- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

Recent Posts

© Copyright 2007 - 2023 Gfiles India. All rights reserved powered by Creative Web INC.Home Cover Story Delhi HC heard PIL arguments; judgement reserved Ananda Krishnan selling scam- tainted spectrum?Cover StoryDelhi HC heard PIL arguments; judgement reserved Ananda Krishnan selling scam- tainted spectrum?

This is the biggest scam in India that is continuing despite intervention of the Supreme Court. Under the supervisouion of the apex court, the CBI filed a chargesheet against Malaysia-based Maxis and its promoter T Ananda Krishnan and director Ralph Marshall for forcing C Sivasankaran to sell his company Aircel to Maxis at a price much lower than the market price. Dayanidhi Maran, the then Union Telecom Minister, was involved in it. This became a part of the 2G scam as it basically involved sale of spectrum. Four years later, the scam continues. Krishnan is busy selling spectrum to Indian Telcos, Airtel and R-Com, so that he can get maximum value out of the Rs. 32,000-crore empire that he created by using fraudulent and criminal means. The 2G spectrum that he is selling is the same spectrum that Aircel got on first-come-first-served basis at an administered price. The 3G spectrum that he is selling to Airtel was bought from funds raised by the value of the company created out of the 2G spectrum that he got at a low price. In a nutshell, it is basically Indian taxpayers’ money that he is converting into his personal asset. What is shocking is that, in the process, he is making a mockery of the Indian establishment—the government, the Central Bureau of Investigation (CBI) and the Enforcement Directorate (ED). Consider this, for last two years, the CBI has not been able to serve summons to Marshall and Krishnan in Malaysia. ED has not been able to trace both of them. But, the promoters of Airtel (Sunil Mittal) and R-Com (Anil Ambani) are engaged in spectrum trading with Krishnan and, in the process, are helping the absconder. Isn’t this surprising? Further, no one is concerned about the huge loan that the company has taken from a consortium of banks led by the State Bank of India (SBI). What will happen to the loan when Krishnan will sell all the assets (i.e. spectrum) of the company? How will the banks recover their money? Thus, this is a case where the absconder is alleged to have got benefits worth billions of dollars. First, he usurped a telecom company that was allocated spectrum at an administered price through criminal means. Then he pledged the spectrum and got huge loans from Indian banks. When the Government of India initiated legal proceedings against him, he absconded and started selling the assets for his personal gain. Interestingly, the company had earlier sold all its towers to Global Telesystems in a deal worth more than a billion dollar. This happened much before Krishnan was named in the alleged scam. This shows that his intention all through was to exploit the Indian system—get the company and natural assets at a low price and sell it to Indian companies at a higher price. On this issue, the Society for Consumers’ & Investors’ Protection filed a case through leading lawyer Amit Khemka. Mukul Shukla reports.

MK ShuklaSeptember 5, 201619 Mins read107 Views

Written by MK Shukla

Written by MK ShuklaTWO years ago, the people of India voted out the scam-tainted Manmohan Singh-led government, confident that a new government would ensure due investigation and punishment for the big guns caught in corruption scandals. The biggest UPA scam, the 2G Spectrum case, was already in the hands of the CBI and the judiciary. Many anti-corruption activists relaxed their vigil in the belief that the law would now take its course without political meddling.

GFiles is among those who continue to doggedly track the spectrum cases. Spectrum is among the country’s most valuable and prized resources today. Yet, as GFiles found out, the Central Bureau of Investigation (CBI), tasked with the investigation of the scam, is being shockingly lax in pursuing the guilty and seizing this precious asset so that it can be used for public good. Several of the tainted companies and their owners are yet to be served summons, let alone be arrested. Their assets have not been appropriated and they are already selling away their shareholdings. One estimate suggests that the spectrum held by these companies is worth Rs. 50,000 crore.

Worse, these companies allegedly owe a consortium of public sector banks, led by the State Bank of India (SBI), about Rs. 21,000 crore borrowed against the value of the spectrum they possess. If they are allowed to sell their shares, the banks may never be able to recover this money.

Newspaper reports suggest that the Malaysian company, Maxis Communications Berhad, involved in the scam has already negotiated the sale of some 4G spectrum to Bharti Airtel and is also negotiating to sell/merge its wireless business with Reliance Communications.

On August 8, 2016, the Society for Consumers’ & Investors’ Protection (SCIP) filed a writ petition through prominent lawyer Amit Khemka in the Delhi High Court, asking for immediate action to stop the sale of 4G spectrum by Aircel Ltd and allied companies. The PIL had been filed against 29 persons, organisations and companies. Among the government authorities and regulatory bodies that were served notice were the Department of Telecommunications (DOT), CBI, the Enforcement Directorate (ED), the Securities Exchange Board of India (SEBI) and the Telecom Regulatory Authority of India (TRAI). Prominent individuals included former Union Minister Dayanidhi Maran and his brother Kalanithi Maran and Ralph Marshal, owner of a Malaysian company. The clutch of companies asked to respond to the petition included Reliance Communications Ltd and Bharti Airtel Ltd.

Aircel Maxis scandal clock

April-May 2011: The Aircel-Maxis deal comes under the scanner after Aircel owner C Sivasankaran lodges a complaint with the CBI alleging that he was pressurised to sell his stakes to Maxis.

