For every barrel of oil produced in India, the government earns more than 50 per cent of revenue through royalty, cess, profit petroleum; not to mention corporate income tax and other state level taxes. On the other hand, for every barrel of oil imported into the country, the government not only gets zero revenue but has to shell out precious foreign exchange that has a direct bearing on the country’s economy. The need of the hour is to boost domestic production through a robust policy and concerted efforts.

Potential aplenty

India is a country with expansive oil and gas resources, and a huge potential for new explorations. India’s 26 sedimentary basins have a total resource (in place) base of 41,872 million metric tonnes with varying degrees of prospective hydrocarbon potential spread across onshore, offshore and deepwater areas.

Given India’s current domestic crude production of 36million tonnes, this itself translates into revenue of billions of dollars for the government, not to mention the energy security it ensures for the country. The irony is that the current domestic oil production barely meets less than 20 per cent of the country’s needs with most of the demand being met through imports.

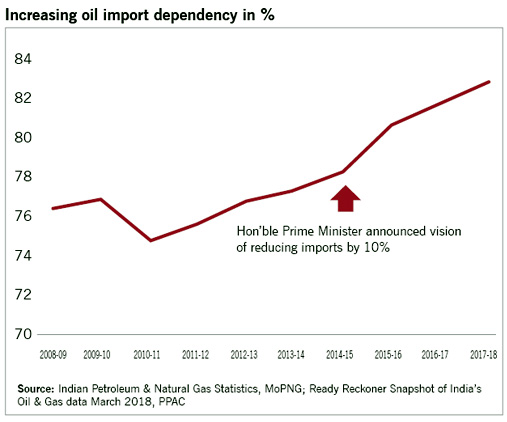

Prime Minister Narendra Modi’s vision to cut imports by 10 per cent by 2022 through increased domestic production will give a double boost to the economy by way of increased revenue-share on domestic production and savings on foreign exchange for imports.

Swift response

Over the last more than four years, GOI has taken series of policy liberalisation measures in the oil and gas sector. GOI’s focus is to attract investments, usher ease of doing business and promote the principle of ‘Maximum Governance and Minimum Government’.

Discovered small fields, policy framework for early monetisation of CBM, Hydrocarbon Exploration and Licensing Policy (HELP), Open Acreage Licensing (OAL), policy to access Unconventional Hydrocarbons from existing contracts, Policy Framework to Promote and Incentivise Enhanced Recovery Methods for Oil and Gas are seen as fundamental shift in India’s E&P sector which will have transformational impact. Focus on expeditiously increasing domestic production and minimising project delays has boosted investor confidence. For instance, the Discovered Small Field Round I is envisaging an investment of about USD 600 million, while Discovered Small Field Round II is envisaging investments of about USD 1.2 billion.

Similarly, the Policy Framework to Promote and Incentivise Enhanced Recovery Methods for Oil and Gas can be a game-changer and significantly increase India’s domestic production. For instance, the Union Cabinet press note highlighted that an increase of 5 per cent in recovery rate of original in-place volume in oil production can lead to 120 MMT additional oil production in next 20 years. In case of gas, an increase of 3 per cent recovery rate on original in-place volume can lead to additional production of 52 BCM of gas in next 20 years. Thus, Enhanced Recovery Methods holds significant promises and can prove game-changing for the country.

While all the above reforms measures are transformational with far-reaching impact on the sector, certain policy issues continues to threaten and hold back the sector’s true potential.

High taxes crippling hydrocarbon production

Consistency and continuity are crucial to big private investments, especially in sectors like oil and gas with long gestation periods where the returns on the billions of dollars are accrued over decades. For companies who commit their funds and resources on the confidence of the Government’s word, running the business in India’s highly regulated environment is tough enough and any variance on part of the Government can have a severe impact on the very viability of projects.

A case in point is the steep 20 per cent cess on domestically produced crude oil, which puts a huge burden on domestic production. It is pertinent to point out that this cess burden has kept on increasing over the last many years. While linking the cess to an ad valorem rate is a step forward, cutting the cess to 8-10 per cent will go a long way in boosting domestic production.

The policies governing extension of Production Sharing Contracts, introduced in March 2016 and April 2017, is another example of increasing tax burden. The arbitrary increase in government’s share of profit petroleum by 10 per cent and significantly higher levels of royalty and cess vis-à-vis current levels further deteriorates the economics of domestic oil producers.

IT is disquieting to note that the Unconventional Hydrocarbons Policy, introduced in August 2018, further increases government’s share of profit petroleum by 10 per cent. Thus, two new policies introduced after the Prime Minister’s vision of higher domestic production has increased government’s share of profit petroleum by 20 per cent.

Increasing tax burden is counter-intuitive since most of the fields going for extension of contract are ageing and hence require more financial and technological investments than before. By increasing the profit share and payable levies, the government is effectively discouraging investments in oil producing blocks. Even the recently introduced GST, which was supposed to be tax neutral, actually ended up increasing the tax burden on the sector.

