EXCEPT for introduction of dividend tax for those receiving it in excess of Rs. 10 lakh, I could hardly find anything that can be termed negative for the market in the Union Budget 2016. The measure of dividend tax can best be described as ‘penny wise pound foolish’, looking at the current scenario of the market and the disproportionate damage it may cause to the sentiment compared to the minuscule revenue it will end up generating. In fact, the much-needed focus on agriculture, rural development and infrastructure will give the desired push to demand stimulation in rural India, that has become a matter of concern post two consecutive monsoon failures and the world economy going through a massive slowdown. Also, it will be a step towards ensuring food security and will prepare the necessary base for the ‘Make in India’ initiative.

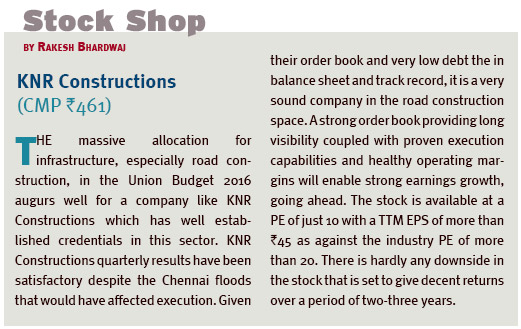

By sticking to the fiscal deficit target of 3.5 per cent of GDP, the Finance Minister has not only reiterated the fact that fiscal stability and discipline remain his key focus, but has also ensured that dysfunctional consequences of fiscal splurge are not allowed to spread to the economy in the form of inflation and currency depreciation. However, in view of the impending implementation of one rank one pension (OROP) and recommendations of the Seventh Pay Commission, how the FM will meet the target is not clear. A massive boost to infrastructure will not only augur well for economic growth but will also be positive for sectors such as steel and cement that are languishing for quite some time due to demand slowdown across the world and crash in commodity prices. The Rs. 25,000 crore allocated for recapitalisation of public sector banks is too little to not only meet the Basel III norms in time, but is grossly inadequate in view of the deep malaise the banking sector is facing following mounting NPAs. Also, this will not enable the banks to give the much-needed push to credit growth for the private sector.

The Budget has nothing positive for the corporate sector which is reeling under consecutive earnings downgrades and has seen a sharp deterioration in the interest coverage ratio that may further compound the woes of the banking sector. Lack of incentives for the corporate sector and the capital market in general and no relief in direct taxation will result in the savings rate going down further. This may not augur well for an economy that desperately needs investment to pick up. Also, this may prove to be counterproductive for the success of the ambitious disinvestment target of the government in view of the market not showing any signs of revival anytime soon.

The face-off in Parliament over the JNU and Rohith Vemula issues is unlikely to make room for any major reform to get through in this session. The global scenario remains equally volatile with Japan introducing negative interest rates and China continuing to witness FII outflows.

Investors will do well to exercise caution as there may be some more downturn felt in the market. However, wherever value is seen, one needs to start investing gradually. Even investing in Nifty in a staggered manner shall give decent returns over a period of two-three years.

The author has no exposure in the stock recommended in this column. gfiles does not accept responsibility for investment decisions by readers of this column. Investment-related queries may be sent to editor@gfilesindia.com with Bhardwaj’s name in the subject line.