September 2011: The Arbitral Tribunal rejects Sivasankaran’s allegation regarding breach of obligation on the part of buyers in undertaking an IPO of Aircel. The tribunal directs him to pay Maxis’s legal costs of $7.9 million, of which at least $1.4 million was paid. The award was not challenged.

October 2011: The CBI files a case alleging that Sivasankaran, who had applied for spectrum licence, was coerced into selling his company to Maxis. It is later alleged that the Maxis Group, which bought 74 per cent stakes in Aircel in March 2006, invested Rs. 742 crore in Sun Direct between 2007 and 2009.

May 2014: The CBI tells the Supreme Court that there was difference of opinion between the CBI Director and the prosecution regarding filing of the chargesheet. On reference, the Attorney General opines that there was enough prosecutable evidence.

July 2014: Maxis Communications Berhad, on July 25, urges Finance Minister Arun Jaitley that it be treated in a fair manner, citing a contrary opinion by two retired Chief Justices of India.

August 2014: The CBI on August 29 files a chargesheet against former Telecom Minister Dayanidhi Maran and his brother Kalanithi Maran, T Ananda Krishnan, owner of Malaysian company Maxis, Ralph Marshall, a senior executive of the Maxis Group, and four companies, including the Sun Direct TV Pvt Ltd.

February 5, 2015: The Marans move the Supreme Court, challenging the 2G Special Court’s decision to summon them in the Aircel-Maxis case.

February 6, 2015: The Supreme Court recalls its order refusing to entertain petitions of the Dayanidhi Maran and Kalanithi Maran, to quash summons in the Aircel-Maxis case issued by the 2G Special Court.

February 9, 2015: The Supreme Court refuses to intervene with a summons order issued by the 2G Special Court to the Maran brothers.

March 16, 2015: Marans challenge the jurisdiction of the Special CBI Court over the Aircel-Maxis deal case.

April 1, 2015: ED attaches assets estimated at Rs. 742.58 crore held by Dayanidhi Maran and Kalanithi Maran and wife Kaveri Kalanithi.

August 3, 2015: The CBI tells a Special Court that Malaysian authorities were not “cooperating” in the service of summons against four accused in the Aircel-Maxis deal case after which the judge issues fresh summons.

August 21, 2015: The Supreme Court stays ED move to attach Sun TV assets

August 25, 2015: ED summons two directors of the private firm, Advantage Strategic Consulting.

September 9, 2015: CBI files status report.

January 8, 2016: ED names the Maran brothers, Kalanithi Maran’s wife Kaveri Maran and three others, including two companies as accused in its chargesheet.

January 23, 2016: ED summons Ralph Marshall, former non-executive director of Maxis Communications Bhd in Malaysia.

February 1, 2016: Dayanidhi Maran illegally generated Rs. 742.58 cr and Kaveri Kalanithi participated in money laundering, says ED.

The petition pointed out that the Supreme Court, in the matter titled ‘Centre for Public Interest Litigation & Ors. Vs Union of India & Ors’, had given specific directions to the government and the CBI to investigate the 2G licensing scam.

Investigations had revealed that the then Minister of Communications and Information and Technology, Dayanidhi Maran, had misused his office to exert pressure on C Sivasankaran, the owner of telecom company Aircel Ltd, to sell his company. Approvals for several of Sivasankaran’s business ventures had been repeatedly delayed or denied and eventually he was forced to sell 100 per cent shares of Aircel Ltd and its subsidiary companies to Maxis Communications Berhad, Malaysia, on December 26, 2005.

30 Indian companies identified for scrutiny

THE Enforcement Directorate is said to have identified over 30 Indian companies for scrutiny of transactions in connection with the ongoing investigation in the Aircel-Maxis deal case. The agency has zeroed in on these entities after searches conducted last December, in coordination with the Income-Tax Department, against Vasan Health Care and Advantage Strategic Consulting Private Limited. Vasan Health Care and Advantage Strategic belong to the associates of former Finance Minister P Chidambaram’s son Karti.

The ED had also carried out searches on the premises of Karti’s company, Chess Global Advisory Services, in his presence. He told the media that his businesses were fully compliant with laws and regulations. According to a senior official, most of the companies currently under the ED scanner are based in Chennai. Karti has a stake in some companies.

The over 30 entities identified by the agency are into legal, tax and investment consultancies, healthcare solutions, logistics, estate development activities, household goods, textiles and fast-moving customer goods. Some companies are into tourism services, including running hotels and resorts and providing car rentals.

ED has received details of the bank accounts of some companies, which are being examined. Suspected overseas financial transactions in over a dozen countries, including the United Kingdom, Spain, Singapore and Sri Lanka are also being probed as part of the Aircel-Maxis deal case. The ED had recently issued two summons to seek some clarifications from Karti in connection with the investigations.

The CBI found that after Maxis Communications Berhad took control of Aircel Ltd and its subsidiaries, all the pending licenses and other statutory approvals were granted to them by the Ministry of Communication and Information Technology without any further delay.

Dayanidhi Maran allegedly received a kickback of Rs. 742 crore in the form of ‘investment’ in his brother’s firm, Sun Direct TV Ltd. The entire deal was sought to be concealed and ownership of the spectrum vested through a complicated layer of companies and subsidiary companies, including firms based in Mauritius, Malaysia and India.

