NATIONAL Stock Exchange (NSE) has in the recent past been in the news for all the wrong reasons. A stock exchange has two primary functions to perform. One, to provide a platform to enable investors to buy and sell securities in the most efficient and transparent manner. Two, it essentially functions as the ground level regulator to ensure that the market functions smoothly wherein all participants follow the rules of the exchange to avoid any default or crisis and protects the interests of investors, especially small or retail investors who are considered more vulnerable than other participants. Unfortunately, the exchange has not only been found wanting on both these counts, but has indeed been indulging in what can best be described as unbecoming of an exchange of the stature of NSE.

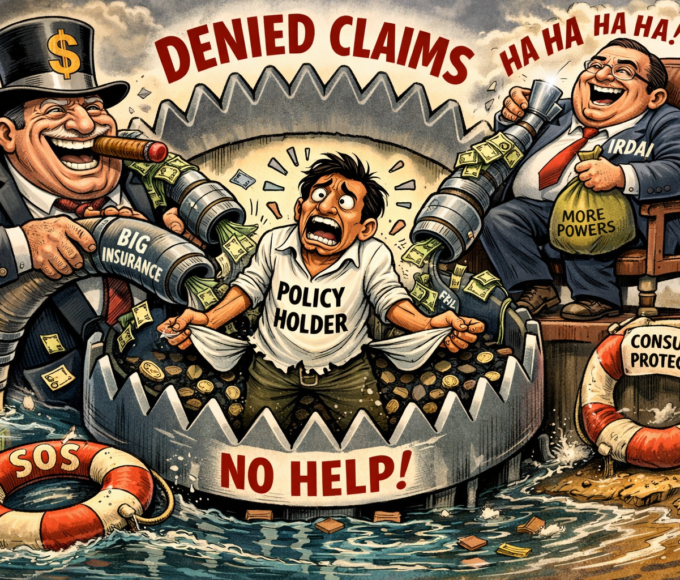

The forensic audit carried out by SEBI has found that NSE gave preferential access to some brokers on its algorithmic trading platform by allowing them to co-locate their servers on the exchange’s premises so that they can be the first to connect to the specific servers and enabled them to profit unfairly or illegally. This is a grave issue and serious governance lapse where the system is being manipulated to put one set of brokers at an advantageous position at huge cost and peril for other brokers and investors at large. In the same way, NSE has been found to be playing against the investors whenever they complain against any member broker by not only protecting the erring member brokers but also not allowing the investors to get any relief from the so-called IEPF (Investor Education and Protection Fund) that has huge funds meant to carry out investor education activities and compensate investors whenever any trading member defaults in payment.

Though a large number of complaints are received against NSE by various Investor Associations (IAs) that have never been resolved, a recent complaint made to the Society for Consumers’ & Investors’ Protection (SCIP) has proved beyond doubt that there is something seriously wrong with NSE as a stock exchange and ground-level regulator. One Mr Ashok Kaushik, who recently retired from the Delhi University along with his wife Geeta Kaushik, complained against trading member (TM) Moongipa Investment Ltd (MIL), when they found that delivery instruction slips issued for transfer of shares to Kotak Mahindra were dishonoured. TM failed to transfer the shares as it had already misappropriated the same to cover losses incurred due to personal deals by its directors (members of Aggarwal family).

Proceedings were referred to NSE and BSE by SEBI. Both the exchanges offered arbitration and the same was acceded to the investors as the Arbitration and Conciliation Act has been enacted to speed up resolution of disputes without hassles of litigation in courts. Arbitrators appointed by NSE and BSE awarded the amount arrived at in favour of these two investors. The Defaulter Committee Section (DCS) of BSE, without additional probe, honoured the award announced by its Ld. Arbitrator immediately.

On the other, the DCS of NSE refused to honour the award (NSE/ARBN/CM/D-0031/2015/0091/2016 dt. 28.01.2016 of Rs. 536,151.75 and NSE/ARBN/CM/D-0032/2015/0089/2016 dt. 28.01.2016 of `648,085.25) by citing an arbitrary and outdated directive adopted way back on July 2, 2010, that has never been put in the public domain. Moreover, the DCS requisitioned information relating to the investor’s Demat Account with HDFC, bank statements and trade data, post announcement of award by its Ld. Arbitrator. This has raised some very interesting questions/issues about the functioning of NSE.

