COMPANIES must be managed in a manner so as to create maximum value for all its stakeholders. Over the past few years, several corporate houses have tried and undertaken various steps such as demerger, delisting, buyback, open offers and so on. However, there is hardly any example of a holding company unlocking intrinsic value, especially for its minority shareholders. We all know, in India it is not unusual to find holding companies quoting at massive discounts compared to the sum of the parts valuation of their constituents. At times, these discounts can go up to as much as 70-90 per cent of the sum-of-the-parts valuations of quoted/listed investments. Some of the reasons cited for such discounts are poor corporate governance, inconsistent or volatile dividend policies and numerous deterrents in friendly/hostile takeovers. Also, in several situations, formation of these holding companies appears irrational; the parts of holding companies are completely unrelated businesses serving no purpose or logic except helping promoters or promoter-families continue their control.

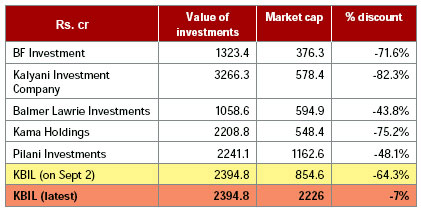

In a holding company structure, promoters control their key or strategic companies through a holding company. Even though economic interest remains the same, their effective control increases. As a result, minority investors do not value the holding company at NAV. Normally, non-operating companies have a basket of more than one companies’ shares. Not all the companies are attractive from minority investors’ point of view. Promoters never sell even when price is very high and never go for buy-backs if the discounts become too steep. Also, sometimes promoters may remove some holdings through intricate intra-group transactions, causing suspicion and discomfort in minority shareholders’ minds. Some examples of holding companies with their market cap, value of investments and resultant discounts are given in the table.

KBIL and the market perception of KBIL…

Kirloskar Brothers Investments Ltd (KBIL) is the holding company of the Kirloskar group. It holds a 55.6 per cent stake in Kirloskar Oil Engines Ltd (KOEL) and 54.5 per cent stake in Kirloskar Pneumatic Ltd (KPL). Apart from being the holding company of these two companies, the company does not have any business of its own per se. KBIL’s primary source of income is the dividend that it receives from its subsidiaries, KOEL and KPL. The market value of KBIL’s investments in KOEL and KPL combined was close to Rs. 2,400 crore before the restructuring. However, just like any other holding company, KBIL too was trading at a steep discount of 64 per cent to its investments (read NAV) as its market cap then was just Rs. 850 crore. For a layman it means a company where two of its holdings were valued at more than Rs. 2,400 crore was available just for Rs. 850 crore. This was happening on account of perception amongst minority shareholders that, just like any other holding company, KBIL too would never unlock its intrinsic value and therefore the stock traded at a deep discount.

The restructuring at KBIL…

In a landmark decision that may herald newer benchmarks of corporate governance and value unlocking for minority shareholders, the Kirloskar group recently announced a novel plan of restructuring across various groups of shareholders. KBIL in a notification to BSE on September 2 said it will reverse merge with Kirloskar Oil Engines Ltd (KOEL), an operating company. KBIL shareholders would receive 76 shares of KOEL for every 5 shares held in KBIL. For example, a shareholder holding 10 KBIL shares would now receive 152 KOEL shares, valued at Rs. 38,600. In addition to that, a shareholder would also receive 10 shares of a new company, which will house the investments in Kirloskar Pneumatic (the value of which is around Rs. 400 crore). The market understandably presumes that, down the line, this holding company would also go the KBIL way and would eventually merge with Kirloskar Pneumatic.

WHAT it means is that KBIL’s investments, which were valued at 60-70 per cent discount, have now been valued at NAV, creating major value for minority shareholders (see the table). For promoters, even though it means a reduction in stake, their effective control remains the same.

In a country like India, where a high level of corporate governance practices, especially in manufacturing sector companies, are not a commonality, it requires exceptional courage and extraordinary mindset in promoter groups to take such innovative and ground-breaking steps. It should be imperative for owner groups to understand that the long-term interest of different shareholder groups, be it minority or majority, are always aligned and any step seemingly taken to benefit minority shareholders will always create long-term value for the owner and promoters’ group. It’s a win-win situation for all at the cost of nothing!