- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

Recent Posts

© Copyright 2007 - 2023 Gfiles India. All rights reserved powered by Creative Web INC.Cover StorySEBI: Turning a blind eye

SEBI operates less as a regulator and more as a puppet in the hands of those wielding power. Unless the pressure to act comes from the top, it desists from action. The crackdown on DLF is a point in case.

Anil TyagiNovember 4, 201424 Mins read858 Views

The SEBI BhavanWritten by Anil Tyagi

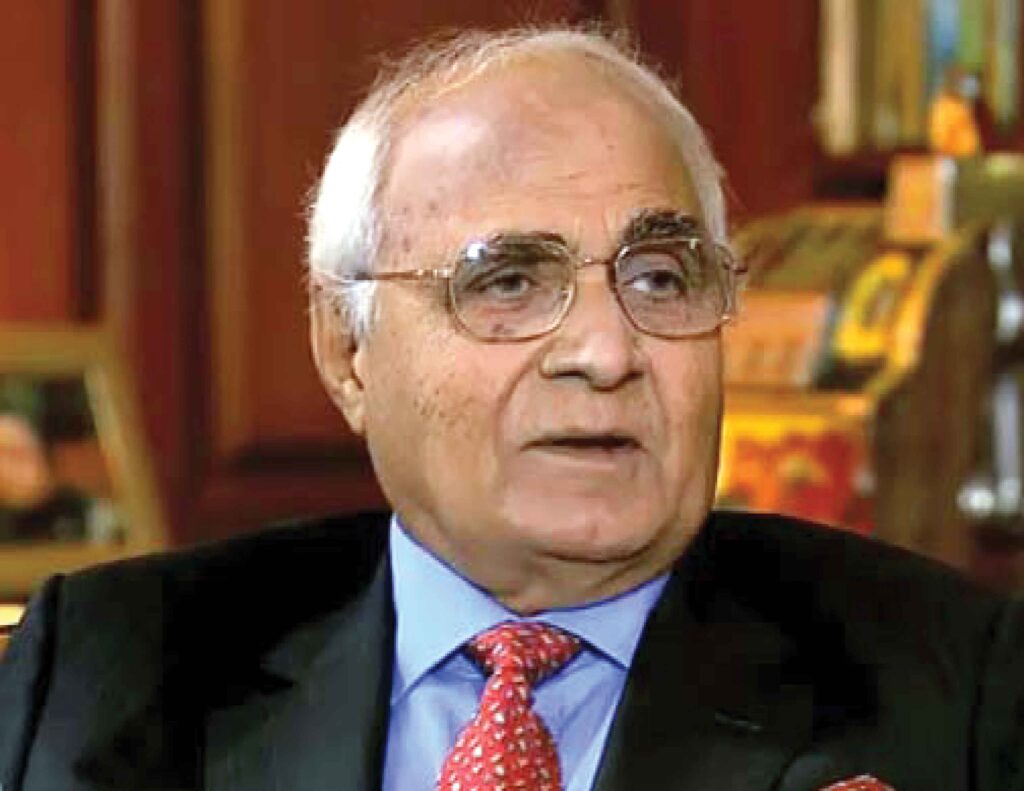

The SEBI BhavanWritten by Anil TyagiRecently, SEBI cracked down on India’s biggest realty company, DLF. It barred six of its top executives, including promoter-chairman KP Singh, from entering the securities market for three years. Most critics hailed the judgment. On social media, there were comments that the stock market regulator had finally found its teeth. SEBI’s action was linked to lapses in disclosures when DLF went public and was listed on exchanges. “I find that a case of active and deliberate suppression of information to mislead and defraud the investors in the securities market in connection with the issue of shares of DLF in its IPO is clearly made out,” said SEBI’s whole-time member Rajeev Agarwal in his 43-page order.

But the question that no one asked was: Why did SEBI wake up seven years after a complaint was filed against DLF in 2007? Another pertinent corollary: Was the order influenced by a change in the government? It is an open secret that Prime Minister, Narendra Modi, and the BJP would like to take on Robert Vadra, the controversial husband of Sonia Gandhi’s daughter, Priyanka Gandhi, who has deep business links with DLF. In Haryana, where the BJP came to power, there is a move to initiate investigations against Vadra.

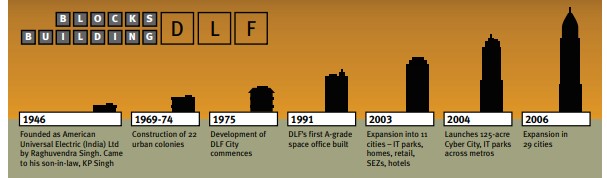

The dirty tricks of the realtor were first exposed in 2007 by the Society of Consumers’ and Investors’ Protection (SCIP), which pointed out the anomalies in the firm’s IPO (Initial Public Offering) before the Delhi High Court. In fact, gfiles published a detailed story in its inaugural issue, titled “Demolishing India” (which is reprinted in this issue). SCIP raised issues that were related to DLF’s offer letter (dated December 21, 2005) on its rights issue of debentures. The Society said that many shareholders claimed that they did not receive offer letters, or that the terms of the offer were forbidding.