Several of the tainted companies and their owners are yet to be served summons, let alone be arrested. Their assets have not been appropriated and they are already selling away their shareholdings. One estimate suggests that the spectrum held by these companies is worth Rs. 50,000 crore

Interestingly enough, CBI has chosen to pursue only a limited number of those involved in this scandal despite its massive proportions. Initially, only the Maran brothers and two Malaysians, Ralph Marshall, director of Astro All Asia Networks and Maxis Communications Berhad, Malaysia, and T Ananda Krishnan, Chairman, Usaha Tegas, and their companies were named in the chargesheet filed by the CBI before a Special CBI Court on August 29, 2014. Letters Rogatory for Investigation were sent to Malaysia, but the Malaysian authorities did not cooperate. Letters Rogatory were reportedly also sent to the United Kingdom, Bermuda and Mauritius, but, predictably, yielded no response.

Whodunnit?

IN a bid to bring the spectrum scam guilty to justice and prevent further fraud on the Indian people, the Society for Consumers’ & Investors’ Protection (SCIP) filed a PIL in the Supreme Court against the following persons, government authorities and regulatory bodies in India and abroad:

• The principal respondent is the Union of India, through the Secretary, Department of Telecommunications (DOT) in the Ministry of Communication and Information Technology.

• The Indian companies involved are Mumbai company Aircel Ltd, five Chennai-based companies Aircel Tele Ventures Ltd, Aircel Cellular Ltd, Dishnet Wireless Ltd, Sun Direct TV Pvt Ltd and Sindya Securities and Investments Pvt Ltd and two New Delhi based companies South Asia Communications Pvt Ltd and Deccan Digital Networks Pvt Ltd besides Reliance Communications Ltd and Bharti Airtel Ltd.

• The foreign companies are the London and Kuala Lumpur-based Astro All Asia Networks Plc; Maxis Communications Berhad based in Kuala Lumpur; and two companies based in Port Louis, Mauritius—South Asia Entertainment Holdings Ltd. and Global Communication Services Holdings Ltd.

• The individual respondents are former Union Telecom Minister Dayanidhi Maran and his brother Kalanithi Maran, Ralph Marshall of Kuala Lumpur, T Ananda Krishnan of Kuala Lumpur and Suneeta Reddy and Dwarkanath Reddy of Chennai.

• The multiplicity of government authorities invoked, apart from the Secretary, DOT, are the Central Bureau of Investigation and the Enforcement Directorate and the Secretaries of the Ministry of Corporate Affairs, Ministry of Finance, Ministry of Home Affairs and Ministry of Personnel, PG and Pensions besides the two regulators, Telecom Regulatory Authority of India and the Securities and Exchange Board of India. All these authorities stand accused by the petitioners of negligence or, worse, in prosecuting the scamsters and permitting sale/alienation of company shares and assets including valuable spectrum.It should have been evident to the CBI that no response would be received from Malaysia as the earlier Letter Rogatory sent in 2013 had yielded no cooperation from the Malaysian government. Yet, it chose this route to proceed. A look at court proceedings reflects CBI’s deliberately casual attitude. On March 16, 2015, when none of the accused persons had been served, CBI prayed for issuance of summons again. The matter was adjourned for a period of five months to August 3, 2015. Strangely, when it was reported that the summons has not been received back, served or unserved, the leading public prosecutor again sought six months time for serving them! On July 11, 2016, the matter was once again listed after more than six months but no progress was made.

Augustus Ralph Marshall

AUGUSTUS Ralph Marshall served as the Chief Executive Officer of Astro All Asia Networks Limited since September 2003. He was the Chief Executive Officer of MEASAT Broadcast Network Systems Sdn, a wholly owned subsidiary of Astro All Asia Networks Ltd, since 1995 and its Deputy Chairman. He served as the Chief Executive Officer of Astro Group from 1994 to May 2006. Marshall has the responsibility for Tanjong group’s financial management and plays a key role in the development and implementation of its corporate objectives. He has more than 30 years experience in Financial and General Management in UK and Malaysia. He has been the Chairman of Powertek Berhad since February 2007. He serves as a Non-Independent Non-Executive Deputy Chairman of Astro Malaysia Holdings Berhad. He has been Executive Deputy Chairman of ASTRO Overseas Limited since April 2011. He serves as the Non-Independent Non-Executive Deputy Chairman of Astro Malaysia Holdings Berhad. He served as Deputy Chairman of Astro All Asia Networks Ltd since August 2003 and its Director since July 2003. He has been a Director of Astro Malaysia Holdings Berhad since March 21, 2011. He has been a Non-Executive Director of Johnston Press PLC. He has been an Executive Director of Tanjong Public Limited Company since February 21, 1992, and Usaha Tegas Sdn Bhd since 1992, and primarily responsible for providing strategic direction and investment policy decisions. He has been an active member of the management group responsible for developing and implementing the financial and corporate strategies of the UT Group and its affiliates He serves as Non-Executive Director at Powertek Berhad since April 1, 1999, Measat Global Berhad since May 8, 2002, and Maxis Communications Berhad since June 30, 1993. Marshall has been an Independent Non-Executive Director of KLCC Property Holdings Bhd since September 1, 2005. He has been a Director of Kuala Lumpur Convention Centre Sdn Bhd, Suria KLCC Sdn Bhd and Asas Klasik Sdn Bhd. He has been an Independent Non-Executive Director of KLCC Reit Management Sdn Bhd, Manager of KLCC Real Estate Investment Trust since December 5, 2012. He has been a Director of London Stock Exchange PLC since August 1991. Marshall has been Director of MEASAT Broadcast Network Systems Sdn Bhd since 1994 and London International Exhibition Centre Holdings PLC. He served as Maxis Berhad from August 7, 2009, to July 14, 2015. He served as a Director of Tanjong Energy Holdings Sdn Bhd. He served as a Non-Executive Director of OUE Limited (Alternate Name: Overseas Union Enterprise Ltd) from September 21, 2006, to March 9, 2010. He served as a Non-Executive Director of Summit Ascent Holdings Limited since February 8, 2002. Marshall is an Associate of Institute of Chartered Accountants in England and Wales, post qualifying in the UK and a Member of Malaysian Institute of Certified Public Accountants.

