- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

Recent Posts

© Copyright 2007 - 2023 Gfiles India. All rights reserved powered by Creative Web INC.Home Governance Strengthening Social Enterprise Ecosystem: Need for systemic support from the GovernmentGovernanceStrengthening Social Enterprise Ecosystem: Need for systemic support from the Government

Our societal challenges are enormous. The trinity of the government, market and civil society now need to work together rationally through a structure which has the heart of a social organisation and head of a business entity to hold hand with the government to address our massive societal problems with much needed scale, speed and sustainability. Social Enterprises (SE) are the answer to this. Sensing the pulse, the government has already announced a Social Stock Exchange (SSE) in the budget speech in July 2019 at an opportune time. This also comes with a huge responsibility to build right ecosystem for SE in India. It also necessary to make the stakeholders aware of the market functions of a Social Enterprise, and the roles critical to the government in bringing distinct value in different market sub-segments of social impact investment.

Jyotsna Sitling and Bibhu MishraMay 5, 20206 Mins read442 Views

Written by Jyotsna Sitling and Bibhu Mishra

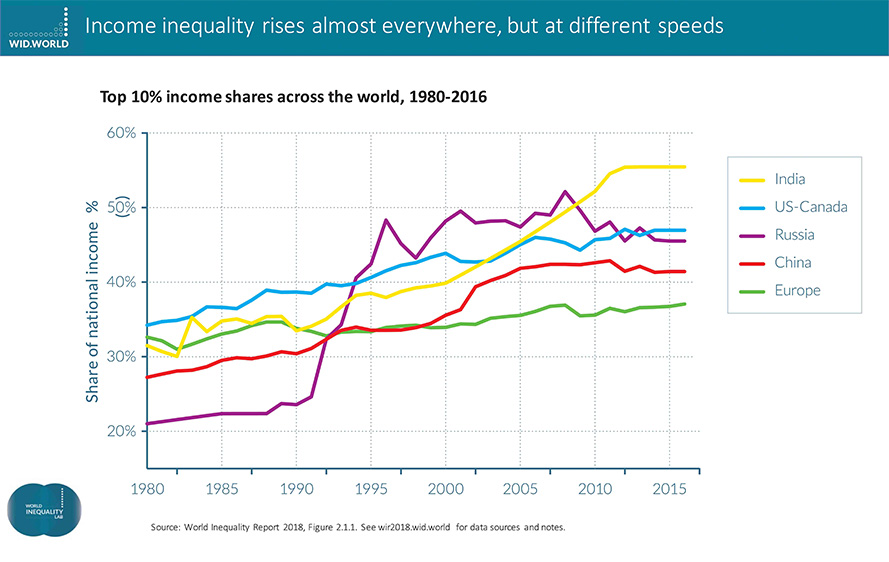

Written by Jyotsna Sitling and Bibhu MishraTHE world faces several challenges today. Businesses in the pursuit of maximising profits and shareholders’ value have already done lot of damage to the environment and society. On the top of it is the ‘rising inequality’. If we talk about India, in 2018, top 10 per cent of India’s population got 55 per cent of all income and the bottom 50 per cent shared only 15 per cent (World Inequality Report 2018) of the income.

Figure 1 suggests that inequality is rising in India at a much faster rate as compared to the USA, China, Europe and even Russia. More importantly, although it is true that millions came out of poverty and share of middle class in total population has grown consistently in India between 2006 and 2016 according to UN study, the major concern is that our ranking in Human Development Index is still 129 (out of 189 countries, 2019) . Similarly, our performance on the status of environment is much appalling. We are ranked 177 out of 180 countries (2018) in Environment Performance Index. The rising inequality will sharpen further in the post COVID world. This clearly shows that businesses have to find ways which are more inclusive and tries to balance people, planet and profit. This alternate business model gaining momentum across the globe is that of Social Enterprises.

WHAT IS A SOCIAL ENTERPRISE?

In simple terms, Social Enterprises are businesses that have a revenue-generating model. Therefore, they cannot be categorised as charity or philanthropy. They re-invest most of their profits into the cause for which the enterprise is existing and do not focus on multiplying shareholder’s money value. They, therefore, are different from traditional businesses. And most importantly, their primary focus is on social and environmental good. However, there is no universally accepted definition of an SE. SE is not new In India, but the scale is not there. A number of mutual profit and non-profit organisations registered as a Cooperative, Trust, Society and Section 8 Company in India are unto social business, addressing the challenges of access, affordability and assurance of societal products and services to the needy public.

- https://wir2018.wid.world/files/download/wir2018-full-report-english.pdf

- https://www.in.undp.org/content/india/en/home/sustainable-development/ successstories/MultiDimesnionalPovertyIndex.html

- http://hdr.undp.org/en/content/2019-human-development-index-ranking

- https://epi.envirocenter.yale.edu/epi-topline?country=

WHAT IS A SOCIAL STOCK EXCHANGE?

