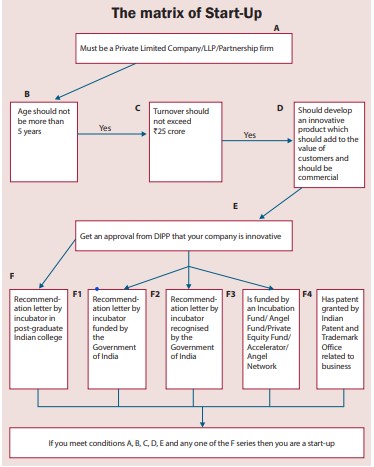

PRIME Minister Narendra Modi has reiterated that his government doesn’t want to run and manage businesses, but act as a facilitator. If this is the case then the Start-Up India Action Plan (SIAP), with its 19 broad points encompassing capital, labour, incubation, industry-academia partnership, financial incentives, and handholding, is a non-starter. The reason: one of its lynchpin is the ‘Fund of Funds’, a corpus of Rs.10,000 crore to be set up by the government, where the state-owned Life Insurance Corporation of India (LIC) will be a co-investor, which will decide the venture funds to invest in, and whose representative(s) will sit on the boards of these venture funds.

As Devesh Kapur, in his paper titled “The Causes and Consequences of India’s IT Boom”, noted: “Unlike other sectors of the Indian economy, state intervention (in IT) has been markedly different. India’s IT minister, Pramod Mahajan, once quipped that India is a leader in ‘IT and beauty contests, the two areas that the government has stayed out of.’ Undoubtedly, there is much merit in this argument. The industry is driven by private sector firms that compete in global markets; while the state’s regulatory role is relatively limited, its role as direct producer is even more sharply so. The non-material nature of the sector’s output constrains the myriad state agencies’ grabbing hands – from octroi (a local tax) to customs to unionised public sector ports.”

However, Kapur mentioned that the State can surely facilitate the growth of a sector, as it did with the IT sector, over a longer period, usually several decades. In the case of IT, the government took several steps that yielded huge benefits after 30-40-50 years. For example, in the late 1950s, India settled the divisive issue about whether to make Hindi a national language, and impose it on the opposing southern states, with a compromise. According to Kapur, it was that “while Hindi would remain the national language, it would not be imposed on non-Hindi speaking states. Instead, English would henceforth enjoy the status of the official language”. The result: a large pool of human capital that was versed in the English language.

Two, India’s “much maligned trade and industrial policies” played a positive role. When India kicked out IBM in 1977, it indirectly protected the country’s domestic hardware sector, which led to “development of software skills in a form of induced innovation”. Three, the Monopolies and Restrictive Trade Practices Act, which limited the entry of large business houses in new sectors, allowed entrepreneurship to flourish in IT. Finally, the State’s “investments in R&D labs and tertiary education were also important in creating human capital and infrastructural clusters”. Clearly, what Modi and his A-Team need to do is to create a long-term vision and blueprint.

Lopsided tax incentives and exemptions

ONE of the sops in SIAP is the exemption from corporate tax for three years. Most start-ups across the globe, possibly 99.99 per cent of them, don’t earn profits in the first three years of operations. A blog by Benedict Evans on Amazon, the largest e-retailer in the world, said that “there is the fact that almost 20 years after it was launched, it has yet to report a meaningful profit”. He published a chart that captured the contradiction—“massive revenue growth, no profits, or so it would seem”. Since its launch in 1995, its profits were negligible and included years of losses.

Microsoft, which was founded in 1975 by Bill Gates and Paul Allen, showed little or no profits for the next 15 years. One of the rare exceptions to this golden rule of ‘no profits for several years’ is Google. Three years after it was launched in 1998, the company earned a net profit of nearly $7 million on annual revenues of over $86 million in 2001. Subsequently, Google scaled up frenetically with annual revenues of over $45 billion in 2014 and net profits of over $13 billion. Therefore, start-ups aren’t excited about corporate tax incentives.

What is critical for start-ups is possibly a waiver of capital gains tax. Most angel investors and venture capitalists desire to exit a start-up within 3-5 years, and the period for private equity is three years. These investors seek a huge jump in valuations so that they can earn returns on their investments. Capital gains is the name of the game for them and they will be happy if they don’t have to pay taxes on them. However, SIAP doesn’t address this issue.

Instead, the Plan allows for capital gains exemption for investors only if they pump in their profits in the “Fund of Funds recognised by the Government”. Apart from restricting opportunities, this will dissuade investors, who wish to put in the money directly in start-ups so that they have a say in the decision-making process. In addition, this clause will give more financial powers to the State, which will then decide discretionally on which venture funds to finance. Similarly, the start-ups themselves are exempt from capital gains, but only if they

“purchase ‘new assets’ with the capital gain received”. This too is a half-hearted effort to help start-ups.

Discover, invent and then Make in India

Modi’s Start-Up India is not restricted to the technology sector, Internet and e-commerce. He hopes to extend it to several other manufacturing sectors such as health and agri-business. In this respect, Start-Up India also extends to manufacturing and connects with Make in India. But as David J Gross, a Nobel Prize winner in Physics, wrote in The Indian Express: “But in order to ‘Make in India’ and compete with better or cheaper goods from abroad, one must first ‘Invent in India’; and in order to ‘Invent in India’ one cannot just rely on underlying science done elsewhere, one must ‘Discover in India’. I suggest the strategy: Discover, invent and make in India.”

