- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

Recent Posts

© Copyright 2007 - 2023 Gfiles India. All rights reserved powered by Creative Web INC.GovernanceA WEB OF DECEIT: The man who pretended to know too little…

It would be wrong to suggest that Jignesh Shah, who was one of the “key managerial personnel” on the Board of Directors of NSEL, did not know what was going on there. All outward emails of NSEL were routed through an outbox, “FT outbox”. The minutes of the NSEL’s Board were regularly tabled at the FTIL board meetings, which meant that it had knowledge of the goings-on in NSEL. Otherwise, on what basis did Shah assure that the stock held in NSEL’s 120 warehouses was valued at around Rs. 6,000 crore?

Neeraj MahajanJuly 8, 20198 Mins read117 Views

Written by Neeraj Mahajan

Written by Neeraj MahajanCAN “Ram”, or FTIL and NSEL, be penalised for defaults by “Shyam”, or the 24 alleged defaulters? The answer to this riddle assumes far-reaching significance in light of Additional Secretary, Department of Economic Affairs, Dr KP Krishnan’s letter to the Ministry of Corporate Affairs, stating that FTIL and NSEL appeared to be maintaining separate identities for a fraudulent purpose to deprive the investors of their money.

There is a need to lift the corporate veil in order to unearth the fraud, which impacted market participants and, in his letter (October 15, 2014), Krishnan opined that FTIL and NSEL should be merged under Section 396 of the Companies Act. Based on it, the Centre passed an order in February 2016, and transferred the assets and liabilities of NSEL to FTIL.

However, early this year, a Supreme Court Bench comprising Justices Rohinton Nariman and Vineet Saran declared the government’s amalgamation of Rs. 5,600 crore scam-hit NSEL and FTIL as a violation of both the Constitution and Section 396 of the Companies Act, which deals with compulsory amalgamation of companies by a Central Government order when it becomes essential in the public interest. “Complete non-application of mind by the authority assessing compensation to the rights and interests of the shareholders and creditors of FTIL,” said the 133-page judgment.

This verdict was music to the ears of Jignesh Shah, who controlled 99.99% of NSEL through FTIL, when trading was suspended in July, 2013. As things stand, 63 Moons Technologies Ltd (earlier FTIL), which is in the business of selling software used by brokers and exchanges for trading, is a profitable company with about 900 employees, and a positive net worth of over Rs. 2,500 crore. FTIL’s (63 Moons) Board of Directors is different from the Board of Directors of NSEL, a wholly-owned subsidiary, which provided an electronic platform for trading of commodities.

Given the judgment, it may be an opportune time to recollect why FTIL and NSEL were merged, and the underlying reasoning behind it. In January 2013, MMTC Ltd, a state-owned company, visited some of the warehouses to verify the stocks at different locations and reported the existence of full commodity stocks. However in July 2013, 13,000 persons who traded on the NSEL platform claimed to have been duped by 24 trading members, who defaulted on payments of Rs. 5,600 crore. NSEL was asked to suspend trading and close its operations. The Forward Markets Commission (FMC) recommended steps to verify the quantity and quality of commodities at various warehouses, financial status of buyers and trading members, and the liability of NSEL’s promoters.

On August 27, 2013, FMC directed a forensic audit by Grant Thornton, and inspection of the books of accounts of NSEL and FTIL. On the same day, the Economic Offences Wing registered cases against Directors and key management personnel of the NSEL and FTIL, trading members of NSEL, and brokers of NSEL. Several suits were filed by the traders who had allegedly been duped. NSEL also filed third-party notices to recover Rs. 5,600 crore from the 24 defaulter traders. It filed arbitration proceedings against them, and is in the process of recovering Rs. 3,365 crore.

As things stand, 63 Moons Technologies Ltd (earlier FTIL), which is in the business of selling software used by brokers and exchanges for trading, is a profitable company with about 900 employees, and a positive net worth of over Rs. 2500 crore

On December 17, 2013, based on the Grant Thornton report, the FMC declared that it was not “fit and proper” for FTIL to hold equity in any commodity exchanges and it must dilute its shareholding to not more than 2% of the paid-up equity capital of MCX. The order was challenged in the Bombay High Court. On February 28, 2014, the Bombay High Court refused to stay the order.

On January 6, 2014, the Economic Offences Wing, Mumbai, filed a chargesheet against the Managing Director and CEO of NSEL, Anjani Sinha, BabuKanvi, the Head of Warehousing of NSEL, and two other defaulters. It revealed that the three NSEL employees colluded with the defaulters, in exchange for monetary kickbacks, to enable them to trade on NSEL’s platform without depositing adequate goods in the warehouses.

ON August 18, 2014, the FMC suggested that FTIL and NSEL be merged. Meanwhile, the Bombay High Court appointed a three-member committee —Justice VC Daga, J Solomon, and Yogesh Thar—to ascertain the liability of the defaulters and to assist in recovery of debts. Thus, in addition to Rs. 3,365 crore, the committee crystallised a further sum of Rs. 835.88 crore to be recovered from the defaulters.