AUGUSTUS Ralph Marshall served as the Chief Executive Officer of Astro All Asia Networks Limited since September 2003. He was the Chief Executive Officer of MEASAT Broadcast Network Systems Sdn, a wholly owned subsidiary of Astro All Asia Networks Ltd, since 1995 and its Deputy Chairman. He served as the Chief Executive Officer of Astro Group from 1994 to May 2006. Marshall has the responsibility for Tanjong group’s financial management and plays a key role in the development and implementation of its corporate objectives. He has more than 30 years experience in Financial and General Management in UK and Malaysia. He has been the Chairman of Powertek Berhad since February 2007. He serves as a Non-Independent Non-Executive Deputy Chairman of Astro Malaysia Holdings Berhad. He has been Executive Deputy Chairman of ASTRO Overseas Limited since April 2011. He serves as the Non-Independent Non-Executive Deputy Chairman of Astro Malaysia Holdings Berhad. He served as Deputy Chairman of Astro All Asia Networks Ltd since August 2003 and its Director since July 2003. He has been a Director of Astro Malaysia Holdings Berhad since March 21, 2011. He has been a Non-Executive Director of Johnston Press PLC. He has been an Executive Director of Tanjong Public Limited Company since February 21, 1992, and Usaha Tegas Sdn Bhd since 1992, and primarily responsible for providing strategic direction and investment policy decisions. He has been an active member of the management group responsible for developing and implementing the financial and corporate strategies of the UT Group and its affiliates He serves as Non-Executive Director at Powertek Berhad since April 1, 1999, Measat Global Berhad since May 8, 2002, and Maxis Communications Berhad since June 30, 1993. Marshall has been an Independent Non-Executive Director of KLCC Property Holdings Bhd since September 1, 2005. He has been a Director of Kuala Lumpur Convention Centre Sdn Bhd, Suria KLCC Sdn Bhd and Asas Klasik Sdn Bhd. He has been an Independent Non-Executive Director of KLCC Reit Management Sdn Bhd, Manager of KLCC Real Estate Investment Trust since December 5, 2012. He has been a Director of London Stock Exchange PLC since August 1991. Marshall has been Director of MEASAT Broadcast Network Systems Sdn Bhd since 1994 and London International Exhibition Centre Holdings PLC. He served as Maxis Berhad from August 7, 2009, to July 14, 2015. He served as a Director of Tanjong Energy Holdings Sdn Bhd. He served as a Non-Executive Director of OUE Limited (Alternate Name: Overseas Union Enterprise Ltd) from September 21, 2006, to March 9, 2010. He served as a Non-Executive Director of Summit Ascent Holdings Limited since February 8, 2002. Marshall is an Associate of Institute of Chartered Accountants in England and Wales, post qualifying in the UK and a Member of Malaysian Institute of Certified Public Accountants.Finally, almost after two years of taking cognizance of the matter, the CBI Special Court, on August 1, 2016, issued warrants of arrest against the accused Astro All Asia Networks Plc, Maxis Communications Berhad, Ralph Marshall and T Ananda Krishnan. On August 27, 2016, the Delhi High Court heard SCIP’s arguments and reserved its judgement.

This two-year delay in issuing warrants of arrest (let alone actual arrest) is strange, specially as it has given the accused time to negotiate various deals, including the sale of the assets of the companies involved in the scam.

It should have been evident to the CBI that no response would be received from Malaysia as the earlier Letter Rogatory sent in 2013 had yielded no cooperation from the Malaysian government. Yet, it chose this route to proceed

It is strange that the CBI did not pick the low-hanging fruit by attachment of properties of the companies and arresting, questioning and prosecuting Indian citizens involved in the scam. Chennai-based Suneeta Reddy and Dwarkanath Reddy, who are directors of the Sindya Securities and Investments Pvt Ltd, which currently owns 26.001 per cent of Aircel Ltd were not even charged in the ‘CBI vs. Dayanidhi Maran and Others’ case.

Maran brothers

Dayanidhi Maran A Delhi court on August 27 reserved order on applications by former Telecom Minister Dayanidhi Maran, his brother Kalanithi Maran and others challenging its jurisdiction to hear a money-laundering case against them connected with the Aircel-Maxis deal, arguing that the court was designated only to hear the 2G cases.

The court had summoned them in the case in February after taking cognizance of a complaint filed by the Enforcement Directorate in January. Special Judge OP Saini reserved the order for September 6. Since this issue goes to the press before this date, we are unable to state what the order said.

The Maran brothers have also moved bail applications in the case. The agency has opposed their bail pleas. Opposing their bail applications, the Directorate through its Assistant Director Kamal Singh said that “possibility of hampering the investigation and tampering with the evidence by the applicants may not be ruled out…The bail applications deserve to be rejected and the question of imposition of conditions does not even arise,’’ the ED said.