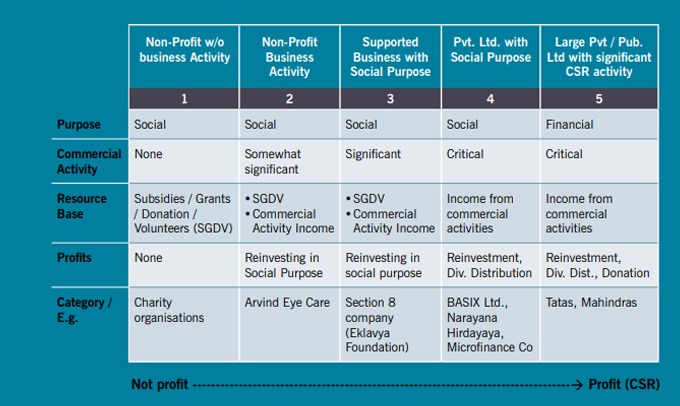

Regulatory reforms for introducing innovative financing instruments that can trigger wide cross sector partnerships to scale up the proven social programs and innovate new social business through SE would need more primary, secondary and applied research on scale and characteristics of SEs in India. Above (from Col 2 to Col 4) is the spectrum of SEs in India. The totally non profits are ( Col1 and CSR of Col 2) Social Stock Exchanges (SSE) are different from traditional stock exchanges in multiple ways. Most importantly, they do not facilitate the trading of shares. The most important function of a SSE could be to act as a platform for SEs and ‘Impact Investors’. Impact Investors are investors who are not only interested in financial returns but also focus on social and environmental return. They invest mostly in SEs having direct societal impact, or in socially and/or environmentally responsible businesses and projects that prevent negative impact on people and planet. The impact measurement globally has been characterised by prominence of metrics, certifications and ratings built on robust assessment systems and measurement systems. This has largely benefited the market by allowing investors to compare and accordingly invest in social businesses by assessing their potential impact. Brookings India 2019 report cautions that although it will be prudent to look into methods and instruments from global best practices for channelising the resources, it will be equally critical to examine several aspects/ externalities of the Indian market on impact focused take up from a policy standpoint.

SSE AND NATURE OF SERVICES

Globally, SSEs have been set up in more than ten countries. The prominent SSEs are in UK, Canada, USA, South Africa, Singapore and Mauritius. The ambit of functions of SSE differ widely with respect to:

- Types of organisations listed—‘for profit’ vs non-profit;

- Services offered—directory only, matching funders and organisations and providing for direct online fund raising;

- Abilities to trade securities;

- Methodology for accreditation of organisations and investors; and,

- Ability of retail investors to participate. (Roopa Kudwa and Raahil Rai, 2019).

THE FOUNDATIONAL ROLE OF THE GOVERNMENT

As SEBI is on the task to develop a regulatory framework for SSE operations in India, there is a need now for the government to be involved in multiple layers of intervention that can address supply development, directing capital and demand development through policies, regulations and direct participation in the market (Brookings India, 2019). This is important, especially at this challenging COVID times, to instill the faith in Impact Investors to make effective investments and build morale of Social Entrepreneurs and Civil Society Organisations (CSOs) to address refractive social problems with immediate support signal from the government. The key roles that are important at this foundational stage are as under:

Educate market participants: The purpose is to broaden the ecosystem and deepen the knowledge of the sector through education, training and awareness about market players. This could be done through massive targeted campaigns using fiscal neutral resources of the banking sector.

Foster social business: The purpose is to design and implement government policies and programmes to improve the social impact investment ecosystem. This can be done through introducing innovative financing (both debt and equity) instruments / products to trigger partnerships and convergence and promoting robust diverse intermediaries for developing optimum traction for social investment.

Strengthen demand side through public commissioning: Public commissioning of services to SEs would require sensitisation and awareness of govt / public sector on SE policies and ecosystem players and putting administrative practices in place that allows SEs to better work with govt / public sector. The government should also revisit procurement guidelines for SEs by laying social conditions for public procurement, for example, Public Procurement Policy for MSEs Order, 2018, under Section 11 of MSMED Act, 2006.

Co-build impact audit system for convergence, efficiency and cost effective growth: Apart from becoming a repository of SEs and Impact Investors, SSE platform can become more investment friendly by integrating MIS on recent developments and best practices using AI and machine learning. This needs close collaboration of SEBI with relevant social / business / people / academic institutions / research organisations. The complexity and cost of handling impact audit can also be reduced if the government’s social data (MoSPI), environmental data (MoEFCC & MNRE), business data and CSR data (MCA & MSME), and NGO data and Aspirational District Programme data (NITI Aayog) can be reviewed and be made usable for seamless and authentic confirmation of impact. More importantly, this would help build co-ownership of private, government and CSO to tackle emergent societal problems with much needed scale and speed.

