 shall be reduced from 28 per cent to 18 per cent and on cinema tickets up to Rs. 100 from 18 per cent to 12 per cent.

- GST rate on third-party insurance premium of goods carrying vehicles shall be reduced from 18 per cent to 12 per cent.

- GST rate on frozen vegetables reduced from 5 per cent to zero per cent.

- Services supplied by banks to Basic Saving Bank Deposit (BSBD) account holders under Pradhan Mantri Jan Dhan Yojana (PMJDY) shall be exempted.

- Air travel of pilgrims by non-scheduled / charter operations, for religious pilgrimage facilitated by the Government of India under bilateral arrangements shall attract the same rate of GST as applicable to similar flights in economy class (i.e. 5 per cent).

One important item not moved from 28 per cent to the lower bracket has been cement. Doing so would have caused considerable revenue loss (approximately of Rs. 13,000 crore) to the Centre and the States. But indications during public discussions indicate that there may be a change in the cement rate too before presentation of Union Budget for the year 2019 in July 2019 or so.

Media reports show that the view expressed during discussions is that GST on under-construction units bracket at 5 per cent shall be without offering the benefit input tax credit to builders. But to keep a check on cash transactions, the builder will have to certify that 80 per cent of the inputs – such as cement, steel, paints and other building material – have been purchased from entities that are registered for GST.

The revenue loss estimated is Rs. 5,500 crore. Now, only 28 products such as cement, auto parts and aircon-ditioners are left in the top slab of 28 per cent, along with some luxury and “sin” goods.

The most important change suggested regarding the law is bringing ‘services’ also under composition scheme. Currently only the goods sector can avail of composition scheme with persons having turnover up to Rs. 1.50 crore. The details about such changes will be worked out soon.

The Finance Minister said, “We have followed a pragmatic and prudent policy that as revenues move up and affordability increased, we gradually bring down the rates. The 28 per cent bracket is already moving towards a sunset, except the luxury and sin items, three items (such as ACs) which are used by upper income groups and only one item (cement) of common use remain.” The Opposition-ruled States have not liked the suggestions of CGST in regard to slashing of the number of items in the 28 per cent bracket.

Future outlook

The Finance Minister has stated that the future scenario of GST law would be somewhat on following lines:

(a) Break-up of present rates:

- Total items in GST net – 1214

- Zero GST items – 183

- 5% rate – 308

- 12% rate – 178

- 18% rate – 517

- 28% rate – 28

There seems to be no ground why electricity, real estate and petroleum products should remain outside the purview of GST levy. States need to show the same magnanimity in agreeing to the inclusion of these items as they have shown in ushering in the GST law in the country

(b) Future slabs

In future, there would be 3 slabs viz: 0%, 5%, Standard rate. There would be exceptional rate for luxury and sin goods.

(c) Immediate priority is to move cement from 28% to a lower rate.

The CGST Council activity is the result of PM’s comments in one of his addresses to the people of the country expressing the desire that number of goods from the top bracket of 28 per cent be moved to lower brackets. The GSTC has done a good job in implementing the PM’s suggestion.

IN one and half years since the GST law has been in force, it has undergone many changes consequent to implementation. This shows the Government’s responsiveness to changes that need to be made. However, there are still areas where amendments are needed. One of these relates to the numerous exemptions which bring down the collections. There seems to be no ground why electricity, real estate and petroleum products should remain outside the purview of GST levy. States need to show the same magnanimity in agreeing to the inclusion of these items for levy of GST, as they have shown in passing the Constitution amendment law and in ushering in the GST law in the country.

The Centre has always been responsive to the States’ demands. For example, originally only essential items such as wheat, rice and food grains were included in the exempted category, but the list expanded after many states sought the inclusion of mass-consumption items in their states. Deliberations in the GST Council meetings should be based on economic considerations and not on political grounds and issues should be decided on consensus basis as has been done in the past. Punjab has already taken a lead in this direction. It has sought reconstitution of the law review committee, in view of the upcoming general election, to look at the entire law holistically. “We should avoid the temptation of another knee-jerk reaction and work towards making our GST truly world class,” Badal is said to have observed.

The writer is former Chairman, CBDT