ALL sections of media in the country are currently engaged in the process of making an assessment of what has been achieved by the Government in three years of its being in office. Though three years’ time is not a long time for judging the performance of any Government, yet having voted in the present Government with lot of hopes and aspirations the people are keen to know how far their expectations have been met or are in the process of getting fructified!

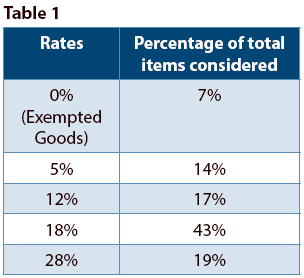

One of the institutional reforms undertaken by the NDA Government relates to far-reaching economic legislation and achievement of federal cooperation in the matter of enactment of Goods and Services Tax (GST) laws at the Central and State levels. This matter was pending for years with the previous UPA Government and it is certainly a big achievement that the present Government has been successful in giving practical shape to the proposals and getting the constitutional amendment for the same passed. The rollout of such law from July 1, 2017 now almost seems a certainty after two meetings of the GST Council held in Srinagar on May 18-19, 2017 finalising the tax rates for almost all the goods and services bringing these into five categories of 0%, 5%, 12%, 18% and 28%. In the meeting held on May 18, the rates for almost 1,211 goods items were finalised and these were grouped under five rates as in Table 1.

Amongst the exempted (0% rate) goods are items like foodgrains, gur, milk, bread, atta, pulses, fruits, vegetables, etc. In most States, these are already exempt though some States tax some of these commonly consumed items. This indicates that the impact of GST on these items for the common persons will be almost neutral – no gains, no losses. According to Union Mines and Power Minister Piyush Goyal, ‘GST will light up homes of poor’ because of fall in price of coal consequent to revision of tax rate to 5% by keeping coal in the 5% slab group (currently, it is taxed at 11.7%).

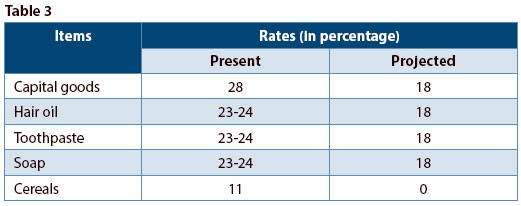

Sugar, tea, coffee (not instant tea and coffee) and edible oil will attract tax at 5%. Hair oil, soap, toothpaste, capital goods, industrial intermediaries will be taxed at 18% rate. Consumable durables like refrigerators, ACs, televisions, cars, etc., would be subjected to 28% tax.

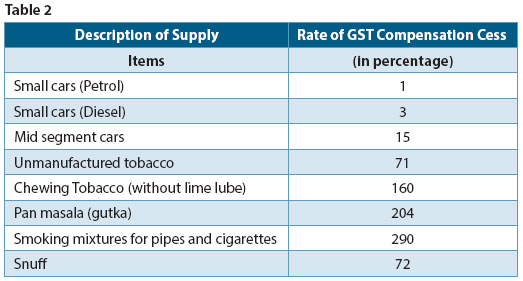

The Central Government has made a commitment to the States that it will compensate States for five years in regard to any deficit that the States may suffer consequent to imposition of GST. To meet this obligation, the Central Government will impose ‘Cess’ over and above the tax rate to generate revenue for this purpose. The rates of cess vary from 1% of tax to 290%. Some instances of the imposable cess are given in Table 2.

The above are just few instances. The list for levy of cess is quite long. The cess will serve dual purpose. Besides generating revenue, these high rates check the consumption of pernicious goods in the society which are harmful.

From the figures slated earlier, it could be seen that nearly 60% of the items will be taxed between 12% and 18% tax rates. The major reduction in rates will be in the categories of goods in Table 3. As against this, the tax on mobile handsets will increase to 18% from present 12%. In white goods, it will increase to 28% from the present 23-25%.

