After being dubbed anti-farmer, Prime Minister Narendra Modi’s government faces the prospect of being branded anti-labour as serious discontent is brewing in central trade unions of the country over changes in labour laws, the proposal to invest part of Employee Provident Fund’s (EPF) incremental corpus of Rs. 6 lakh crore in conventional equity and delay in extension of the Rs. 1,000 minimum monthly pension scheme in the financial year 2015-16.

The trade unions are particularly incensed by what they call their abandonment by the Labour Ministry in protecting the interests of the workers. They allege the new Labour Minister, Bandaru Dattatreya, has become a yesman for the Finance Ministry and the latter has even stopped consulting the former while taking decisions about the workers.

The first signs of this were visible when, during his Budget speech, Finance Minister Arun Jaitley announced changes with respect to the Employees’ Provident Fund (EPF) and the Employee’s State Insurance (ESI). Jaitley said the employee may opt for EPF or the New Pension Scheme (NPS) and, below a certain threshold of monthly income, should have the option of not contributing to the EPF without affecting or reducing the employer’s contribution. The Finance Minister said his government would amend the laws to allow the employee to choose between the ESI and a health insurance product recognised by Insurance Regulatory Development Authority (IRDA).

On March 31, there was a confirmation of the Labour Ministry’s changeover when in a Central Board of Trustees (CBT) meeting Dattatreya backed the Centre’s proposal to invest 5 per cent of the fresh accruals of EPF in equity, leaving the 10 representatives of labour unions stupefied. This was the first time in the history of the CBT that the Labour Minister, who is an ex officio Chairman of the 42-member board, backed a proposal against the wishes of labour unions. Except for the 10 representatives of employees, all other members (10 employers’ representatives, 10 State representatives and 10 Centre representatives) of the board backed the move.

“If you ask me, the department of labour is being taken for granted. It has become an appendage of the finance ministry. The government’s attitude towards labour is very, very bad. It is an anti-labour government,” says AK Padmanabhan, President of the Centre for Indian Trade Unions (CITU). Padmanabhan asserts the government has no prerogative to invest the EPF in the market because it is the ‘property of the workers’.

Harbhajan Singh Sandhu, General Secretary of the Hind Mazdoor Sabha (HMS), charges the Modi government with working for corporates and rich people. “The government has changed or in the process of amending the Industrial Disputes Act, Contract Labour Act, Apprentices Act and Overtime Act. We will oppose this,” Sandhu claims. Eleven central trade unions, including CITU, Indian National Trade Union Congress (INTUC) and Bharatiya Mazdoor Sangh (BMS), had called a national convention in New Delhi on April 26 to discuss the situation. The convention, according to Sandhu, is expected to witness congregation of over 2,000 labour leaders from sectors like defence, railways, postal department, banks and insurance. It was followed by a mass demonstration in front of Parliament two days later.

Labour Secretary Shankar Aggarwal has since allowed EPFO (Employees’ Provident Fund Organisation) to invest at least five per cent of its incremental corpus (fresh accruals) in equity instruments by the end of 2015. The Secretary has sent a notification (for revised investment patterns) in this regard to the EPFO. The investment may subsequently be hiked to 15 per cent.

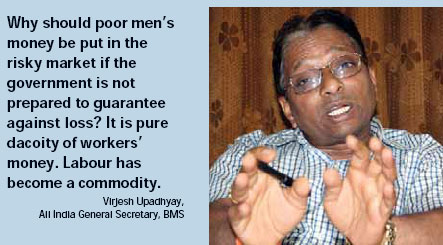

Ironically, the decision has brought even INTUC (affiliated to the Congress) and BMS (aligned to the Rashtriya Swayamsevak Sangh and the BJP) on one platform. INTUC President G Sanjeeva Reddy calls the order anti-worker on the grounds that the “share market always fluctuates”. Virjesh Upadhyay, All India General Secretary of the BMS, agrees with him. “Why should poor men’s money be put in the risky market if the government is not prepared to guarantee against loss? It is pure dacoity of workers’ money. Labour has become a commodity,” Upadhyay thunders.

The workers’ groups are not sure whether the EPFO has the expertise to invest in exchange-traded funds. “Who will insure the insurer?” Upadhyay asks. He says EPFO is not credible like the Life Insurance Corporation (LIC).

Upadhyay regrets the Modi government is only bothered about improving ease of doing business in India and cares two hoots about bettering ease of living in the country. He opposes the National Pension Scheme (NPS). He claims that under the NPS, there will be no pension for widows, orphans and parents and there will be no minimum pension.

The trade union leaders also question the intent of the government in not extending the Rs. 1,000 minimum monthly pension scheme. The scheme was announced with much fanfare in September 2014. In March this year, the EPFO told its regional and zonal offices across the country that it was suspending the payment in absence of any direction from the government to continue the benefit beyond March 31, 2015. This would hit about 32 lakh pensioners across the country and allow them to draw the amount they were drawing before September 2014.

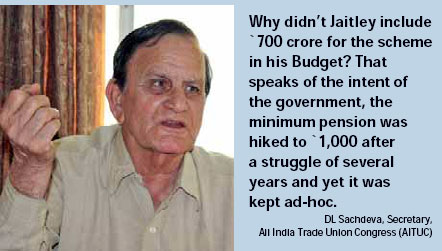

“Why didn’t Jaitley include Rs. 700 crore for the scheme in his Budget? That speaks of the intent of the government,” says DL Sachdeva, Secretary, All India Trade Union Congress (AITUC). According to Sachdeva, the minimum pension was hiked to Rs. 1,000 after a struggle of several years and yet it was kept ad-hoc. The unions had demanded Rs. 3,000 as the minimum pension.

How pension is worked out

How pension is worked out

An employee contributes 12 per cent of his basic pay to his provident fund every month. His employer too contributes an equal amount, out of which 8.33 per cent is diverted to his pension fund. The government adds 1.16 per cent to this pension fund.

According to Sachdeva, an employee’s pension is worked out on the basis of pensionable salary and the number of years of contribution. The current highest threshold for pensionable salary is Rs. 15,000 per month.

The pensionable salary includes only basic pay plus dearness allowance. It excludes HRA (house rent allowance), LTA (leave travel allowance), CCA (compensatory city allowance), children’s education allowance, transport allowance, conveyance and all other allowances. The trade unions want all these heads to be merged into the basic pay so that an employee becomes entitled to a substantive pension after retirement.

Upadhyay says about Rs. 6,000 crore of the EPFO corpus is unclaimed money. This is probably the money the employees could not withdraw either at the time of leaving their jobs or switching over to other jobs.

Before December 31, 1985, the minimum salary for a fourth-class central government employee was Rs. 196. It must have been even less in the private sector. This is why we had till some years back a pensioner in South India who drew even less than Rs. 10 as pension per month. We still had bidi workers who drew pension in two and three figures before the minimum monthly pension was hiked to Rs. 1,000 per month in September 2014.

‘Good beginning,’ says business

‘Good beginning,’ says business

The decision to invest 5 per cent of the fresh accruals into exchange credit fund like Nifty has been hailed by business and industry. Industry feels that the decision faced minimal risk and the ceiling should be increased in future if the yield is rewarding.

“The government is going to invest in conventional type of equity where the risk is not high and the growth is good,” says BP Pant, who is an adviser for labour and employment in Federation of Indian Chambers of Commerce and Industry (FICCI) and a member of the CBT.

Pant says the global benchmark for investment of pension funds into equity is 42 per cent with various countries of Europe, including the United States of America, having adopted the practice.