BLACK money has been a matter of concern since decades. The governments of the times have been taking action on black money, its extent and how its proliferation can be checked. For this, a number of committees have been appointed-Wanchoo Committee, Choksi Committee, Chelliah Committee, Parthasarthy Shome Committee, Kelkar Committee and a Black Money Panel in 2011 to prepare a white paper on black money. This issue was also entrusted for study to three premier institutions of the country-National Council of Applied Economic Research (NCAER), National Institute of Financial Management (NIFM) and National Institute of Public Finance and Policy (NIPFP)-but their reports have not been placed by the UPA and NDA governments in public domain for reasons best known to them.

Meanwhile, the problem remains unabated despite so many studies. This is because no efforts have ever been made to ensure implementation of the suggestions of the expert bodies in a consolidated way. Some suggestions from the reports were picked up for implementation, but that obviously could not provide solution to the multi-faceted problem.

One of the promises made by Narendra Modi during the 2014 elections was, if voted to power, his government would take strong steps to check and eradicate black money domestically and abroad. In pursuance of that promise, the government has taken the following steps:

• Constitution of Special Investigation Team (SIT) to give effect to Supreme Court’s directive. The UPA government kept postponing it despite SC’s directions.

• Special Act enacted for black money, namely Undisclosed Foreign Income and Assets (Imposition of Tax) Act, 2015.

• Opening one-time compliance window for black money abroad. This regretfully did not evoke a favourable response and only 644 taxpayers made use of the scheme, netting only Rs. 2,428 crore as tax.

• Income Disclosure Scheme (IDS) for declaration of domestic black money under which black money worth Rs. 66,250 crore was disclosed with tax of Rs. 30,000 crore.

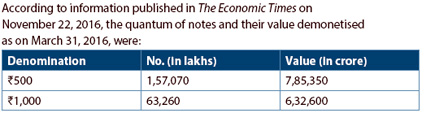

• Demonetisation of Rs. 500 and Rs. 1,000 notes. These have ceased to be legal tender from November 8, 2016 (midnight). Presently, the country is struggling with the aftermath of the problem of demonetisation on which no attention was paid before.

The basic fallacies in the approach have been that there was no assessment of the magnitude of the problem expected to arise and unpreparedness of the government to meet the same

The basic fallacies in the demonetisation approach have been that there was no assessment of the magnitude of the problem expected to arise and unpreparedness of the government to meet the same These notes constituted nearly 86 per cent of the total notes in circulation. All of these, in the prime Minister’s own words, became worthless pieces of paper after his declaration.

The issue is why the consequences of declaration were not perceived before demonetisation of such large number of notes from circulation. The decision has created immense hardship, inconvenience and chaos. People died while standing in queues before the banks for getting new notes, or got crushed on way to banks, or because of shock. They were unable to get new notes. With marriages already fixed, the situation plunged into uncertainties. Patients experienced difficulty in continuing their treatment or getting medicines because of terrific cash crunch. People could not draw money from their own accounts, except to the limited extent prescribed as a result of shortage of new notes and ATMs stopped functioning consequent to non-adjustment to the new notes coupled with shortage of notes. The new note of Rs. 2,000, issued in a limited way, created its own problem of getting small notes, adding to the woes of liquidity.

THE worst sufferers are persons in whose cases marriages were already fixed. It was a pity that would-be brides, grooms and their parents had to stand in long queues to get their money and that too limited to Rs. 24,000 in a week when they were expected to be busy in marriage arrangements. When the government, after nearly two weeks of delay-dallying, decided to give Rs. 2.5 lakh for marriages, the formalities prescribed by the RBI to get the money were so many that it became almost impossible to get one’s own money. The conditions to be complied with are so numerous that it makes one feel that he is living in anarchy, not democracy.

The Prime Minister wants citizens of the country to bear all such hardships in the hope of a better future, saying that after the grilling period, economy will improve and interest rates would come down.

There are no authentic figures regarding the quantum of undisclosed income in the economy. The World Bank Development Research Group on Poverty and Inequality and Europe and Central Asia Region Human Development Economics Unit in July 2010 estimated ‘Shadow Economies’ of 162 countries from 1999 to 2007 and reported that the weighted average size of the shadow economy (as a percentage of ‘official’ GDP) of these 162 countries was 31 per cent as compared to 34 per cent in 1999. For India, these figures were 20.7 per cent and 23.2 per cent, respectively, comparing favourably with the world average. Shadow economy for the purposes of the study was defined to include all market-based legal production of goods and services that are deliberately concealed from public authorities.

Unofficially, it is claimed that black money ranges between 20-68 per cent of the GDP. This is anywhere between Rs. 27-90 lakh crore. The issue is whether all of this is going to be unearthed by demonetisation. The answer has to be a strong ‘No’ because all of this does not exist in hard cash. Black money is not generated to be kept in safes and strong rooms. It is used to earn more income and wealth in the form of benami properties, bullion, jewellery, shares, rare paintings, works of art, etc. According to R Ramkumar of Tata Institute of Social Sciences, “…part of the illegal earnings is seamlessly transferred as capital invested in productive activities”.

A Committee on ‘measures to tackle Black Money in India and abroad in 2012’, set up bwy the Ministry of Finance, headed by the Chairman of the CBDT, strongly said that demonetisation may not be a solution for tackling black money in the economy, which is largely held in the form of benami properties, bullion and jewellery.

Estimates for illegal cash range from 3 per cent to 5 per cent of the total black money. Taking the higher figure of 5 per cent, black money in cash could be estimated between Rs. 1.4 lakh crore and Rs. 4.5 lakh crore. Arun Kumar, a former JNU Professor who has conducted studies concerning black money, has said, “Assuming the velocity of circulation to be no different than in the white economy, you could say that cash component is 38 per cent of the total currency (of Rs. 16.5 lakh crore). So, around Rs. 6.5 lakh crore is in the form of cash.” It is this component of black money which is affected by demonetisation. Thus, a very large bulk of black money is not in the form of cash, which is not likely to be returned to the coffers of the RBI.

OTHER advantage of demoneti-sation claimed was that it would wipe out considerable portion of fake currency from the system. A recent study by the Indian Statistical Institute, Kolkata, carried out under the supervision of the National Investigation Agency with the help of top government economic and intelligence bodies, concluded that the total fake currency in circulation in India was Rs. 400 crore. This figure was confirmed by the Minister of State for Finance, Arun Meghwal, in the Rajya Sabha in August last year. So, fake notes worth Rs. 400 crore will definitely become unusable as a result of demonetisation. But that will last only till fresh fake currency is printed based on new notes. Then the whole cycle may start again. Meanwhile, fake Rs. 2,000 notes have already started surfacing. Two such notes were found with terrorists killed in recent encounters. Hence, the benefit regarding fake notes going out of circulation may be short-lived.

The benefits projected do not seem to be commensurate with the hardships being experienced by the people of the country. The hardships will continue till a sufficient number of new notes are made available and all the ATMs start functioning in full force. Till then, the government has to ensure that people’s frustration does not get out of control. Already the SC has cautioned that such situation could lead to riots.

The ongoing disruption of daily life across the country is highly unlikely to finish the scourge of either black money or terror-funding. May be, all this pain is in vain.

The writer is former Chairman, CBDT