On September 19, 2014, the Ministry of Finance issued a notification that withdrew the exemption granted to NSEL in 2007. Exemptions granted to the National Commodity and Derivatives Exchange (NCDEX) and the National Agricultural Produce Market Committee (NAPMC) were also withdrawn. The government felt that ready delivery or spot delivery contracts in commodities should not be traded on commodities exchanges.

According to Shyam Divan, a Senior Advocate for NSEL Investors Action Group, FTIL held 99.9998% of NSEL’s shares. NSEL was promoted by and was part of the FTIL group. The Board of Directors of NSEL was under the control of FTIL. NSEL’s exchange was represented by FTIL as its own, and treated, as a part of its “exchange verticals”. According to him, Jignesh was the kingpin in both the companies. He held 45% shares of FTIL and was its Chairman-cum-Managing Director and one of the “key managerial personnel” on the Board of Directors of NSEL as its Vice Chairman and member of NSEL’s Audit Committee. The minutes of the NSEL’s Board meetings were regularly tabled at the FTIL Board meetings, showing that FTIL had full knowledge of the goings-on in NSEL. All outward emails of NSEL and the other FTIL-group companies were routed through an outbox, “FT outbox”.

A forensic audit conducted by Grant Thornton, revealed that the operations of NSEL were not that of a commodity exchange but of a finance exchange, and it had no commodities in stock. The FMC issued show cause notices and then passed an order (December 17, 2013) which found NSEL guilty of severe malpractices. It wrote a detailed letter to the Secretary, Ministry of Corporate Affairs, indicating that as NSEL was financially incapable of repaying the investors/traders, it would be expedient in public interest to amalgamate NSEL with FTIL, so that the latter’s resources could be used to repay the debts.

A forensic audit conducted by Grant Thornton, revealed that the operations of NSEL were not that of a commodity exchange, but of a finance exchange, and it had no commodities in stock. The FMC issued show cause notices and then passed an order (December 17, 2013) which found NSEL guilty of severe malpractices

Senior Advocate Rakesh Dwivedi argued that the amalgamation was only to ensure that the finances of FTIL could be used to pursue the on-going litigation as NSEL does not have the wherewithal to do so. Thus, it is wholly incorrect to say that shareholders of FTIL will be unduly punished and forced to pay for the liabilities of NSEL. He added that Jignesh and his family owned majority of shares in FTIL. In addition 24% was purchased by the speculators, who took advantage of the low prices after the scam. These speculative investors need not be compensated.

IN 2012, when the FMC initiated action, Jignesh claimed that NSEL had full stock of commodities as collaterals and had 10-20% of open positions as margin money. He stated that the stock currently held in NSEL’s 120 warehouses was valued at around Rs. 6,000 crore. After the payment crisis in July 2013, on August 14, 2013, NSEL wrote to FMC with a detailed settlement plan. It indicated the period within which the dues would be paid with simple interest at 8% to 16% per annum. This was an abject failure. The audit by Grant Thornton came out with damning facts about NSEL.

The FMC issued show cause notices and passed an order that found NSEL guilty of malpractices. Based on this, the FMC wrote a detailed letter to the Secretary, Ministry of Corporate Affairs, in which it indicated that amalgamation was the way forward. Appearing on behalf of the Union of India, Additional Solicitor General Pinky Anand alleged that NSEL had never had a single registered warehouse in its name, as the Warehousing Development and Regulatory Authority rejected NSEL’s application for the registration in May 2011. Therefore, NSEL’s claim of 120 warehouses was a misrepresentation.

The paired contracts that were introduced was with a view to increase turnover of NSEL, and introduce a system based on vyajbadla. The increased turnover of NSEL enhanced revenues to FTIL. According to CBI, NSEL and its defaulters allegedly operated through nine shell companies, such as Brinda Commodity, Tavishi Enterprises, Dunar Foods, White Water Foods, VimaladeviAgrotech, and Yathuri Associates, which were used to divert the proceeds of the scam. Sources in CBI contend that these companies were allegedly used to divert close to Rs. 340 crore of the investors’ money, and illegally trade on the exchange without any verification or actual possession of commodities. CBI is investigating the role played by Jignesh, Anjani Sinha and some 20 others in this.

The Serious Fraud Investigation Office (SFIO) revealed that between 2009 and July 2013, NSEL, its Board of Directors, Chief Executive Officer and other Officers, as well as FTIL entered into a criminal conspiracy to earn money through fraudulent, illegal trading on the NSEL exchange platform and thus caused a loss to 13,000 registered traders. It said that NSEL, Indian Bullion Market Association Ltd. (IBMA) and others colluded to undertake fraudulent trades which were short sales and/or did not involve physical deliveries. The required fictitious paperwork was arranged by NSEL and IBMA officials.