“The vision of SEBI is to be the most dynamic and respected regulator—globally.”– Official website of the Securities and Exchange Board of India (SEBI)

“We have to ensure that there are no issues involving investor interest. We have to watch out for that. I am looking at SEBI to be a benchmark for the rest of the world.”

– GN Bajpai, Former Chairman, SEBI

“SEBI has become like a programmed watchdog. The robbery takes place right under its nose but it barks only the next morning when its owner (the Ministry of Finance) asks it to do so.”

– Sujay Marathi, Journalis

Advocate and now the country’s Finance Minister, Arun Jaitley, defended DLF in the court of then Justice TS Thakur (now Justice in the Supreme Court) and Justice SM Aggarwal. Justice Thakur initially stayed the IPO and later allowed it to go through after ordering the Ministry of Corporate Affairs to investigate the matter and submit a report. SCIP is still waiting for the Ministry’s report. SEBI was aware of the controversy since 2007 but it remained paralysed despite several reminders by SCIP.

The above episode-of how SEBI remained mute to market irregularities and then became overactive because of changes in the political environment-provides an insightful account of how the regulator operates. Critics contend that its functioning is more a matter of mystery than going by the rules and the book. Even when the world is aware of murky deals in the stock market, or fraudulent practices by members of stock exchanges, banks and merchant bankers, SEBI pretends to be ignorant and merely warns the violators, or slaps minor fines. Over the past decade, the regulator has worked on whims and fancies; it is seen as a pawn in the hands of the Finance Ministry.

Nothing illustrates this better than its performance under the chairmanship of Upendra Kumar Sinha, a Bihar-cadre IAS officer of the 1976 batch. In recent history, the appalling state of SEBI was exposed by KM Abraham, a Kerala-cadre IAS officer of the 1982 batch, who wrote three letters to then Prime Minister Manmohan Singh. In his second letter, Abraham alleged that four cases-related to the Sahara group, Reliance Industries, Bank of Rajasthan, and MCX Stock Exchange-were handled by him, and in each one SEBI Chairman Sinha forced him to go easy as these cases were closely monitored by the Finance Ministry.

SEBI could have denied the Jignesh Shah-promoted MCX-SX permission to start an exchange from day one because of non-compliance with its shareholding regulations. Instead, it permitted MCX-SX to start a currency futures exchange. Similarly, SEBI let Nirmal Singh Bhangoo’s PACL off the hook for long.The allegations were so sensitive and critical that the then Cabinet Secretary, KM Chandrasekhar, asked Abraham to submit the facts in writing. In effect, the charges were directed against the then Adviser to the Finance Minister, Omita Paul, and Sinha. Both vehemently denied the allegations. In fact, if Abraham had not pursued the Sahara case, despite the pressures on him, the group’s founder-chairman, Subrata Roy, would not have found himself in Delhi’s Tihar Jail for several months.

It seems that SEBI’s operations are influenced by the Finance Ministry and other political pressures. In rare cases does it deliver commendable orders, but only when the culprits are unable to twist the regulator’s arm. Consider SEBI’s controversial consent order on January 14, 2011, on Reliance ADA Group (R-ADAG), and four of its senior executives, for violations of SEBI (Prohibition of Fraudulent and Unfair Trade Practices Relating to Securities Market) Regulations, 2003, and the SEBI (FII) Regulations, 1995. R-ADAG, and its owner, Anil Ambani, and executives agreed to pay a Rs. 50 crore fine and abstain from the stock market till December 2011 in their individual capacities. They said that their companies-Reliance Infra-structure and Reliance Natural Resources Ltd (RNRL)-would also stay out of the secondary markets till December 2012. Without any admission or denial of guilt, they claimed that the fine would be paid out of personal funds, and not those of the firms.

Senior journalist R Jagannathan wrote a detailed article that exposed the fallacies of the consent order. In an article on FirstPost, an online venture of TV18, he said: “The consent order related to what SEBI initially thought were merely misrepresentations by Reliance Infrastructure and RNRL on ‘the nature of investments in yield management certificates/deposits and profits and losses there of’ in their annual reports for 2006-07, 2007-08 and 2008-09. SEBI also investigated the group’s bid to use the money raised abroad through external commercial borrowings (ECBs) and foreign currency convertible bonds (FCCBs) in Reliance Communications (RCom) through the alleged illegal FII route.”

However, the real story was quite different. On May 15, 2012, a UK Tribunal-which hears appeals against orders of the country’s regulator, Financial Services Authority (FSA)-confirmed a fine of $1.25 million (around Rs. 10.08 crore at the current exchange rates) on Sachin Karpe. A former UBS Wealth Management (Asia II Desk) Managing Director, Karpe was the key intermediary who enabled the channelisation of $250 million (about Rs. 1,000 crore at the then exchange rate of Rs. 40 to a dollar) of Anil Ambani, or R-ADAG, into a Mauritius Protected Cell Company (Pluri Cell E) to allegedly buy RCom shares.

