THE Prime Minister who believes in inclusive growth with “sabka saath sabka vikas” not only gave those hoarding black money more than one chance to declare it but has also given investors, who missed the bus, yet another opportunity to enter the market at attractive valuations post the correction witnessed due to demonetisation. Since most analysts are of the opinion that demonetisation will be very positive for the economy in the long run, those entering the market with a time horizon of 3-5 years can expect decent returns from equities. However, there is a general consensus that economic activity will take a hit for at least 3-6 months slowing GDP growth considerably thereby increasing volatility in the market with a downward bias.

The global scenario also indicates that there are headwinds for the emerging markets. The victory of Donald Trump has added new risk variables for equity, bond and currency markets. The US Federal Reserve is likely to increase rates in December that will adversely impact emerging markets, including India. FPIs sold close to Rs. 32,000 crore of securities in November (till 25th) and the Indian rupee has depreciated by more than 2 per cent in November alone. The sudden increase of CRR by 100 per cent will only add to underlying weakness. Services exports are expected to deteriorate progressively with IT exports to be the worst hit due to likely changes in visa regime and other related decisions in the US. The referendum in Italy may further lead to European disintegration and China’s depreciating yuan can add to our difficulties. Waning global demand and declining remittances are likely to put pressure on our current account deficit.

The sudden liquidity withdrawal due to demonetisation is likely to have a shock effect on the economy, disrupting the supply chain, dampening an imminent consumer led economic revival, and deterring capex ambitions of the industry. The earnings recovery may now have to wait for another couple of quarters. This has made FPIs sell aggressively making India underperform EMs by around 3 per cent. The rupee may touch a new low of 70 to a dollar. Some sectors such as real estate, jewellers, discretionary goods, FMCG, auto, NBFCs, and so on, may be hit hard with SMEs and rural sectors impacted severely. This may lead to sharp spike in NPAs of the banking sector in the near term.

In the medium to long term, huge liquidity will come into the system without impacting inflation and one can expect rate cuts by the RBI to the extent of 50 basis points in the near future. This will lead to cost reduction and higher profitability for corporate India and will also give a push to further capex. The revenue will rise and fiscal deficit contained boosting government spending on infrastructure and social sectors that will in turn boost growth and employment generation. All this with reduced corruption and black money generation will improve ease of doing business coupled with low real estate prices giving a boost to the Make In India dream of the Prime Minister.

Equities will get a massive boost due to low rates of interest and other avenues of investment such as gold and real estate losing their attraction. Also, mutual fund mobilisation is set to cross Rs. 12,000 crore in November and retail investors are pouring money in SIPs to tune of Rs. 3,800 crore every month with 7 lakh new accounts added every month. Investors should use every sharp dip to buy into themes such as infra, PSEs, etc.

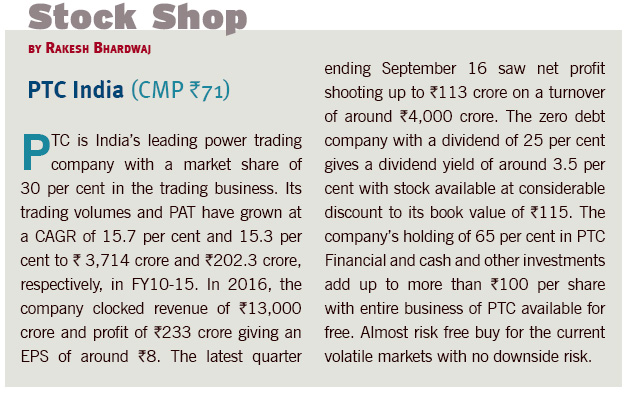

The author has no exposure in the stock recommended in this column. gfiles does not accept responsibility for investment decisions by readers of this column. Investment-related queries may be sent to editor@gfilesindia.com with Bhardwaj’s name in the subject line.