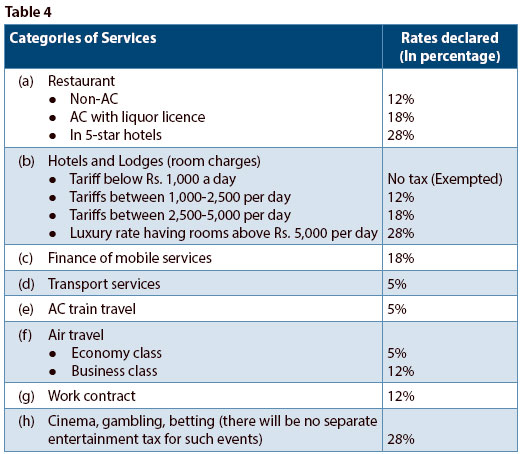

The rate brackets for services were considered on the second day of the Council meeting, i.e., on May 19, 2017 when rates for all services, except lotteries, were fixed. By and large, the burden of tax on services is expected to rise from the present 15%. According to the Revenue Secretary, this will be offset by input credits. Exemption from service tax for healthcare and education and some others are to continue.

On some categories of services, the rates finalised are given in Table 4.

In a short write-up like this, rates in respect of various other services cannot be stated. The rates mentioned here are merely illustrative. However, broadly it could be said that other than those services which are exempt, all services numbering nearly 500 have been grouped in four categories of rates namely 5%, 12%, 18% and 28% which will mean that for the bulk of them there will be an increase from the present rate of 15% to 18%.

REGRETFULLY, it is noted that work of finalisation of rates for some categories of goods has been left to be decided in the next meeting of the GST Council, scheduled for June 3, 2017. The leftovers are gold, bidis, agricultural implements, textiles, footwear and biodiesel. It is not understood why rates for these products too could not be finalised in the May meetings.

Besides the rates as stated earlier, the GST Council also finalised Rules in respect of seven matters concerning GST implementation. This could be considered to be a good performance.

In the foregoing discussions, an attempt has been made to highlight some salient aspects relating to the proposed GST regime. It could be said that the GST Council has given some shape to the GST law and on that basis, States too have made their laws (which were hitherto being discussed in different ways in different forums). The long wait for the new regime concerning indirect taxes to be in the form of a new law could be said to be over. The rate finalisation work which was a stupendous exercise and was being talked about in different ways, in a way, has ended. But it cannot be said that everything has been finalised to the point of leading the country to the avowed objective behind the GST law of ‘one country, one tax’?

One aspect that complicates tax laws are the ushering in of various categories of exemptions and the foregoing discussion shows that the new GST law could not be an exception in this regard. However, the Centre seems to have promised that these would be stopped in a gradual manner in coming months and the new system materialises. A beginning could perhaps be made from petroleum products and spreading over to rate structure thereafter! It may perhaps be better to fix a time frame for this.

The new laws for the Centre and the States have been hurriedly conceived of and besides being complicated, considerable adhocism has set in their formulation! For example no reason has been given why lottery services have been left out of the purview of the new law! Further, though entertainment services are to be taxed at the rate of 28%, Revenue Secretary H Adhia has said that the State Governments will have the authority to create a separate law to charge tax in addition to the 28% proposed for funding local bodies. Where will be the end if such relaxations are permitted in other areas? Will it not put an end to the concept of one nation, one tax?

Admittedly, the common man will gain in certain respects as some items of daily needs like foodgrains, milk, sugar, tea and coffee may be cheaper but he will be paying higher amounts for certain items and services like air travels, telecom and financial services, eating in restaurants, etc. According to Revenue Secretary H Adhia, implementation of GST will bring down inflation by 2%. If that happens, the common man will benefit immensely.

There is also another angle. Zero tax on food items may benefit the consumers, but this may dry up revenue generation for States like Punjab who levy VAT on such products and the Centre may have to compensate such States for such loss of revenues! However, it may be too early to make an assessment in this regard.

BUSINESSMEN and service providers are expected to pass on the benefit arising to them consequent to regime of ‘no tax on tax’ in the GST era, and because of availability of input tax credit in certain respects and a non-profiteering clause in the GST law. But will there be efficient and adequate machinery to implement such a provision!

The Finance Minister, the Revenue Secretary and many other dignitaries have hailed the law calling it anti-inflationary. The Commerce Minister has said that it will boost exports and make it easy to get refunds. Many others have praised it on similar lines. However, all adverse comments and praises are at present on a presumptive basis. According to the Government, the new tax regime would be revenue neutral (which means that the common man will not be adversely affected). Let the new regime work from July 1, 2017 and then a review could be done after one year. Any new legislation which is the result of a more than a decade of work needs to be given a fair trial.

The writer is former Chairman, CBDT