The Regulatory Body

Funds that invest in India must register with the Securities and Exchange Board of India (SEBI), which is India’s answer to the US Securities and Exchange Commission. SEBI is located in Mumbai, the site of the country’s major stock exchanges. It was founded in 1992 with a mission to “protect the interests of investors in securities.

” SEBI has to be responsive to the needs of three groups, which constitute the market:-

- the issuers of securities

- the investors

- the market intermediaries

The Crash

SEBI’s role as a regulator of Indian capital markets was once again questioned on March 2, 2001, when the BSE index crashed by 176 points. This was the result of the large position taken by a stockbroker—Ketan Parikh (KP) in 10 stocks, popularly known as K10. The companies in which KP held high equity stakes included Amitabh Bachchan Corporation Limited, Mukta Arts, Tips, Pritish Nandy Communications, HFCL, Global Telesystems, Zee Telefilms, Crest Communications and PentaMedia Graphics. He had huge exposures in these stocks, which required a lot of money. Reportedly, KP borrowed from various companies and banks for this purpose.The Reasons

Analysts felt that the major reason for SEBI’s failure to protect investors against scams was lack of skilled human capital. For instance, they quoted the example of the KP scam in which KP had taken huge positions in 10 stocks. In spite of SEBI possessing this information, it could not gauge KP’s vested interests in acquiring these huge positions and his plans

The tribunal observed that Karpe helped Ambani open an account with the Swiss bank (UBS) in Zurich for Pluri Cell E, and the shares and derivatives (and other assets) of RCom were tied to this account. “At certain times, the value of these assets exceeded US$400 million.” So, the value of the assets oscillated between $250 million (Rs. 1,000 crore) and $400 million (Rs. 1,600 crore), or a paper gain of Rs. 600 crore. But in its wisdom, SEBI and the High-Powered Advisory Committee (HPAC), which scrutinises requests for consent orders, levied a Rs. 50 crore fine on a possible Rs. 600 crore gain!

Jagannathan raised other questions. Was SEBI aware of the scale of the operation before it agreed to the consent order? Did it quiz Karpe on his role and links with the R-ADAG accounts he handled? Did the regulator close the investigations too soon? The Internet is flooded with information about Karpe’s murky operations, apart from R-ADAG, and how he is adept at creating a maze of transactions that can take years to track. The former SEBI chairman does not have an answer to justify R-ADAG’s consent order.

Let us take another example of how deals are sealed between the regulator and offenders. In December 2012, SEBI took action against Indiabulls Securities, one of the fastest-growing firms, due to alleged fraudulent transactions in Aurobindo Pharma shares. The regulator said that the company modified its client codes without informing the stock exchange(s) and issued contract notes to transferee clients. The brokerage firm indulged in wrong margin reporting for both the transferer and the transferee. It failed to provide the relevant order book for the Futures and Options segment.

During a SEBI probe, it was found that a relationship manager of Indiabulls, Abhijit Sen, confessed in a criminal case that he had given the password of the trading account of Arunava Chakraborty to IndiaBulls’ Vice-President (Eastern Region), Sidharth Daga, as the latter threatened him with dire consequences. Daga then placed orders from Chakraborty’s account in Aurobindo Pharma’s shares. SEBI concluded that Daga was “directly or indirectly involved in fraudulently placing the orders from the trading account of Chakraborty and they are also corroborated by the statement of Sen”. Surprisingly, SEBI didn’t disclose the amount involved in the dealings.

Demolishing India?

a lawsuit poses a major hurdle for the real estate firm’s mega stock market plan

The Delhi High Court, on February 20, 2007, converted into a Public Interest Litigation (PIL) a writ petition filed by the Society for Consumers’ and Investors’ Protection (SCIP) against real estate major DLF Ltd. SCIP, an NGO empanelled with the Securities and Exchange Board of India (SEBI) and Ministry of Company Affairs (MCA), had received a large number of complaints from shareholders. The complaints related to the offer letter dated 1.12.2005 regarding the company’s rights issue of debentures. The shareholders said that they either did not receive the offer letter or that the terms of offer were too forbidding. The first complaint was backed by an FIR lodged by the postal authorities stating that the company got letters addressed to shareholders marked with cancellation stamps in the Safdarjung Post Of fice but never posted the letters.

The second complaint related to the fact that the company announced that the entire issue of debentures and equity shares, if any, would not be listed at the time of issue and there was no intention of getting them listed on any stock exchange. The company offered optionally convertible unsecured debentures of face value of Rs 100 each, carrying interest at 2 per cent per annum on 1:1 right basis. The issue closed on 18.1.06.

However, on March 17, 2006 — within two months of issue closure — the company convened an Extraordinary General Meeting (EGM) at which it got an in-principle approval for listing its shares on the BSE and NSE. It also converted each debenture into 10 equity shares of Rs 10 each. It declared a further bonus of seven shares for each share and split the Rs 10 share into five shares of Rs 2 each.

