- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

Recent Posts

© Copyright 2007 - 2023 Gfiles India. All rights reserved powered by Creative Web INC.Cover StoryCatch me if you can

It was a systemic failure. But it was a massive fraud engineered by a single individual, Ravi Parthasarathy who, along with his crony managers, used the hard-earned taxpayers’ money routed through state governments, state-owned banks and financial institutions, and huge user charges paid by the mass of people who used the infrastructure facilities. It was a classic case of failure of corporate governance, as the board of directors, which comprised renowned names like RC Bhargava, Maruti’s Chairman, and Jaithirth Rao, the former Citibanker who promoted an IT firm, Mphasis, and nominees of state-owned institutions slept peacefully. Regulators resorted to the excuse that the business group hadn’t raised deposits from the public, quietly forgetting that it was largely public money that funded the assets worth Rs. 1,16,000 crore, most of which were toxic and tainted. The guilty should be punished in the strictest manner. The sordid saga of IL&FS should become an abject lesson for the future Parthasarathys of India, writes Alam Srinivas

Alam SrinivasOctober 7, 20189 Mins read123 Views

Written by Alam Srinivas

Written by Alam SrinivasRavi Ramaswamy Parthasarathy perfected the art of networking and science of logical persuasion. He carefully built contacts in financial, political, bureaucratic and business circles, both at the national and state levels. When the opportune time came, he used them to bag lucrative and large projects and gold-plate costs. His model helped him to recover group’s investments before the projects were completed. He left before the overleveraged and bloated castle caved in. His story began in the 1980s.

Despite the global stock market crash of 1987, the 1980s was the decade of the financiers, i.e. those who understood the subtleties, dynamics, and volatility of money. Global bankers, who were laughed and scoffed at for massive aid to the Third World, which found its way into the pockets and assets of the ruling families and dictators, sought ways to earn profits. They found willing takers, who promised them the moon.

Brokers and merchant bankers wanted cash to fuel the stock market boom. Easy money, according to them, could easily lead to easy and lucrative profits. Predators, prowlers, arbitrageurs, and professional managements wanted the money to fund their ambitious and audacious leveraged buyouts, in which bank finance was used to bank roll takeovers, largely at outrageous prices. Even the retail investors were hungry for loans, as they witnessed the upward and upward trajectory of stocks, almost on a daily basis.

In India, three banker-financiers made their mark in the 1980s. The foremost among them was the late MJ Pherwani of UTI. He could swing stocks any way he wished to. Armed with huge cache of cash, he was the original Harshad Mehta, the ‘Big Bull’. A few steps behind Pherwani was Deepak Parekh, who made a name through HDFC, which was involved in the infrastructure lending sector. They were joined by KV Kamath, who later became the banker of bankers, and was the head of ICICI. The trio knew everyone there was to know in Mumbai’s financial and Delhi’s political circuits.

Ravi Ramaswamy Parthasarathy, the suave and intelligent banker, a former Citibanker, entered this financial milieu in a big way in 1987. Aided and supported by Pherwani and Parekh, he launched the Infrastructure Leasing & Financial Services (IL&FS), which aimed to finance and operate mega infrastructure projects. UTI and HDFC, along with Central Bank of India, were the original promoters, the initial backers of Parthasarathy.

Over the three decades that he remained at IL&FS – he resigned as the Executive Chairman in October 2017, and then as Non-Executive Chairman in July 2018, due to health reasons – Parthasarathy grew his empire. The business expanded across the country – from Gujarat to Odisha, Haryana to Tamil Nadu. His companies were present in several other countries, and his was a known name in cities from New York to Tokyo, London to Hong Kong, with stopovers at Dubai and Abu Dhabi.

No one new Parthasarathy well. But he seemed to knew everyone in Delhi, Mumbai, states’ capitals, and global power hubs. He was influential and powerful, the mover and shaker in the world of finance and infrastructure

The first phase of the IL&FS scam is over. We largely know what happened, how it happened, and the people responsible for it. Although more disgraceful details will tumble out over the next few months, they will be incremental and additional in nature, i.e. they will add to our overall understanding. But it is now important to be prepared for the next phase of the scandal – when corporate, financial and political lobbies will work together to further loot the business empire. There will be new conspiracies to dispose off whatever assets are left and that too at ridiculously-cheap prices.