Kalanithi Maran Taking cognizance of the complaint, the Judge had said that he was satisfied on perusal of the material on record that there was enough material to proceed against the accused persons. The complaint is a spin-off of the corruption case lodged by the CBI in the Aircel-Maxis deal.

The complaint alleged that Rs. 742.85 crore was paid to Dayanidhi Maran by two Mauritius-based companies through Sun Direct TV Pvt Ltd (SDTPL) and South Asia FM Ltd (SAFL). The two companies are owned and controlled by Kalanithi Maran, and the money was utilised by these companies for their business, the complaint alleged.

K Shanmugam, MD of SAFL, SDTPL, and SAFL, has also been named as accused in the complaint. He has also moved for bail.

Anil Ambani

ANIL Ambani’s Reliance Communications (R-Com) and Aircel are said to be preparing the ground for signing an agreement for a merger of their businesses by September first week. Terms for the merger are said to have been finalised. The merger, if it materialises, would lead to the formation of the third-largest telecom operator in the country with a subscriber base of over 196 million. At present, no regulatory approvals are said to be required. The process for regulatory approval will begin after R-Com and Aircel sign a definitive agreement. It may take around 4-6 month for the merger and the combined entity may be re-branded.

The new entity will hold spectrum across all allocated bands for 2G, 3G and 4G services. On the other hand, R-Com and Sistema (MTS) are in process of merger. Sistema will hold 10 per cent stake in the new entity that will be formed post its merger with R-Com. In December last, the two firms announced a 90-day ‘exclusivity period’ for the merger deal that will exclude R-Com’s tower and optical fibre assets for which a separate sale process is ongoing. The talks were later extended twice.

The merged entity is expected to have Rs. 25,000-crore business from the first day of its operation and is estimated to have Ebitda (earnings before interest, taxes, depreciation and amortization) of Rs. 7,000 crore and finance cost of about Rs. 3,000 crore. R-Com and Aircel have had nil free cash flow for a long time but the resultant entity is being structured in a manner to have R. 4,000 crore free cash flow, which it can use for investments in network, according to a telecom analysts.

Ananda Krishnan

ACCORDING to Forbes, Tatparanandam Ananda Krishnan’s net worth is estimated at RM44 billion, or US$10 billion, as on May 2015 and he is the sixth richest man in Asia.

In the global financial world, everyone knows how Dr Mahathir Mohamad helped make Krishnan rich by milking Petronas. What many do not know is that he transferred billions of his wealth to India to finance a shady Maxis-Aircel deal.

But then he got caught and now the Indian government wants him arrested and charged and most likely jailed. And the only person who can save him is Malaysian Prime Minister Najib Tun Razak.

And that is why Krishnan gave 1Malaysia Development Berhad (1MDB) a loan of RM2 billion a year ago, much to the chagrin of Dr Mahathir. The old man wanted 1MDB to default on its loan repayments. Krishnan, however, wanted to curry favour (pun intended) with the Malaysian government. And this did not quite fit into Dr Mahathir’s plans.

There are some who say that Dr Mahathir is the main wayang and is pretending he is not pleased that Krishnan gave 1MDB an RM2 billion loan. And this is because Krishnan would never do anything that Dr Mahathir does not want him to do—especially to help save 1MDB. But then Dr Mahathir also could not afford for Krishnan to be extradited to India and eventually put in jail. So giving 1MDB a loan of RM2 billion is a small price to pay to save Krishnan.

CBI is investigating Krishnan, Augustus Ralph Marshall and their companies—Maxis Communication Berhad, South Asia Entertainment Holding and Astro All Asia Network PLC—for their alleged role in the Maxis-Aircel scam. Maxis Communications Berhad, between 2007 and 2009, bought 20 per cent Kalanithi Maran–owned Sun TV Network Ltd through its subsidiaries Astro All Asia Network and South Asia Entertainment Network for Rs. 599.01 crore.

CBI had filed the chargesheet in the case containing the names of 151 prosecution witnesses and a set of 655 documents, on which it has relied upon during its probe. The case involves investigation in foreign countries and in its submission in court stated that there were sufficient grounds to proceed against the accused named in the chargesheet.

So far, the Centre through its diplomatic channels has not been able to convince the Malaysian government—even though both countries have signed a Mutual Legal Assistance Treaty (MLAT)—to cooperate with the Indian government in these serious allegations of corruption.

For months, the CBI have not been able to issue summons to the accused in Malaysia. Compare that to the cooperation extended by the Mauritius government on investigating the Global Communications Services Holdings Limited (GCSHL)—a Maxis Communication Berhad company—under which the entire intricate buy-out of Aircel took place.

Maxis Communications Berhad, Malaysia, through its subsidiary companies, owns 73.999 per cent of Aircel Limited and the remaining 26.001 per cent is owned by Sindya Securities and Investment Pvt Ltd., through Deccan Digital Networks Pvt Ltd.

The CBI has so far made no move to attach the shares and assets of Aircel Ltd or any of the other companies involved. The PIL specifically requests the High Court to direct the CBI to initiate proceedings “under Sections 105C r/w 105D-J of the CrPC for attachment and forfeiture of shares and all the assets of M/s Aircel Ltd as held by M/s Maxis Communications Berhad through M/s Global Communications Services Holdings Ltd, (which is 100 per cent subsidiary Company of M/s Maxis Communications Berhad) and M/s Sindya Securities and Investments Pvt (who has also acquired shares in M/s Aircel Ltd and its subsidiaries at the instance of M/s Maxis Communications Berhad).”