SCIP, after approaching SEBI and Ministry of Company Affairs, filed the writ petition and sought a direction from the court to SEBI and the ministry to probe DLF’s affairs and also to cancel the issue of debentures. Before replying to the court, and also to avert the consequences of violating SEBI rules, the Companies Act, 1956 and the Indian Penal Code, DLF convened another EGM on November 14, 2006 to modify the resolutions passed earlier. It extended benefits of convertible debentures issued on rights basis, their subsequent conversion into equity shares, issue of allotment of bonus shares and split of those shares to the shareholder who could not subscribe in terms of the letter of offer dated 21.12.2005.

The average cost of acquisition of these shares for the promoters is Re 0.31 per equity share, at face value of Rs 2 each, which they are offering to prospective buyers at about Rs 800. The shares are alleged to have been widely traded in the gray market at around this price. The likely offer price is hardly in sync with the fun damentals of the company with the latest EPS for Rs. 2 face-value share being only Rs 2.53, and the net asset value per share being Rs 19.37.

These fundamentals have been arrived at by showing sale of properties to DLF Assets Pvt Ltd, an entity promoted by the key shareholders themselves. Profits for eight months ending November 30, 2006, have been shown to have increased to Rs 1,830 crore from about Rs 192 crore in 2005-06, an increase of 853 per cent! A Draft Red Herring Prospectus (DRHP) filed with SEBI by DLF in January 2007 shows that 75 per cent of the company’s pre-tax profits came from sales to DLF Assets. About two-thirds of DLF’s revenue for the same period was accounted for by the same sales.

In 2002, DLF vice-chairman-cum-director Rajiv Singh was found guilty of violating SEBI (Substantial Acquisition of Shares & Takeovers) Regulations, 1997 for acquiring equity shares in excess of specified limits without prior public announcement. Chairman KP Singh paid a fine of Rs 5 lakh to SEBI. They got the shares de-listed on the stock exchanges and told shareholders to sell to them as told shareholders to sell to them as they could not sell otherwise. The delisting also helped to avoid the regulator’s attention for various irregularities committed by the company.

In another case, the Supreme Court also passed an order with regard to illegal sale of shares of Bhoruka Financial Services Ltd (BFSL) to a DLF Group Company—DLF Commercial Developers (DLFCD). DLFCD entered into a share purchase agreement with the promoters of BFSL to buy out their 98.37 per cent stake and sought exemption from SEBI from making an open offer to public shareholders—numbering just 26. BFSL shares were listed on the Bangalore Stock Exchange but DLF bought the shares from promoters of BFSL on the Magadh Stock Exchange—where they were not listed but were hurriedly allowed to be traded in the permitted category through a local broker. SEBI recently slapped a fine of Rs 1 crore for this violation.

A huge number of complaints and cases, both civil and criminal, is pending against the company and its directors. Thirty-two complaints are with the Monopolies & Restrictive Trade Practices Commission (MRTPC) while 83 complaints are before various original as well as appellate commissions, including the National Commission under the Consumer Protection Act, 1986. These complaints can leave the company facing claims worth hundreds of millions of rupees. Over 85 criminal and civil proceedings against DLF are before the Supreme Court, various high courts and district courts. A number of arbitration proceedings are also pending. About 80 cases are with tax authorities and labour courts. About 10 criminal and civil cases are pending against DLF’s subsidiaries and their directors in various courts.

On January 2, 2007, DLF filed the aforementioned DRHP with SEBI. It had filed a DRHP in May 2006 but withdrew for reasons best known to it, or to SEBI and the Ministry of Company Affairs. Now, DLF intends to make a public issue of 175 million shares at face value of Rs 2 each.

If market buzz, as reflected in the pink papers, is any indication, the issue price is likely to be Rs 800 per share. At this price, DLF will raise Rs 14,000 crore, which makes it the biggest IPO of a private company in India. The only company to have raised more than Rs 10,000 crore through a public issue so far is the state-controlled Oil & Natural Gas Corporation which raised Rs 10,500 crore in March 2004.

Post-IPO, DLF Ltd would be a company worth over Rs 1,36,000 crore and its chairman would emerge a leading billionaire—controlling more than 85 per cent of the paid-up equity share capital of the company after its listing. His wealth will be in the region of Rs. 1,15,000-Rs 1,20,000 crore.

(A questionnaire sent to the DLF chairman by gfiles had elicited no response till the time of going to press).

When the scam was unearthed, Palaniappan Chidambaram was the Finance Minister. In December 2012, Daga was barred from the securities market for five years. However, on January 9, 2013, Indiabulls and SEBI reached a settlement. SEBI’s HPAC recommended a fine of Rs. 5,10,000 against the company. Everybody was shocked. Rather than pursuing criminal cases against the brokerage firm which indulged in illegal and unfair practices as listed above, the regulator chose to settle out of court for a meagre amount. The key question: was SEBI under pressure to do so? Sinha knows the truth, but possibly his lips are sealed to protect his masters.