Although the majority of the nearly 350 ILFS group entities incurred losses in 2017-18, and many of them defaulted on their loans, or are the verge of doing so, there are some attractive gems, pearls and diamonds, embedded among the assets. These are the ones that earned huge profits, even as the group went down under its heavy debt burden. Although the consolidated accounts of 2017-18 gave the financial details of only 200-odd entities, these included: Barwa Adda Expressway (annual profit in 2017-18: Rs. 142 crore), Land Registration Systems in the Philippines (Rs. 109 crore), Srinagar Sonmarg Tunnelway (Rs. 78 crore), Congqing Yuhe Expressway in China (Rs. 101 crore), and Fagne-Songadh Expressway (Rs. 77 crore).

Even the previous management, which was ousted at the insistence of the Ministry of Corporate Affairs, insisted that the group has assets worth Rs. 70,000 crore, and some of them were hugely profitable. Many, or most, of these assets may be sold now in order to raise much-needed cash. And, it will a case of distress sales, where assets will be sold or auctioned in a hurry. It will give opportunities to the lobbies to buy them off at cheap prices. This has happened before, and it will happen again. Way back in the 1860s, after the stock market crash in Bombay, bankrupt and insolvent companies and assets were sold off similarly, and yielded huge profits to the vested interests.

With over 350 subsidiaries, associate companies, and joint ventures, the ILFS group managed global assets worth Rs. 1,16,000 crore. The companies ranged from those that earned either an annual profit or incurred a yearly loss of Rs. 500-1,000 crore to dozens of smaller ones that earned or lost Rs. 100,000-200,000 per annum. The group was into highways, expressways, tunnelways, power plants, waste management, advisory, investment funding, non-renewable energy, and townships. Nothing was taboo for Parthasarathy.

Art of the possible

People who knew him said that the IL&FS head was a master of the art of networking, and science of persuasion. Over time, he got to know the powerful and influential, the movers and shakers in Mumbai and Delhi. Says a Delhi-based business lobbyist: “I didn’t know Parthasarathy well, but he seemed to know everyone. In the past, he used to refer to the former Finance Minister as ‘Chettiar’, as though he was a family member.”Although he was publicity-shy, and rarely spoke to the media, at least on-record, one could still catch potent glimpses of his political connections. When Congress’ Kamal Nath was the highways minister, and aggressively pushed the PPP (Public-Private Partnership) model, journalists gossiped – and a few wrote – that the minister invariably wanted Parthasarathy to be at the event that he attended. The IL&FS Chairman was always there.

IN fact, Parthasarathy popularised the PPP model in the country, and sold the idea to the policy makers as he finalised the first few deals. Hence, he got close to the members of the Planning Commission (now NITI Aayog), including the former Deputy Chairman, Montek Singh Ahluwalia, who was one of the staunch proponents of PPP. During the two UPA regimes, the PPP became the basis for most of the large infrastructure projects. Over time, the model was corrupted, and proved to be controversial.

Retired, but formidable, bureaucrats found their way as directors in the companies within the ILFS group. Gopi Arora, whose tenure as Special Secretary in Rajiv Gandhi’s PMO was “eventful and at time controversial”, headed the Noida Toll Road subsidiary. His colleague on the board of directors was Piyush Mankad, the former Finance Secretary. Michael Pinto, the former Secretary (Shipping), was involved with the ILFS group for 15 years.

The states’ connections

Apart from national politicians and bureaucrats, ILFS group made deep inroads into the power centres in several states, especially Gujarat, Andhra Pradesh, and Tamil Nadu. In its 2017-18 annual, IL&FS mentions three projects that were awarded on special terms. All of them are in Gujarat – two, the Vadodara Halol Road, and Ahmedabad Mehsana Road were guaranteed a 20 percent annual return. If the projects had not recovered money over the tenure of the concession, it could be extended by two years.

