- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

Recent Posts

© Copyright 2007 - 2023 Gfiles India. All rights reserved powered by Creative Web INC. Dr GS Sood, Business Editor gfilesWritten by GS Sood

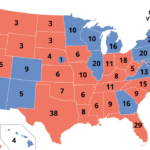

Dr GS Sood, Business Editor gfilesWritten by GS SoodTHE market is likely to witness increased volatility as the December quarter results pour in. How the initial days of the Trump Administration pan out coupled with lack of clarity on GST and impact of demonetisation on the economy and corporate sector may further add to the choppiness of the market. However, investors should be clear that though the market may witness bouts of correction, a complete blood bath may be ruled out since domestic funds have a lot of liquidity and are waiting for any steep correction to happen. Investors will, therefore, do well to pick stocks in a staggered manner with each correction they witness lest they are bound to miss the bus again. The market may go into a prolonged bearish phase only if the government fails to tackle demonetisation effectively with the implementation of GST getting delayed beyond a point and Union Budget 2017 not able to meet the expectations of the resurgent economy and the market and if the earnings revival of the corporate sector get delayed beyond the next quarter.

However, India’s macro-fundamentals still makes it one of the most attractive destinations for FPI investments. Political, economic and financial uncertainty remains clouded over Europe post the Italian referendum with Germany, France and Netherlands going in for elections this year. Back home, the elections in Uttar Pradesh, Punjab, Uttarakhand, Goa and Manipur are likely to keep the market on edge since the results may not only impact the ability of the current dispensation to go in for further bold reforms but will also impact the coming Presidential election this year. With inflation remaining benign, the RBI may opt for aggressive rate cuts sooner than expected due to the ample liquidity in the system, provided crude prices in the international market remain range bound. Demonetisation has led to a fall of almost one lakh crore rupees in domestic credit and corporate capex plans may not see an early revival.

Most analysts are of the view that the gains from demonetisation will far outweigh the pains in terms of the cash brought into mainstream formal productive channels, improvement in the tax to GDP ratio due to widening tax base, ability of the Government to spend more on infrastructure and social sectors without adversely impacting the fiscal deficit but creating a lot more job opportunities, improvement in financial inclusion by bringing more people to mainstream banking channels thereby improving the ease of doing business. Also, the Government may extend tax concessions to corporate and individual tax payers thereby reducing the cost of doing business as also increasing spending to prop up demand leading to a higher rate of growth in GDP. Besides, efforts are on to create a robust financial system with ongoing, merger of banks to create fewer but fundamentally strong banks to achieve the twin goals of financial stability and growth.

With just 2.8 per cent of household wealth invested in equities as against 12.5 per cent in gold and 56.4 per cent in real estate, investors should not miss the current opportunity to shift their investments from physical to financial assets. Banks, infra, consumer durables, logistics, chemicals, oil and gas, IT, pharma, power utilities, and exports may be interesting themes to look at during the next two quarters. Wishing you all a happy new year and happy investing.

The author has no exposure in the stock recommended in this column. gfiles does not accept responsibility for investment decisions by readers of this column. Investment-related queries may be sent to editor@gfilesindia.com with Bhardwaj’s name in the subject line.

Recent Posts

Related Articles

Stock DoctorStock Doctor : In a sweet spot

Written by GS Sood THE market is witnessing an unprecedented bull run post...

ByGS SoodApril 11, 2017Stock DoctorStock Doctor : Happy times to continue

Written by GS Sood THE Union Budget 2017 can well be viewed as...

ByGS SoodFebruary 14, 2017Stock DoctorStock Doctor : Opportunity to buy

Written by GS Sood THE Prime Minister who believes in inclusive growth with...

ByGS SoodDecember 17, 2016Stock DoctorStock Doctor : Worrying times ahead

Written by GS Sood DESPITE pricy valuations of Indian market at around 20...

ByGS SoodNovember 15, 2016 - Governance

- Governance