The problem with SEBI is not just back-room deals; it is also the manner in which the regulator looks the other way when blatant wrongdoings happen in front of its eyes. Here are a few instances. KEW Industries had no business commencement certificate, nor had its promoters brought in their equity contribution when Chartered Capital & Investment filed the red herring prospectus on its behalf. SEBI suspected that the promoters of FIEM Industries were in the list of RBI’s wilful defaulters; the issue was managed by IL&FS Investsmart. Transwarranty Finance was accused of shoddy documentation and wished to transfer the issue proceeds to two brokerage firms.

Gayatri Projects was also accused of shoddy documentation, and Celestial Labs were finding it tough to get in-principle listing approval from the bourses. Global Broadcast News (now IBN18) had applied without completing its amalgamation scheme. Sobha Developers did not wish to disclose its land bank; its investment bankers were Kotak Mahindra, Enam and IL&FS Investsmart. Global Vectra Helicorp and Ruchira Papers were two others on SEBI’s accusation list.

The Economic Times reported that seven investment bankers-Kotak, Enam, DSP Merrill Lynch, SBI Caps, HSBC, Keynote and Aryaman Financial-would be penalised for shoddy work in connection with the IPOs of Yes Bank and IDFC, which were the subject of major investigations. It was alleged in the Yes Bank case that the details in its prospectus differed from those filed with the RBI. What do these cases indicate? Does the regulator have the skills to spot defaulters? Does it fail to act tough when things do not seem right? Does it deliberately or otherwise allow the investment bankers to get away with shoddy work? Or worse, is SEBI hand-in-glove with investment bankers, promoters, and companies?

Let us look at another case which has hogged newspaper headlines for months. One of the most politically-managed and influenced battles was fought between MCX-SX (of the infamous Jignesh Shah) and SEBI. Apparently, SEBI acted against the firm. A 68-page SEBI order said that MCX-SX was not fully compliant with the MIMPS (Manner of Increasing and Maintaining Public Shareholding in Recognised Stock Exchanges) Regulations, 2006, as it was dishonest in withholding material information, its promoters were illegally holding more than 5 per cent equity, and its buyback transactions were illegal under the SCR Act.

SEBI Order on DLF dated October 10, 2014

DLF Ltd’s IPO for 17,50,00,000 equity shares of `2 each at a price of `525 per equity share aggregating to `9187.5 crore opened on June 11, 2007 for which it filed Red Herring Prospectus (RHP) with SEBI on May 25, 2007. With regard to the said IPO, one Kimsuk Krishna Sinha filed two complaints with SEBI on June 4, 2007, and July 19, 2007, stating that Sudipti Estates Private Limited (Sudipti) and certain other persons had duped him of `34 crore in relation to a transaction between them for purchase of land, and he had registered an FIR No. 249/2007 dated April 26, 2007, at Police Station, Connaught Place, New Delhi against Sudipti, one Praveen Kumar and others in that regard. He stated that Sudipti had only two shareholders, namely, DLF Home Developers Ltd (DHDL) and DLF Estate Developers Ltd (DEDL), both being wholly owned subsidiaries of DLF, and therefore Sudipti, DHDL and DEDL are sister concerns and are inextricably linked and are a part of the DLF group. In view of this, Sinha requested that for safeguarding the interests of the general public, the listing of DLF pursuant to the IPO be disallowed and immediate action be taken in this regard. Sinha filed Writ Petition No. 7976/2007 before the Delhi High Court and the same was disposed with the High Court directing SEBI to investigate the said complaints. The purpose of the investigation was to ascertain the violations, if any, of the provisions of SEBI (Disclosure and Investor Protection) Guidelines, 2000 (DIP Guidelines) read with corresponding provisions of SEBI (Issuance of Capital and Disclosure Requirements) Regulations, 2009 (ICDR Regulations) and the relevant provisions of the Companies Act, 1956 (Companies Act).

DLF has failed to disclose its related party transactions as also in terms of the provisions of DIP Guidelines and AS-23, names of these subsidiary companies should have been disclosed in the RHP/Prospectus of DLF, which it has failed to do. DIP Guidelines also required DLF to provide certain disclosures with respect to its subsidiaries, e.g. history and nature of business of subsidiaries and their financial information. DLF’s prospectus dated June 18, 2007, did not provide any such information of the aforesaid subsidiaries. Therefore, it has been alleged that DLF has violated provisions of clause 6.10.2.3 of the DIP Guidelines.

Clause 6.11.1.2 of the DIP Guidelines read with regulation 111 of the ICDR Regulations, inter alia, required DLF to disclose in its prospectus the information about outstanding litigations in respect of its subsidiaries or any other litigation whose outcome could have a materially adverse effect on the financial position of DLF. However, the prospectus did not provide any information of FIR (249/2007) registered by Sinha on April 26, 2007, against Sudipti, Praveen Kumar (KMP of DLF) and others. On this basis it has been alleged that DLF has violated clause 6.11.1.2 of the DIP Guidelines. Moreover, DLF dissociated a very large number of companies by entering into sham transactions to avoid disclosure about them. This is evdent from the fact that during the year 2006-07, a total of 355 companies (including Sudipti) were stated to be dissociated by DLF.