ILFS group got another GIFT from Gujarat. It was in the form of a joint venture (50:50 ) between IL&FS and the state government to build Gujarat International Finance Tec-City (GIFT), a pet project of Prime Minister Narendra Modi. In 2016, the head of the venture’s audit committee, Dr DC Anjaria, filed a litigation which, according to media reports, “alleged that this massive Rs. 70,000 crore project has been virtually gifted away to IL&FS, leading to massive losses to the state government and the people”. Tirupur’s (Tamil Nadu) aim to privatise water supply through ILFS’ Tirupur Water Project was mired in allegations, litigations, and claims and counter-claims. Critics accused ILFS group of charging huge fees, and making “false promises”. In one of the court orders, the judge observed, “The Government has pumped in money, unfortunately, only to service the debt with a pre-condition that the money will not even be used to improve the infrastructure. Investing more money just for the purpose of servicing a debt, is neither a prudent business decision nor in the interest of the public.”

Parthasarathy links in Andhra Pradesh were exposed when IL&FS successfully bid to buy out the property companies owned by the maligned and jailed Ramalinga Raju, who cooked up the books of Satyam Computers, and defrauded its shareholders. In the late 2000s, the central and state governments were not in favour of IL&FS. But the latter’s Chairman managed to get his say, and took over Maytas Infrastructure.

Parthasarathy popularised the PPP model in the country, and sold the idea to the policy makers as he finalised the first few deals. Hence, he got close to the members of the Planning Commission (now NITI Aayog), including the former Deputy Chairman, Montek Singh Ahluwalia

Wrote a journalist in 2009: “That Ravi Parthasarathy managed to persuade the government to hand over the company, despite some reported initial unwillingness, speaks volumes for his negotiation skills. But then, the 57-year-old Chairman of IL&FS is known for his ability to swing deals.” The fitness fanatic and voracious reader of the Financial Times desperately wanted to own Maytas given ILFS group’s Rs. 200 crore exposure in 2009.

A financier speaks to private business

It wasn’t just about politics, bureaucracy, and bankers. Parthasarathy links spread to the leaders in India Inc. He joined hands with Mukesh Ambani of Reliance Industries to build a special economic zone (SEZ) in Haryana. In September 2010, the two inked a deal to use almost 9,000 of the 10,000 acres acquired for the project to build a “Model Economic Township’, which would be separate, but adjoining, the SEZ built over the remaining 1,100 acres.However, when the government stipulated that a private enterprise couldn’t purchase more than 5,000 acres for a specific project, IL&FS walked out of the project. Mukesh Ambani decided that given the smaller size, it was better for Reliance group to handle it on its own. Media reports indicate that while te township part of the project is on course, the SEZ component hasn’t taken off due to issues related with the government policies.

SEVERAL years ago, Parthasarathy and a few of the director-managers in the ILFS group were accused by SEBI, the stock market regulator, of insider trading. The former were charged with rigging the scrip price of Adani Exports, owned by Gautam Adani, who is possibly the businessman closest to the current Prime Minister. In a form of a plea bargain, Parthasarathy & Co decided to pay penalties without accepting or denying the allegations.

The great downfall

The genesis of Parthasarathy’s fall, which now threatens to have a contagion effect on the country’s financial sector, including banks, financial institutions, mutual funds, and stock markets, lies in 2005. UPA-1 decided to actively pursue projects under PPP, and ILFS group took the plunge from merely being a financier to become a funder-operator. IL&FS’ group entities emerged as the private component in the dozens of PPPs.But although the former IL&FS Chairman was a financial whiz kid, he had little expertise in managing large infrastructure projects. Initially, the connections at the central and states’ levels helped grab projects at lucrative terms. Later, especially in the recent past, several projects initiated by him came unstuck, and got involved in huge losses, as well as tensions with the state governments. More importantly, the model overleveraged the group.

A media report described the modus operandi, “Although each project was structured as 50:50 partnership, the equity capital was tiny (as low as 5 percent) – keeping risk capital (of the promoters) minimal. Another 25-30 percent would be brought in as subordinated debt which helped balance the debt-equity ratio…. The rest was raised by senior debt, raised mainly from public sector banks.” The networks in finance, central and states’ circles helped to bag the projects under this overall structure.