- NSE has either not been enforcing rules and regulations that have been put in place to protect the interests of investors and avoid any systematic risk to the market, or it has been allegedly accommodating defaulting broker members for reasons best known to the top brass of the exchange. The exchange has not been able to enforce one simple rule that the actual settlement of funds and securities shall be done by the member at least once in a calendar quarter or month, depending on the preference of the client (Exchange Circular NSE/INSP/13606 dated December 3, 2009). Had this rule been followed, clients like Mr Kaushik would not have suffered a loss of this magnitude. NSE Auditors never assured zero quarterly trading balance as the defaulter TM kept Mr Kaushik’s holding in trading account for years with malafide intention.

- Since NSE has said that it adopted DCS directive way back in 2010 to refuse payment to the victimised investor, then why did it refer the matter to the arbitrator. Further, even the directive is grossly ill-conceived and arbitrary and will not pass the simple rule of natural justice and equal opportunity to the suffering investors. The directive states: “Where the claimant has failed to withdraw the credit balance and/or securities from the defaulter for a substantial period of time without trading activity, or substantially meager trading disproportionate in value to the quantum of the trade balance, or securities lying with the defaulter” is ascertained as loan transaction. On the one hand, this gives an impression that all those who do not frequently trade and buy stocks for long term (something that most of the investor education programmes of the exchange itself propagate) are not considered active investors, or the exchange itself wants to push the investors to be traders or speculators. The guideline is not only arbitrary, but is grossly in favour of delinquent fraudster brokers and is apparently redundant in India where regulations pertaining to stock exchanges and their brokers are still evolving.

- The above quoted assertion/guideline is not in public domain as also the other leading exchange—BSE—has no such guidelines made to put the investor at a gross disadvantage vis-a-vis trading members. Rest assured, if NSE makes these so-called guidelines public, it is bound to witness mass exodus of long term investors from the equity market—something that will negate the serious efforts made by the present dispensation to encourage people to invest their savings in financial assets instead of physical assets such as gold or real estate.

- The implication of the above guideline (treating LT holding as loan) may have serious inference and is fraught with grave repercussions like it will empower the broker/custodian to forfeit/sell shareholdings without consent of investors; banks will seize deposit in PPF A/c (15 years scheme) and jewellery and assets in lockers; mutual funds will enrich their managements by insider trading and unscrupulous trading. Such a scenario is truly frightening.

- The investor is a retired teacher of Delhi University and made these investments while in service to meet his and his family’s future needs. He never speculated in stocks and invested for the long term not knowing that the TM he so trusted will defraud him by keeping his holdings in the trading account without his express consent.

- Interestingly, the TM, Moongipa Investment Ltd (MIL), managed by Aggarwal family, was declared defaulter by SEBI on September 10, 2015. NSE declared MIL defaulter at its own leisure on November 9, 2015. The investor lodged the complaint with SEBI on August 14, 2015, immediately on MIL’s refusal to honour DIS in favour of Kotak Mahindra. The investor had been regularly paying annual maintenance charges till 2015-16 as he planned to sell the said investments after his retirement to make arrangements to buy a house. NSE seized the records/computers/server of defaulter TM in August 2015 itself. The seizure details are with NSE only and it is quite possible that the holdings of the investor had been part of seized holdings which were realised by NSE later on.

- NSE has till date taken no perceptible action against the TM as its directors are still leading comfortable lives, but duped investors like Kaushiks have been made to suffer. Also, the IEPF is allegedly not being used for the very purpose it has been set for.

- The simple act of NSE sidelining the Ld. Arbitrator’s Award on the basis of an unjust and arbitrary guideline despite incontrovertible proof against the fraudster not only proves the opaqueness of the exchange’s functioning but it has deprived investors like Kaushiks of their hard-earned money who made investments out of their post-tax earnings, believing in the solid regulatory mechanism of the exchange. This act of the exchange has and will embolden wrongdoers and fraudster brokers if the large number of complaints received against NSE brokers by SCIP is any indicator.

The exchange, that has plans to go public soon, has no robust system in place to redress investors’ grievances—those very investors are the reason for the huge profits the exchange is making every year. It seems that investors investing in the IPO of NSE run the same risk of no redressal as also the risk that the goose that lays the golden eggs, for the exchange may not prefer to stay with it the moment any worthwhile competition comes into being.