In view of the above, it has been alleged that DLF and those occupying top managerial positions have failed to ensure that the RHP/prospectus contained all material information which is true and adequate, so as to enable the investors to make an informed investment decision in respect of the issue and have actively and knowingly suppressed several material information and facts in the RHP/prospectus leading to misstatements in the RHP/Prospectus so as to mislead and defraud investors in the securities market in connection with the issue of shares of DLF.

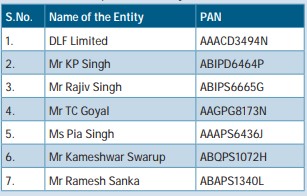

In view of the above, the company i.e. DLF and its key managerial personnel (KMP), including KP Singh, Rajiv Singh, TC Goyal, Pia Singh, Kameshwar Swarup, GS Talwar, and Ramesh Sanka have been charged with violating the provisions of clauses 6.2, 6.9.6.6., 6.10.2.3, 6.11.1.2, 6.15.2 and 9.1 of DIP Guidelines read with regulation 111 of ICDR Regulations and section 11 of the Securities and Exchange Board of India Act, 1992 (SEBI Act) and also the provisions of section 12 A(a), (b) and (c) of the SEBI Act read with regulations 3 (a), (b), (c), (d), 4(1), 4 (2)(f) and (k) of the SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003 (PFUTP Regulations). The order gave the benefit of the doubt to GS Talwar since at the time of filing of prospectus of DLF, Talwar was the non-executive director of DLF and was not found to be actively involved in the day-to-day affairs of the company.

The order states that the violations as found in this case are grave and have larger implications on the safety and integrity of the securities market and needs effective deterrent actions to safeguard the market integrity. It, therefore, becomes incumbent to deal with contraventions, digression and demeanour of the erring KMP sternly and take appropriate action for effective deterrence. In this regard, the observation of the Supreme Court, as a word of caution, in the matter of N Narayanan vs. Adjudicating Officer, SEBI, in Civil Appeal Nos. 4112-4113 of 2013 (order dated April 26, 2013) is worth mentioning:

“A word of caution:

43. SEBI, the market regulator, has to deal sternly with companies and their Directors indulging in manipulative and deceptive devices, insider trading etc. or else they will be failing in their duty to promote orderly and healthy growth of the Securities market. Economic offence, people of this country should know, is a serious crime which, if not properly dealt with, as it should be, will affect not only country’s economic growth, but also slow the inflow of foreign investment by genuine investors and also casts a slur on India’s securities market. Message should go that our country will not tolerate “market abuse” and that we are governed by the “Rule of Law”. Fraud, deceit, artificiality, SEBI should ensure, have no place in the securities market of this country and “market security” is our motto. People with power and money and in management of the companies, unfortunately often command more respect in our society than the subscribers and investors in their companies. Companies are thriving with investors’ contributions but they are a divided lot. SEBI has, therefore, a duty to protect investors individual and collective, against opportunistic behavior of Directors and Insiders of the listed companies so as to safeguard market’s integrity.”

Considering the above, I Rajeev Kumar Agarwal (Whole Time Member, SEBI), in order to protect the interest of investors and the integrity of the securities market, in exercise of the powers conferred upon me under section 19 of the SEBI Act, 1992 read with sections 11, 11A and 11B thereof and regulation 11 of the PFUTP Regulations, clause 17.1 of DIP Guidelines and regulation 111 of the ICDR Regulations hereby restrain the following entities from accessing the securities market and prohibit them from buying, selling or otherwise dealing in securities, directly or indirectly, in any manner, whatsoever, for the period of three years:

MCX-SX contended that SEBI’s conclusion was biased as it didn’t wish to promote healthy competition and was siding with and promoting the interests of an existing exchange that had monopolised the markets. MCX-SX filed a writ petition in the Bombay High Court that challenged SEBI’s rejection of its application to launch new segments such as equity and interest rate derivatives. What was the truth behind this fight?

All for Wives!

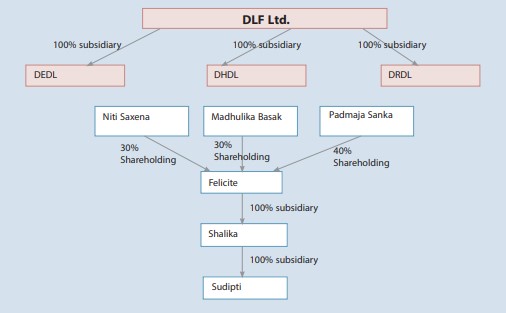

THE DLF case is a complex one, which reflects how realty firms are creating a matrix of companies and blurring the faith of investors. SEBI’s order points out clearly in its showcause notices, how three arms of DLF divested stake in Felicite to three ‘housewives’: Madhulika Basak, Niti Saxena and Padmaja Sanka, all of whom happened to be wives of key managerial persons in DLF.