THUS, huge investments in basic sciences holds the key for India to become a leading Start-Up Nation. But, according to Gross, money alone will not produce the desired results. What is required is a “fundamental reform in the structure of India’s higher education and research institutions”. He added that any country that aspires to become an economic superpower must first become a science and technology superpower. The need is to get rid of scientific bureaucracy and the highly-politicised system. Sadly, in India, the debate today is about whether ancient Indian civilisation knew how to clone humans, make nuclear weapons, and use robotics.

While SIAP does talk about incubation to foster start-ups, Atal Innovation Mission, innovation centres and research parks, the government has to realise that these initiatives may yield results over the next few decades. India will not become a Start-Up Nation in 3, 5 or 7 years. It may take 15-25-40 years to do so. It is, therefore, imperative for the government to evolve a plan or strategy that looks at the long-term implications of their policies. Short-cuts don’t work, never have.

What is also required is a change in entrepreneurial mindset. A 2012 study by the Bay Area Council Economic Institute and Booz & Co found that there was a “special trait that distinguishes Silicon Valley’s firms from ordinary companies: the ability to integrate their innovation strategies with their business strategies. That one trait can make the difference between success and mediocrity—or worse. Our survey reported that Silicon Valley firms are about four times as likely as the average US company… to have a tight alignment of their overall corporate strategy with their innovation strategy. Not surprisingly, the corporate culture of a Silicon Valley firm is also two-and-a-half times more likely to be attuned to the company’s innovation strategy”.

Add to this the fact that Silicon Valley is “dominated by what we call the ‘need seekers’, companies that focus on discerning their users’ actual needs…. According to our research, the need-seekers consistently outgrow” companies with varying strategic business models “over a five-year span, both in gross profits and in company value”. The reason: need-seekers “tend to formulate their innovative strategy decisions at the company’s highest levels”. The Survey found that 46 per cent of Silicon Valley companies follow this model, compared with 28 per cent of the firms in the Global Innovation 1000 list.

angel investors in New Delh

While providing a hassle-free legal environment and financial sops may help a few select start-ups in the short run, they are unlikely to create a start-up ecosystem, which is Modi’s real aim. As SIAP says, “Start-Up India is a flagship initiative… intended to build a strong eco-system for nurturing innovation and Start-Ups in the country that will drive sustainable economic growth and generate large scale employment opportunities.” For this to be translated into reality requires a long journey. Silicon Valley’s trip possibly began in 1938, when Stanford University graduates William Hewlett and David Packard began to work together in a garage in Palo Alto with $500 in cash and a used drill press worth $38. It gained fame only in the 1980s and 1990s.

SIAP & the art of manipulation

Several critics fear that SIAP may turn into a crony-capitalist mechanism to favour those businessmen who are the government’s favourites. It gives immense discretionary powers to the government in various forms. First, the state will select the members of the Fund of Funds, which will be managed by a “Board with private professionals drawn from industry bodies, academia, and successful start-ups”. The Fund of Funds will decide which venture capitalists will benefit from it. It is the state that will decide the winners of the proposed Innovation Awards and private partners for the sector-specific incubators under the PPP (Public-Private Partnership) mode.

Most angel investors and VCs seek a huge jump in valuations so that they can earn returns on their investments. Capital gains is the name of the game for them and they’ll be happy if they don’t have to pay taxes on them. However, SIAP doesn’t address this issue

Smart, but dishonest, businessmen will find ways to manipulate SIAP. They will find innovative ways to convert their black money into capital gains, and convert it into tax-free white money through investments in the Fund of Funds. The start-ups that they launch will show huge profits in the first three years and claim tax exemptions, yet another mechanism to transform black into tax-free white. The credit guarantee fund for start-ups will be misused, as is the case with loans by public sector banks saddled with huge NPAs. False invoices will show purchase of ‘new assets’ to claim a capital gains windfall. It will not be the market, but the businessmen, hand-in-glove with the government, who will decide the fate of their start-ups.

THE ease with which crooks can launch start-ups will enable them to set up new entities only on paper, and use them for dishonest purposes. A start-up entrepreneur recently wrote that it doesn’t matter whether a firm can be set up in a day, week or a month. What really matters is the stability and simplicity of laws and policies, and the confidence that they won’t be changed unexpectedly. Although Finance Minister Arun Jaitley has promised this, the entrepreneurs want to see action, and not just hear promises by policymakers.

In conclusion, Modi needs to turn SIAP on its head. He needs to get the big picture right, think in terms of decades, and then offer short-term sops, if required. In addition, it is not just the policy vision that matters, but also the ability to transform India and Indians.

Alam Srinivas is a business journalist with almost four decades of experience and has written for the Times of India, bbc.com, India Today, Outlook, and San Jose Mercury News. He has written Storms in the Sea Wind, IPL and Inside Story, Women of Vision (Nine Business Leaders in Conversation with Alam Srinivas),Cricket Czars: Two Men Who Changed the Gentleman's Game, The Indian Consumer: One Billion Myths, One Billion Realities . He can be reached at editor@gfilesindia.com