Sunil Bharti Mittal–Airtel’s connection with Aircel

IN July this year, the Telecom Ministry cleared the Rs. 3,500-crore 4G spectrum trading deal between service providers Bharti Airtel and Aircel. “The spectrum trading deal between Bharti Airtel and Aircel was cleared by the telecom minister on July 4,” an official source told PTI. As on July 4, Law and IT Minister Ravi Shankar Prasad was in charge of the Telecom Ministry as well.

Airtel has entered into an agreement with Aircel to acquire rights to use 4G spectrum of Aircel in eight telecom circles of Tamil Nadu, including Chennai, Bihar, Jammu and Kashmir, West Bengal, Assam, the North-East, Andhra Pradesh and Odisha. “Airtel was asked to surrender 1.2 Mhz spectrum in Odisha circle for approval as it breached the spectrum cap limit (after taking into account Aircel’s spectrum). The company has surrendered 1.2 Mhz spectrum in 1800 Mhz before the deal was cleared,” the source said.

In a circle, no player can hold more than 25 per cent of the total spectrum allocated in that particular service area. Activist lawyer Prashant Bhushan, in a letter on July 8, had demanded that CBI and ED immediately freeze spectrum held by Aircel, alleging that its Malaysian parent Maxis will “abscond” if the proposed deals with Airtel and RCom are allowed to go through. CBI has filed a detailed chargesheet against Aircel-Maxis and its Malaysian owner T Ananda Krishnan. Even ED has filed cases against them and attached properties of former telecom minister Dayanidhi Maran, but not that of Maxis, the letter said.

The Malaysia-based Maxis Communications holds 74 per cent in Aircel while the rest is with Sindya Securities and Investments. In August 2014, CBI had filed the chargesheet with the 2G Special Court, alleging Maran had entered into a criminal conspiracy with Krishnan and “forced” Chennai-based telecom promoter C Sivasankaran to sell his stake in Aircel to Krishnan in lieu of investments by Maxis Group in Sun Direct TV (owned by Maran brothers).

The chargesheet has been filed against Dayanidhi Maran, his brother Kalanithi Maran, Krishnan, Ralph Marshall (executive of the Maxis group) and four firms—Maxis Communication Berhad, Astro All Asia Network, Sun Direct TV Pvt, South Asia Entertainment Holdings in Mauritius. Bhushan cited various occasions when courts issued summons to Krishnan, Marshall, Maxis Communications Berhad, and Astro All Asia Network, but there was no compliance. “For a telecom operating company, spectrum is the main asset. Maxis should not be allowed to sell spectrum and equity unless all the accused, Krishnan and firm Maxis comply with summons issued by the 2G special court,” Bhushan said.

The matter is urgent as newspaper reports and other documents accessed by gfiles indicate that Aircel Ltd is in the process of being sold to/merged with the telecom giant Reliance Communications Ltd. Approvals have also been procured for the sale of 4G LTD Spectrum by Aircel Ltd to Bharti Airtel Ltd.

In April 2016, news surfaced that Maxis Communications Berhad had decided to sell rights to use 20 MHz 2300 Band 4G TD spectrum of its subsidiary Aircel Ltd to Bharti Airtel Ltd for a sum of Rs. 3,500 crore. gfiles has accessed a letter of Bharti Airtel, dated July 10, 2016, addressed to the National Stock Exchange of India Ltd, wherein it states that they have concluded their purchase of 20 MHz 2300 Band 4G TD spectrum from Aircel Ltd and have even obtained the necessary approvals from the government.

It is strange that the CBI did not pick the low-hanging fruit by attachment of properties of the companies and arresting, questioning and prosecuting Indian citizens involved in the scam

Stock Exchange Filing reveals that necessary approvals have been granted by the DOT for the transfer of the said spectrum licenses. It is shocking that while Maxis Communications Berhad is an accused before the court of law, DOT has allowed the transfer of its assets.

Similarly, Reliance Communica-tions Ltd has announced that its wireless business in India will shortly be combined with that of Aircel Ltd.

The PIL asked the High Court to direct DOT, SEBI, TRAI and Foreign Investment Promotion Board (FIPB) “to set aside approvals granted to Reliance ommunications Ltd for signing a binding definitive documentation with respect to the merger of Indian Wireless Business of Reliance Communications Ltd and M/s Aircel Ltd as the same is against the public interests of the country”.

Further, the Society for Consumers’ & Investors’ Protection asked that DOT, SEBI, National Stock Exchange of India Ltd., TRAI and FIPB be directed to set aside approvals granted to Bharti Airtel Ltd for the purpose acquisition of 4G LTD Spectrum from Aircel Ltd.

The PIL demanded that no permissions for transfer of shares or spectrum licenses be given by any regulatory body until the case against Maran and others is concluded. It also asked for an inquiry into how the transfer of assets of an accused company is being allowed by the concerned government authorities when it is a fugitive under the law.