Contract sanctity is key

Sanctity of contract remains a challenge for foreign and domestic operators. Many companies have faced numerous cost recovery and tax disputes. India continues to struggle with respect to adherence to contract sanctity.

For example in August 2018, GOI notified policy of Sharing of Royalty & Cess in proportion to the Participating Interest of the Contractors in Pre-NELP Exploration blocks, which is a classic example of violation of contract sanctity. Such repeated violation of contract sanctity derails India’s quest to attract foreign investments and undermines Prime Minister’s efforts to provide a stable and a predictable taxation regime.

Countries like Brazil attribute their success in inviting foreign investors to their oil and gas sector by giving paramount respect to contractual terms. India, on the other hand, has a poor track record in maintaining contract sanctity, ranking a low 164 out of 190 on the global Contract Enforcement index.

It is disquieting to note that the Unconventional Hydrocarbons Policy, introduced in August 2018, further increases government’s share of profit petroleum by 10 per cent

Policy clarity & consistency is need of the hour

An inconsistent policy legacy is one of the key reasons why foreign players aren’t showing any meaningful participation in India’s upstream exploration space. It isn’t that foreign players haven’t invested. Over the years, leading players like Chevron, BHP Billiton, ENI, Gazprom amongst invested in India’s acreages. But regulatory hurdles and administrative burden led to their eventual exit.

The not-so-encouraging response to Discovered Small Fields and the Open Acreage Licensing round is reflective of the state of affairs. Not surprisingly, the oil & gas sector accounted for a mere 2 per cent of the total FDI inflows into the country over the past 18 years.

This is the sixth consecutive year of fall in domestic crude oil production—from 38 MT in 2012 to 36MT in 2017 and 35.7 MT in 2018. This has pushed the country’s import dependence for crude oil to an astounding 83 per cent. India’s oil import bill is expected to increase to USD 450 billion by 2040 from USD 65 billion in 2015.

Given the state of India’s oil production the Standing Committee on Petroleum & Natural Gas is not happy with the MoPNG actions to achieve Prime Minister’s vision of reducing import dependence by 10%. The Standing Committee in its 25th Report observed:

1. The Committee does not find any concrete action taken on the part of MoPNG showing the existence of any effective coordination mechanism among different Ministries and clear cut strategy with action plans and stipulated timelines to achieve the target of reduction in import dependence by 10 per cent by 2022.

2. The Committee reiterates its recommendation that more effective and prompt policy decisions are required to be taken on the ground to implement the strategy towards achieving this goal in coordination with other energy consuming ministries.

Similarly, the Standing Committee in its 23rd Report had highlighted projections for crude oil production in the years to come show a marginal increase from 37.34 MMT to 38.34 MMT in 2021-22. All these put together points to the need for urgent measures to turn the corner.

It is possible to turn the corner

In just nine years, the US has increased its oil production by more than 90 per cent—from 6.7 million barrels per day in 2008 to 13 million barrels per day in 2017. This phenomenal growth in the US crude oil production has been driven by the development of tight oil resources. Cutting-edge technologies and conducive policies have enabled tight oil production to constitute 54 per cent of the US total production in 2017.

US Energy Information Administration’s (EIA) Annual Energy Outlook 2018 projects an increasing role of tight oil production. Through the early 2040s, tight oil production will surpass 8.2 million barrels per day (b/d) and account for nearly 70 per cent of the total US production. As Per US EIA, hydraulic fracturing in combination with horizontal drilling has allowed the US to increase its domestic oil production faster than any time in history. Thanks to these technologies and conducive policies, EIA projects that the US will become a net energy exporter in 2022.

The way forward

Just like US, India can stem the decline, ramp up production and realize its hydrocarbon potential. While modern technology and more efficient methods of extraction can boost production in existing reserves, enhancing exploration and production activities on new fields can significantly up the domestic production.

The on-ground implementation of the recently introduced Hydrocarbon Exploration and Licensing Policy (HELP) will help attract more players and investments in the sector. However, the only drawback of these reforms measures is that it will translate into production 5 to 7 years from today.

IN terms of immediate outcomes, the government should roll out the much-delayed reforms for the existing players. From reducing the tax burden of cess and royalty on the upstream sector to introducing a forward-looking PSC Extension policy and a pragmatic Natural Gas pricing policy will give a much-needed boost to domestic production.

To improve investor confidence, it is necessary to ensure that contract stability and sanctity is maintained and no retrospective changes are made to contracts. Institution of a well-defined process for contract extension with clearly identified timelines, roles and responsibilities will enhance India’s image and investment worthiness.

As a nation we must act swiftly and decisively to securitise energy by adopting a conducive policy framework which would ensure at least 50% of our demand is met by domestic production.

The need of the hour is for the industry and the government to join hands and work together towards an energy secured future for the country. Supportive policies from the government will be a huge step forward to this promising future.