The SFIO concluded that the 148 member-brokers of NSEL made unlawful gains, and laundered large amounts of cash, even as their clients suffered losses. SFIO asked the government to initiate the process of winding up the 148 brokerage houses for conducting business in a “fraudulent manner”. These included some of the top brokerage firms in India—Motilal Oswal Financial Services, Anand Rathi Shares and Stockbrokers and India Infoline.

SFIO revealed that NSEL management, including its Board of Directors, promoters, auditors, and partners, were privy to/involved in forgery, falsification of documents, persistent negligence, and carrying out duties in fraudulent manner. According to SFIO, NSEL officials identified financially stressed companies and lured them by promising availability of easy finance

SIGNIFICANTLY, the SFIO report and the Mumbai Police EOW report had stark similarities. The SFIO report said the same things that the EOW report said in 2015. Some of the key issues revolve around the fact that almost 83% clients lacked knowledge of commodity trading, but were lured into the trade by the brokers who indulged in rampant Client Code modifications.

Another modus operandi of the traders on NSEL platform was to produce false and bogus warehouse receipts in collusion with NSEL officials. For instance, Ferro Chrome lying in the warehouse of Metkore Alloys and Industries Limited was found to be of inferior quality and of much less value than claimed. In the process, Prashant Boorugu and Sarita Boorug, the promoters of Metkore Alloys and Industries Ltd received unlawful gains while the traders suffered losses.

SFIO revealed that NSEL management, including its Board of Directors, promoters, auditors, and partners, were privy to/involved in forgery falsification of documents, persistent negligence and carried out duties in fraudulent manner. According to SFIO, NSEL officials identified financially stressed companies and lured them by promising availability of easy finance through the paired contracts scheme. This is evident from the fact that majority of the 22 defaulter companies faced financial distress. Some had taken loans from banks, which had classified their accounts as NPAs. Others were not in a position to arrange finance. Some companies were not even into commodity trade and entered business to make a quick buck.

THE defaulters, who deposed before the SFIO, stated that they were informed that the commodity transaction was only a facade and the real purpose of the transaction was to arrange finances. The money earned by the defaulting companies on NSEL Exchange was illegally ploughed into buying immovable properties, repayment of bank loans, payments of business expenses, providing loans and advances to others and siphoning of money in unrelated ventures.

SFIO found that the governing body of FTIL was controlling the “mind and will” of NSEL and its group companies. FTIL ran NSEL as a exchange vertical and exercised control over its technology, external access of communication via email, human resources and finances. FTIL provided the funds required between 2005-06 and 2013-14. NSEL and its requirements were discussed in FTIL board meetings.

Recent Posts

Related Articles

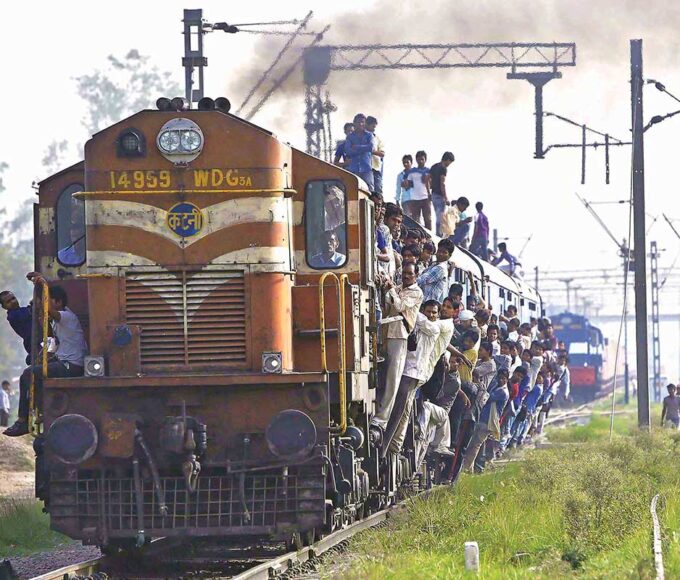

GovernanceNewsBackdoor entry of Private players in Railway Production Units ?

Written by K. SUBRAMANIAN To Shri G C Murmu C&AG Dear Shri Murmu,...

ByK. SUBRAMANIANFebruary 22, 2024GovernanceNailing Labour to The Cross

Written by Vivek Mukherji THEY grease the wheels of India’s economy with their...

ByVivek MukherjiMay 5, 2020GovernanceBig Metal Momentum

Written by GS Sood PRECIOUS metals especially gold and silver are likely to...

ByGS SoodMay 5, 2020GovernanceStrengthening Social Enterprise Ecosystem: Need for systemic support from the Government

Written by Jyotsna Sitling and Bibhu Mishra THE world faces several challenges today....

ByJyotsna Sitling and Bibhu MishraMay 5, 2020 - Governance

- Governance