Raising uncomfortable questions about the role of Global Communica-tion Services Holdings Ltd, Sindya Securities and Investments Pvt Ltd, South Asia Communications Pvt Ltd and Deccan Digital Networks Pvt Ltd in the scam, the petition said that they are impleaded as accused in the case of the “CBI vs Dayanidhi Maran and others” as “their roles in the commission of the crime are apparent from the chargesheet on record and as they are the direct beneficiaries of the crime”. It also asked for impleading of Suneeta Reddy and Dwarkanath Reddy on the same charges.

What is spectrum? Why is it important for mobile telephony?

Spectrum is basically airwaves. In mobile telephony, spectrum, a natural resource, acts as a medium for transmission of voice and data signals. There are different bands of spectrum that are allotted for different usages. Hence, one can say that spectrum is the backbone of mobile telephony.What was the 2G scam?

The Department of Telecom (DOT), with A Raja as the Telecom Minister, decided in 2008 to give spectrum to new players on first-come-first-served basis on the prices decided in 2001. In this auction, the price of 4.4 MHz of spectrum for providing pan-India services came out to be about Rs. 1,400 crore. The government allotted licences to new operators who had no established credentials in mobile telephony. Some of the companies were accused of divesting equity at significantly higher prices. Telecom firms, mainly Unitech and DB Reality, were allegedly awarded licences arbitrarily and granted 2G spectrum on January 10, 2008, at extremely cheap rates, thus robbing the government of revenues.When did the 2G scam assumed significance?

2G scam came to the notice of the public when the Comptroller and Auditor General CAG came out with its findings that the scam caused a loss of revenue of Rs. 1.76 lakh crore to the national exchequer.How did CAG arrive at the presumptive revenue loss figure?

The CAG based its estimates on three primary parameters to arrive at the loss figure of Rs. 1.76 lakh crore. These factors are inclusive of the following: the market price determined in an auction of 3G spectrum in 2010, the price offered by S Tel to DOT and the valuations at which at which the investors bought stakes in these companies.What is the Supreme Court ruling?

The Supreme Court, in a judgment on February 2, 2011, cancelled 122 2G spectrum licences granted on January 10, 2008, on the ground that they were issued in a “totally arbitrary and unconstitutional” manner. The Supreme Court also came down heavily on the FCFS policy and termed it fundamentally flawed.Apart from challenging the inaction of the CBI, the petition also examined the role of the Directorate of Enforcement, arguing that it should immediately institute an inquiry/investigation under Sections 5 of the Prevention of Money Laundering Act, in respect of the shares and other assets of Aircel Ltd obtained by commission of offence by Maxis Communications Berhad through Global Holdings Ltd and Sindya Securities and Investments Pvt Ltd.

Although the PIL did not specifically pray for an investigation into the size of lending by public sector banks to the various companies involved in the scam, it is evident that this is a matter requiring examination by the Reserve Bank of India or other banking authorities, particularly as it is reported that DOT allowed Maxis Communications Berhad to raise a huge loan from the banks. If the CBI is unable to serve notices to the company, one wonders how banks are lending it money. Or, how a leading company is announcing a business merger with its subsidiary!

Recent Posts

Related Articles

Cover StoryTablighi Jamaat : 1000 years of revenge

Written by Vivek Mukherji and Sadia Rehman Two contradictions are evident. Through April...

ByVivek Mukherji and Sadia RehmanMay 5, 2020Cover StoryWINDS OF CHANGE

Written by Gopinath Menon ADVERTISING : The name itself conjures up exciting images....

ByGopinath MenonMarch 4, 2020Cover StoryTHE ECONOMIC ROULETTE WHEEL

Written by Alam Srinivas THE wheel spins, swings, and sweeps in a frenzied...

ByAlam SrinivasMarch 4, 2020Cover StorySYSTEMS FAILURE, SITUATION CRITICAL

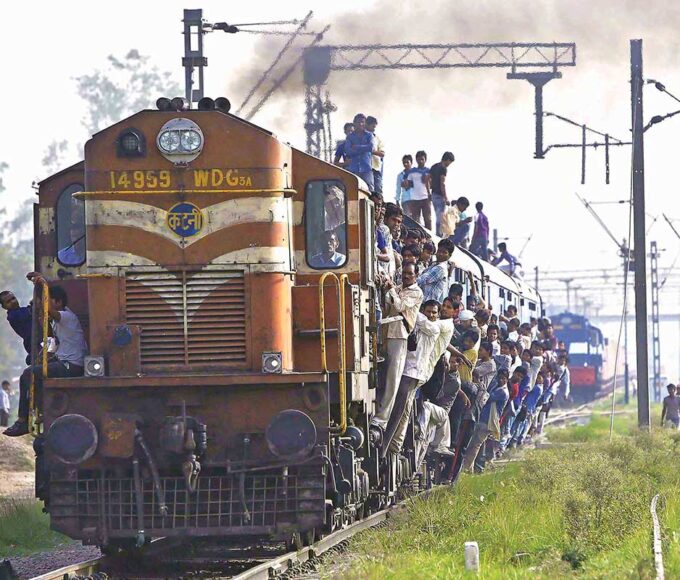

Written by Vivek Mukherji ONE of most quoted allegories of incompetence for a...