Inequality is rising in India at a much faster rate as compared to the USA, China, Europe and even Russia… It will sharpen further in the post COVID world. This clearly shows that businesses have to find ways which are more inclusive and tries to balance people, planet and profit. This alternate business model gaining momentum across the globe is that of Social Enterprises

Attend specific current barriers and / or opportunities in the social impact investment market: There is a need for identifying and targeting specific current barriers and/ or opportunities in the social impact investment market. Small social organisations in transition need more types of blended capital. It is also seen that retail investors are seeking social value but more mainstream social pension opportunities (e.g. National Pension Scheme) need to adapt and capture this interest.

CONCLUSION

Given the need to catalyse the market for the social business at a massive scale, especially at this hour, the need has been felt to have a central networked body under public, private and civil society partnership to be developed as Growth Centre for Social Enterprise and Social Impact Bonds. The role of this Centre would be to provide strategic guidance to leverage State, Market and CSOs’ resources and expertise for impact and recommend supportive policies, institutions and instruments in promoting social businesses. In addition, the monitoring of results and addressing of capacity needs will be a cross cutting role of this organisation.

Taking into consideration the challenge of encompassing convergence function to build the market for social business, it will be vital to bring in relevant social, business, people, academic institutions and research organisations as partners for developing the Growth Centre. Equally important would be to identify the collaborative role of these organisations and the expected outcome of such collaborations in terms of catalysing the social impact market on the ground. Collaboration with the state governments would also be required for necessary policy and programme convergence to give meaningful results.

Government will be able close a full circle of its novel initiative on inclusive investment through SSE by instituting a Growth Centre for Social investment.

Given the multi-stakeholder nature of the proposed Growth Centre and its potential in catalysing cross sector partnerships to foster inclusive growth, a Task Force (think tank) could be formed at the highest level in the government to come up with recommendations on the functions and the institutional architecture of the proposed Growth Centre.

(The views of the Authors are personal)

(Jyotsna Sitling is Indian Forest Service officer presently posted as Principal Chief Conservator of Forests, Van Panchayat, in Uttarakhand Forest Department.

Bibhu Mishra currently works with The Global Education & Leadership Foundation and previously was a German Chancellor Fellow with Alexander von Humboldt Foundation based at Humboldt University, BerliRecent Posts

Related Articles

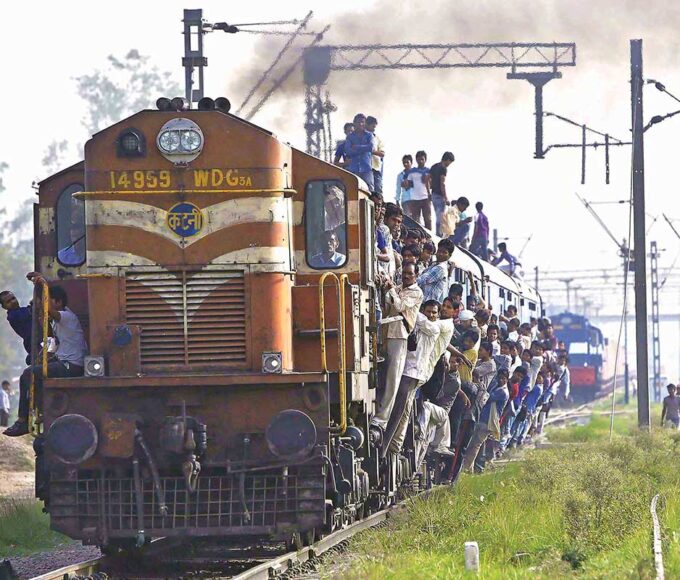

GovernanceNewsBackdoor entry of Private players in Railway Production Units ?

Written by K. SUBRAMANIAN To Shri G C Murmu C&AG Dear Shri Murmu,...

ByK. SUBRAMANIANFebruary 22, 2024GovernanceNailing Labour to The Cross

Written by Vivek Mukherji THEY grease the wheels of India’s economy with their...

ByVivek MukherjiMay 5, 2020GovernanceBig Metal Momentum

Written by GS Sood PRECIOUS metals especially gold and silver are likely to...

ByGS SoodMay 5, 2020GovernanceKamath, Kochhar, Kalpana & Others

Written by K. SUBRAMANIAN IT is like a good-turned-horrific, gold-tinted, but not-so-polished, penny...

ByK. SUBRAMANIANMay 5, 2020 - Governance

- Governance