- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

Recent Posts

© Copyright 2007 - 2023 Gfiles India. All rights reserved powered by Creative Web INC.GovernanceJignesh Shah goes free again

Despite being indicted by various government agencies for economic fraud, Shah manages to get bail

Neeraj MahajanSeptember 5, 20143 Mins read561 Views

Written by Neeraj Mahajan

Written by Neeraj MahajanThe Bombay High Court recently granted Jignesh Shah bail after 107 days in jail in the Rs. 5,600-crore National Spot Exchange Limited (NSEL) scam. Justice AM Thipsay said in his order: “I am granting him bail… since there is no possibility of him absconding.” This has raised eyebrows.

All agree that the Rs. 5,600-crore crime was committed. The only debate is whether the court should have accepted the Economic Offences Wing (EOW) chargesheet which clearly spelt out that Shah was deeply involved in the fraud. However, senior advocate Mahesh Jethmalani, arguing on behalf of Shah, took the plea that his client had no knowledge of the shortfall in stock and that the crisis was perpetrated by a clutch of brokers and NSEL employees, including former CEO Anjani Sinha, and that there was no possibility of Shah tampering with evidence.

This is contested in the EOW chargesheet, which says that, unlike his other ventures, NSEL was not under any regulatory authority and hence proved to be an ideal platform to gain quick success. An earlier Forward Markets Commission (FMC) order corroborates this by stating that there was “malafide intention on part of the promoter of Financial Technologies (India) Limited (FTIL) to use the trading platform of its subsidiary company for illicit gains, away from the eyes of the regulator”. Wash trades on the exchange helped jack up trading volumes from Rs. 10 crore in March 2010 to Rs. 1,700 crore a day by 2012-13. Accordingly, the NSEL profit shot up from Rs. 30 crore to Rs. 130 crore little over half of the FTIL Group profit. This was then informally adjusted with other Group subsidiaries. NSEL was contributing 60 per cent of the FTIL Group’s revenues, the EOW chargesheet adds.

After handpicking dubious characters like Joseph Massey, the infamous erstwhile MD of Interconnected Stock Exchange, and Anjani Sinha, who presided over the closure of Magadh, Ahmedabad and Safal exchanges, does Shah have a right to complain?As the Chairman and Group chief executive, Shah himself made several presentations to government officials and investors on NSEL and should have known that there was virtually no stock of commodities in the exchange, or the fact that 25 borrowers were being allowed to squander Rs. 5,600 crore worth of stocks belonging to the 13,000 investors.

Significantly, FMC chairman Ramesh Abhishek and two members, in their order declaring FTIL ‘unfit and improper’ to run a bourse, had dismissed Shah’s claim that he was a victim of the fraud. He benefited from the profits of NSEL and the illegal paired contracts which helped boost the market capitalisation of his listed entities, the FMC order concluded. “Shah misused his position as the promoter to create confidence in the minds of the participants regarding the legitimacy of the business and its operations in the exchange platform of NSEL,” the order added.

Even the Registrar of Companies (RoC), in its 69-page report opined, “the directors of FTIL have failed in their fiduciary duty to safeguard the interests of shareholders and creditors by not exercising due diligence”. Prima facie, it appears that the FTIL board allowed the state of affairs at NSEL to continue, which resulted in the fraud. Some of the violations are so serious that they can even lead to their imprisonment under the Companies Act, the report added.

Preliminary investigations by Income Tax authorities observed severe lapses, mismanagement, cheating, criminal breach of trust, conspiracy and forgery in NSEL, which was not functioning as a spot exchange is supposed to. “If the NSEL management and Board of Directors say that they failed to see piles of bounced cheques and forged warehouse receipts right on top of their table, they are either incompetent or impractical,” the report concluded.

As the chairman and Group chief executive, Shah himself made several presentations to government officials and investors on NSEL and should have known that there was virtually no stock of commodities in the exchange.After handpicking dubious characters like Joseph Massey, the infamous erstwhile MD of Inter-connected Stock Exchange, and Anjani Sinha, who presided over the closure of Magadh, Ahmedabad and Safal exchanges, does Shah have a right to complain? As the head of the audit committee at NSEL, he could have ensured that the stock offered as collateral was kept with independent warehouse agencies instead of the borrowers’ own factories. He could have also ensured that the borrowers weren’t allowed any credit beyond their financial strength. But he didn’t. Can he now escape responsibility when, instead of barring these defaulting borrowers from trading, his board gave them margin exemptions and extended corporate guarantees to serial defaulters?

To add insult to injury, FTIL and its 60,000-odd shareholders the victims of the pre-planned and premeditated fraud had to shell out over Rs. 40 crore as legal costs to defend Shah, who owns 45 per cent stake in FTIL. He was the director and key management person in both the companies. The entire cost to engage expensive lawyers to argue for him is on company expense.

Many small shareholders have requested FTIL to stop paying Shah’s legal expenses and recover the money spent so far from him, as he is a direct beneficiary of the NSEL scam, as mentioned in the Mumbai Police EOW chargesheet and FMC’s “unfit and improper” order.

Recent Posts

Related Articles

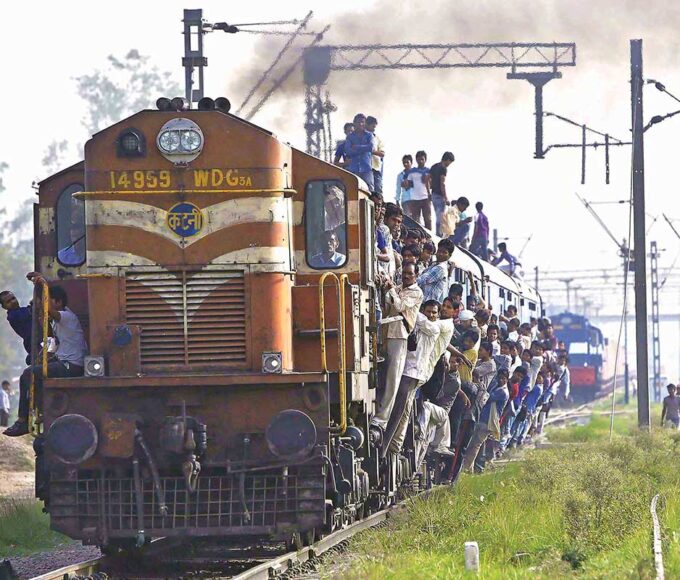

GovernanceNewsBackdoor entry of Private players in Railway Production Units ?

Written by K. SUBRAMANIAN To Shri G C Murmu C&AG Dear Shri Murmu,...

ByK. SUBRAMANIANFebruary 22, 2024GovernanceNailing Labour to The Cross

Written by Vivek Mukherji THEY grease the wheels of India’s economy with their...

ByVivek MukherjiMay 5, 2020GovernanceBig Metal Momentum

Written by GS Sood PRECIOUS metals especially gold and silver are likely to...

ByGS SoodMay 5, 2020GovernanceStrengthening Social Enterprise Ecosystem: Need for systemic support from the Government

Written by Jyotsna Sitling and Bibhu Mishra THE world faces several challenges today....

ByJyotsna Sitling and Bibhu MishraMay 5, 2020 - Governance

- Governance