THIS was followed by the various fees that ILFS group earned from each project. “IL&FS, as a group, project management fees, loan syndication fees, success fees, upfront fees, merchant banking fees, fees for feasibility studies, fees for environmental and social impacts, etc”, said a media report. Since ILFS group comprised the universe of part-financing, advisory, investment, and management services, it was easy to do so. The group entities made a profit on their initial investment each time before the projects were completed.

Inevitably, the project costs were inflated or gold-plated. This was either to possibly pay bribes to government servants and politicians to grab the projects at attractive terms, probably enable the ILFS group managers to siphon off part of the money, or to pay for the exaggerated fees. Says a former bureaucrat, “During the height of the PPPs, beginning 2005 till now, project costs were overstated by 2-3 times on a regular basis.”

Several years ago, Parthasarathy and a few of the director-managers in the ILFS group were accused by SEBI, the stock market regulator, of insider trading. The former were charged with rigging the scrip price of Adani Exports, owned by Gautam Adani, who is possibly the businessman closest to the current Prime Minister. In a form of a plea bargain, Parthasarathy & Co decided to pay penalties without accepting or denying the allegations

Add to this the impact of the terms offered to the private operator of the projects, i.e. ILFS group entities. In the case of Noida Toll, the returns were calculated as a percentage of revenue, rather than equity capital. In other cases, as mentioned above, a high guaranteed return was allowed. The net effect: in the majority of cases, when the projects were finished, the users had to pay higher charges, or the concession (management) period was extended. The resultant public and political outcry harmed ILFS group.

In the accompanying article, we give details of the kind of projects that proved to be huge loss-makers over the past four years. But the truth is that most of the group entities incurred losses, and the few that were profitable saw their margins go down. The end result: although the parent IL&FS earned profits in 2017-18, the consolidated balance sheet showed a cumulative loss. Along with the defaults, and downgrading, which began in June 2018, or weeks before Parthsarathy left, it proved to be the beginning of the end.

Recent Posts

Related Articles

Cover StoryTablighi Jamaat : 1000 years of revenge

Written by Vivek Mukherji and Sadia Rehman Two contradictions are evident. Through April...

ByVivek Mukherji and Sadia RehmanMay 5, 2020Cover StoryWINDS OF CHANGE

Written by Gopinath Menon ADVERTISING : The name itself conjures up exciting images....

ByGopinath MenonMarch 4, 2020Cover StoryTHE ECONOMIC ROULETTE WHEEL

Written by Alam Srinivas THE wheel spins, swings, and sweeps in a frenzied...

ByAlam SrinivasMarch 4, 2020Cover StorySYSTEMS FAILURE, SITUATION CRITICAL

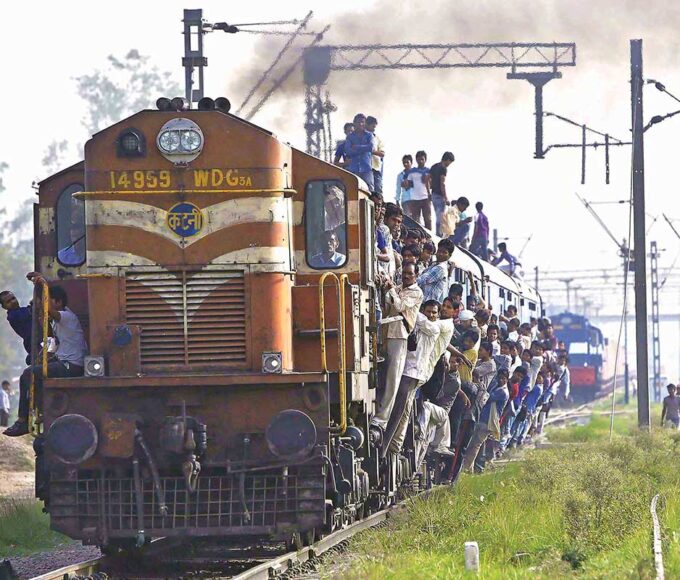

Written by Vivek Mukherji ONE of most quoted allegories of incompetence for a...

ByVivek MukherjiMarch 4, 2020 - Governance

- Governance