THE market has witnessed a sharp rally post budget with fundamentals of the economy showing distinct signs of improvement. Declining inflation, rising IIP and prospects of a good monsoon further bolsters the expectation of good days ahead. The economy is showing signs of cyclical recovery as well with growth in power generation, demand in cement and petroleum products, automobiles and so on. Though a broad-based recovery may take some more time, business confidence has distinctly improved.

In a world where investment destinations are hard to find, India is in a sweet spot with one of the highest growth rates. The RBI’s addressing of the liquidity issue in its recent monetary policy review will create conditions to give a further boost to the recovery process. Otherwise also, quality of growth viewed with 2-3 year perspective in the backdrop of fiscal consolidation has been quite inspiring. And, that has made global investors stay invested in India with a long-term perspective.

The global scenario has turned more benign with the US Fed not in a hurry to raise interest rates and central banks of Europe and Japan continuing with their loose monetary policy stance. The headwinds from China may for the time being be over and the monetary and fiscal stimulus implemented may in fact be supporting of the market. The market is also keenly observing the outcome of regional elections that may be indicative of the public’s endorsement of Modi’s reforms agenda.

The prediction of a good monsoon may bring in several positives for the market. One, it will further bring inflation down by impacting the food prices; two, it will revive rural demand and give headroom to the RBI to cut further policy rates. Retail consumption is likely to go up which will impact capacity utilisation and hopefully will prepare ground for the capital investment cycle picking up. The rupee will also witness more stability.

However, slower global growth is a drag on the economic activity and has impacted both our imports and exports with the latest concern being its impact on services exports. The Brexit issue too needs to be watched closely. The impact of the Seventh Pay Commission on inflation is another factor to worry about though it is likely to directly benefit domestic consumption oriented companies. The recent runup in the market has turned valuations a bit pricy and may make the market witness a correction in the near term. But, with the long-term outlook being very positive, any correction will offer investors a good opportunity to accumulate stocks especially focused on domestic consumption, infra, construction, rate sensitive sectors and financial services.

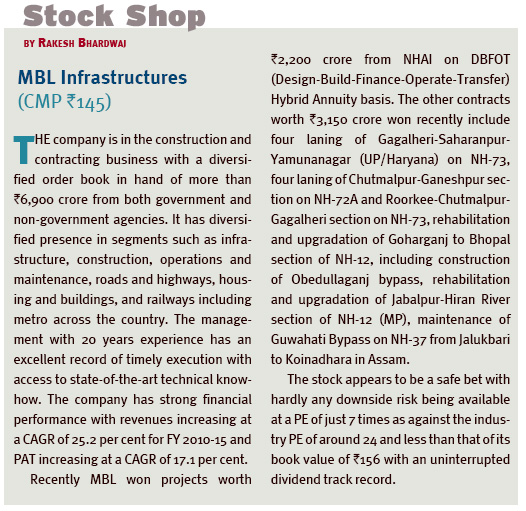

The author has no exposure in the stock recommended in this column. gfiles does not accept responsibility for investment decisions by readers of this column. Investment-related queries may be sent to editor@gfilesindia.com with Bhardwaj’s name in the subject line.