The order of SEBI specifically mentions that ‘Housewives’ were not regular investors/traders in the securities market and they did not have any income of their own” (see the chart, which clearly depicts the shareholding pattern).

“The fact that the spouses of certain employees of DLF were shareholders of Felicite does not lead to a legal inference that Felicite is a subsidiary of DLF,” the company said in its submission.

SEBI’s whole-time member, Rajeev Agarwal, noted in his order that while it was an undisputed fact that the ‘housewives’ involved in the real estate companies used joint accounts with their husbands to fund the deals, the women, who had stake in the three companies, weren’t even regular investors.

Sebi noted that the three women were the wives of the Group CFO, Senior Vice President (Finance) and Vice-President (Finance) of DLF and the three executives were listed as key management persons in the company’s prospectus for the IPO.

“They were also subject to the control of DLF due to their ’employee and employer relationship’. The respective wives held 100% shareholding of Felicite, which in turn held 100% shareholding in Shalika, which in turn held 100% shareholding in Sudipti. Therefore, it has been alleged that DLF never lost control of Felicite, Shalika and Sudipti,” the order noted.

Sebi noted in its order that the purchase of all shares in Felicite were not made by the ‘housewives’ but their husbands and also pointed to the fact that the shares held by the women were only transferred to the wives of other senior management of DLF.

“In my view, it cannot be just a coincidence that Felicite is incorporated on March 26, 2006 with its 100% shareholding held by the wholly owned subsidiaries of DLF, those wholly owned subsidiaries subsequently sold their entire shareholding in Felicite to the ‘Housewives’ of three KMPs who made payments for the purchases made by their respective wives and subsequently, they transfer their entire shareholding to the DHDL (one of the three initial shareholders), wholly owned subsidiary of DLF and the ‘Housewives’ of other KMPs,” the order noted.

SEBI noted that the DLF management had employed a “plan, scheme, design and device to camouflage the association of DLF with its three subsidiaries namely, Felicite, Shalika and Sudipti” and noted that the realty major had actively concealed the filing of an FIR against one of the subsidiaries when it was filing for an IPO. “In the facts and circumstances of this case, I find that the case of active and deliberate suppression of any material information so as to mislead and defraud the investors in the securities market in connection with the issue of shares of DLF in its IPO is clearly made out in this case,” the order noted.

The fact is that SEBI reacted only after the horses had bolted from the stable. Its past conduct shows that the regulator went out of its way to help and promote MCX-SX. SEBI could have denied MCX-SX permission to start an exchange from day one because of non-compliance with its shareholding regulations. Instead, it granted permission to MCX-SX to start a currency futures exchange on the condition that its shareholding regulations-to reduce the holdings of the promoters, Financial Technologies and MCX, to 5 per cent-should be met within a year’s time.

Matrix of Subsidiaries

ANY big corporate house doing business worth billions is playing a game of matrix of subsidiaries and DLF is no exception. It’s a wheel within a wheel. Subsidiaries lend themselves to misuse on two counts. First, plum assets are owned by them primarily for the promoters of the holding company and their associates. In other words, the non-promoter shareholders have no claim on such prime assets. Second, subsidiaries can be used to hide some of the disagreeable assets and liabilities of the holding company. Since the IPO norms of the SEBI require disclosure of material facts relating to both the issuing company and its subsidiaries, DLF had hastily de-subsidiarised these companies by roping in innocent housewives of its key managerial personnel. In fact, the SEBI verdict points out that around that time as many as 288 companies were banished so that they did not legally have anything to do with DLF, though de facto they were all DLF babies. The idea of such wholesale banishment was that these companies holding dubious titles should not spoil the IPO party of DLF. DLF succeeded in its mission—it pulled wool over everyone’s eyes, and walked away with more than `9,000 crore with shares with a face value of `2 issued at `525. A detailed study is required by SEBI on the issue of subsidiaries to be put before Investors and India so everybody knows how a company like DLF is involved in hiding the facts from the very investor who reposed faith in the product and the company.

This conditional grant was extended twice by SEBI, allowing MCX-SX to run its exchange for three years. The relaxations were obviously made because the regulator wished to help and encourage MCX-SX. However, while giving the conditional approval, which was valid till September 15, 2012, SEBI said that the exchange could not launch new products until it complied with the shareholding regulations. But MCX-SX made a mockery of the rules and came up with a capital restructuring scheme which involved its promoters, cutting their stakes to 10 per cent from a combined 70 per cent. In lieu of the capital reduction, the promoters issued themselves warrants that could be converted into equity shares six months after they were sold to investors. SEBI, however, rejected the scheme in September 2010.

Finally, Shah got the clearance to run the stock exchange. As per Abraham’s letter, he was under pressure from the Finance Ministry to grant the clearance. Pranab Mukherjee was the Finance Minister at that time. Shah went to jail and is now out on bail for his involvement in the `5,600-crore scam involving the National Spot Exchange Limited. Although Shah was declared “unfit and improper” to run an exchange, MCX-SX’s Board of Directors is being changed. Why was SEBI silent for such a long time, and did not initiate moves to disband MCX-SX?