ByVivek MukherjiMarch 4, 2020 - Governance

- Governance

AUGUSTUS Ralph Marshall served as the Chief Executive Officer of Astro All Asia Networks Limited since September 2003. He was the Chief Executive Officer of MEASAT Broadcast Network Systems Sdn, a wholly owned subsidiary of Astro All Asia Networks Ltd, since 1995 and its Deputy Chairman. He served as the Chief Executive Officer of Astro Group from 1994 to May 2006. Marshall has the responsibility for Tanjong group’s financial management and plays a key role in the development and implementation of its corporate objectives. He has more than 30 years experience in Financial and General Management in UK and Malaysia. He has been the Chairman of Powertek Berhad since February 2007. He serves as a Non-Independent Non-Executive Deputy Chairman of Astro Malaysia Holdings Berhad. He has been Executive Deputy Chairman of ASTRO Overseas Limited since April 2011. He serves as the Non-Independent Non-Executive Deputy Chairman of Astro Malaysia Holdings Berhad. He served as Deputy Chairman of Astro All Asia Networks Ltd since August 2003 and its Director since July 2003. He has been a Director of Astro Malaysia Holdings Berhad since March 21, 2011. He has been a Non-Executive Director of Johnston Press PLC. He has been an Executive Director of Tanjong Public Limited Company since February 21, 1992, and Usaha Tegas Sdn Bhd since 1992, and primarily responsible for providing strategic direction and investment policy decisions. He has been an active member of the management group responsible for developing and implementing the financial and corporate strategies of the UT Group and its affiliates He serves as Non-Executive Director at Powertek Berhad since April 1, 1999, Measat Global Berhad since May 8, 2002, and Maxis Communications Berhad since June 30, 1993. Marshall has been an Independent Non-Executive Director of KLCC Property Holdings Bhd since September 1, 2005. He has been a Director of Kuala Lumpur Convention Centre Sdn Bhd, Suria KLCC Sdn Bhd and Asas Klasik Sdn Bhd. He has been an Independent Non-Executive Director of KLCC Reit Management Sdn Bhd, Manager of KLCC Real Estate Investment Trust since December 5, 2012. He has been a Director of London Stock Exchange PLC since August 1991. Marshall has been Director of MEASAT Broadcast Network Systems Sdn Bhd since 1994 and London International Exhibition Centre Holdings PLC. He served as Maxis Berhad from August 7, 2009, to July 14, 2015. He served as a Director of Tanjong Energy Holdings Sdn Bhd. He served as a Non-Executive Director of OUE Limited (Alternate Name: Overseas Union Enterprise Ltd) from September 21, 2006, to March 9, 2010. He served as a Non-Executive Director of Summit Ascent Holdings Limited since February 8, 2002. Marshall is an Associate of Institute of Chartered Accountants in England and Wales, post qualifying in the UK and a Member of Malaysian Institute of Certified Public Accountants.

AUGUSTUS Ralph Marshall served as the Chief Executive Officer of Astro All Asia Networks Limited since September 2003. He was the Chief Executive Officer of MEASAT Broadcast Network Systems Sdn, a wholly owned subsidiary of Astro All Asia Networks Ltd, since 1995 and its Deputy Chairman. He served as the Chief Executive Officer of Astro Group from 1994 to May 2006. Marshall has the responsibility for Tanjong group’s financial management and plays a key role in the development and implementation of its corporate objectives. He has more than 30 years experience in Financial and General Management in UK and Malaysia. He has been the Chairman of Powertek Berhad since February 2007. He serves as a Non-Independent Non-Executive Deputy Chairman of Astro Malaysia Holdings Berhad. He has been Executive Deputy Chairman of ASTRO Overseas Limited since April 2011. He serves as the Non-Independent Non-Executive Deputy Chairman of Astro Malaysia Holdings Berhad. He served as Deputy Chairman of Astro All Asia Networks Ltd since August 2003 and its Director since July 2003. He has been a Director of Astro Malaysia Holdings Berhad since March 21, 2011. He has been a Non-Executive Director of Johnston Press PLC. He has been an Executive Director of Tanjong Public Limited Company since February 21, 1992, and Usaha Tegas Sdn Bhd since 1992, and primarily responsible for providing strategic direction and investment policy decisions. He has been an active member of the management group responsible for developing and implementing the financial and corporate strategies of the UT Group and its affiliates He serves as Non-Executive Director at Powertek Berhad since April 1, 1999, Measat Global Berhad since May 8, 2002, and Maxis Communications Berhad since June 30, 1993. Marshall has been an Independent Non-Executive Director of KLCC Property Holdings Bhd since September 1, 2005. He has been a Director of Kuala Lumpur Convention Centre Sdn Bhd, Suria KLCC Sdn Bhd and Asas Klasik Sdn Bhd. He has been an Independent Non-Executive Director of KLCC Reit Management Sdn Bhd, Manager of KLCC Real Estate Investment Trust since December 5, 2012. He has been a Director of London Stock Exchange PLC since August 1991. Marshall has been Director of MEASAT Broadcast Network Systems Sdn Bhd since 1994 and London International Exhibition Centre Holdings PLC. He served as Maxis Berhad from August 7, 2009, to July 14, 2015. He served as a Director of Tanjong Energy Holdings Sdn Bhd. He served as a Non-Executive Director of OUE Limited (Alternate Name: Overseas Union Enterprise Ltd) from September 21, 2006, to March 9, 2010. He served as a Non-Executive Director of Summit Ascent Holdings Limited since February 8, 2002. Marshall is an Associate of Institute of Chartered Accountants in England and Wales, post qualifying in the UK and a Member of Malaysian Institute of Certified Public Accountants.