One can understand the plight and slow pace of SEBI in the Pearl Agrotech case too. SEBI unearthed the wrongdoings of Pearl Agrotech Corp Ltd (PACL), owned by alleged conman Nirmal Singh Bhangoo in 1998. It took 16 years to track him down. Like many others, Bhangoo didn’t give a damn about SEBI’s notices and PACL chugged along. In the last 16 years, it amassed a wealth of nearly `50,000 crore. SEBI finally asked the company to refund its investors and wind up the operations. This was the biggest crackdown on a large-scale illicit money-pooling scheme. The refund is to take place within three months, with a winding-up and repayment report to be submitted to SEBI within another 15 days, according to a 92-page order by SEBI’s whole-time member, Prashant Saran.

Why merchant bankers should not be punished?

THERE are reports appearing in the newspapers since the day SEBI debarred DLF’s directors saying it is the job of the merchant bankers of the IPO to inform the promoters regarding the anomalies in the Red Herring Prospectus (RHP). A company submitting an RHP should not be punished. It is a joke. The merchant banker is a facilitator to a company which desires to bring an IPO, acts as per the information provided by the promoters. Schedule III of the Sebi merchant bankers’ regulations of 1992 vide its code of conduct for merchant bankers clearly asks them to do everything in their power to ensure that the investors are not misled. The Sebi Disclosure and Investor Protection Guidelines of 2000, in fact, make the merchant banker the lynchpin in the whole IPO exercise. In the DLF case, the merchant bankers to the issue were aware of the existing subsidiaries, yet they opted to not include it in the RHP. The role of Kotak Mahindra Bank was allegedly dubious. Ideally SEBI must consider debarring the company and debarring the merchant banker of the said company from performing professional duties for a fixed period. Punishment should be on a par with that for the company.

The order said that the company mobilised Rs. 44,736 crore till March 31, 2012, and another Rs. 4,364.78 crore between February 26, 2013, and June 15, 2014. “The total amount mobilised comes to a whopping `49,100 crore. This figure could have been even more if PACL would have provided the details of the funds mobilised during the period between April 1, 2012, and February 25, 2013,” it said.

PACL collected this huge sum from 58.5 million customers, more than twice the 22 million demat accounts in the country. Of these, the company was yet to allot land to 46.3 million investors.

In February this year, the Central Bureau of Investigation (CBI) registered a case against the promoters of PACL, and its sister firm, PGF Ltd. This followed an inquiry, which was directed by the Supreme Court, into the allegations of collection of deposits from the public. However, irrespective of the CBI raid and case, PACL promoters and directors, including Bhangoo, Tarlochan Singh, Sukhdev Singh, Gurmeet Singh and Subrata Bhattacharya, went scot-free. It’s a clear case of defiance of law. As it is said, money makes the mare go.

But now the real game will begin. PACL will move the Securities Appellate Tribunal against SEBI’s order. Don’t be shocked if one day a settlement order between PACL and SEBI is quietly announced through a press release that reaches the email inboxes of media offices. Given the weaknesses in the system, it remains to be seen how SEBI will fight a company that still has thousands of crores of rupees in its kitty.

To conclude, let’s go back to the points we began with. SEBI’s website talks about it becoming the most respected regulator globally. Former Chairman GN Bajpai said that he wanted to ensure there were no issues related to investors’ interests. In fact, the two points go hand in hand. Respect for a stock market regulator comes from its sincerity and honesty to protect the interests of the small investors. But in most cases handled by SEBI, be they consent order, relaxations, or actions, the small investor is the biggest loser.

In the DLF case, there was no mention of how to compensate the investors who participated in the over Rs. 7,000-crore IPO based on false and misleading information. In the case of R-ADAG, what was the protection for those who purchased the shares of the group companies when there was blatant insider trading by the promoters? In the case of MCX-SX, the government has decided to take over Financial Technologies, one of its promoters. But how will this help the affected and aggrieved investors? Like in the case of Satyam, the small investor will not only lose money but also faith in SEBI.

Recent Posts

Related Articles

Cover StoryTablighi Jamaat : 1000 years of revenge

Written by Vivek Mukherji and Sadia Rehman Two contradictions are evident. Through April...

ByVivek Mukherji and Sadia RehmanMay 5, 2020Cover StoryWINDS OF CHANGE

Written by Gopinath Menon ADVERTISING : The name itself conjures up exciting images....

ByGopinath MenonMarch 4, 2020Cover StoryTHE ECONOMIC ROULETTE WHEEL

Written by Alam Srinivas THE wheel spins, swings, and sweeps in a frenzied...

ByAlam SrinivasMarch 4, 2020Cover StorySYSTEMS FAILURE, SITUATION CRITICAL

Written by Vivek Mukherji ONE of most quoted allegories of incompetence for a...

ByVivek MukherjiMarch 4, 2020 - Governance

- Governance