- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

Recent Posts

© Copyright 2007 - 2023 Gfiles India. All rights reserved powered by Creative Web INC. Dr GS Sood, Business Editor gfilesWritten by GS Sood

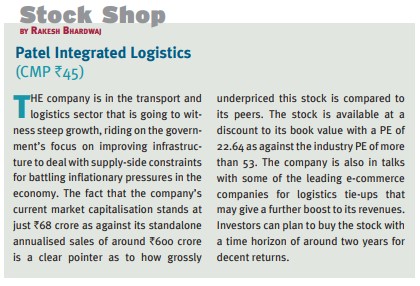

Dr GS Sood, Business Editor gfilesWritten by GS SoodTWO recent events vindicate my view on the market being in a secular bull run with intermittent corrections coming in. One, the rating upgrade and the other, the Supreme Court’s cancellation of allotment of coal blocks. The market may have run ahead of fundamentals but the uptrend will continue to sustain, more due to earnings’ expansion than due to expansion of earnings’ multiples. The fundamentals, of course, have started to catch up, as reiterated by an upgrade of India’s sovereign rating by international rating firm Standard & Poor (S&P) from negative to stable. It is widely believed that the upgrade had been delayed by S&P since the country continued to receive unhindered FII flows that invested more than US$30 billion up to the month of August in this calendar year. However, the rating upgrade will have a decisive impact on further flows since some of the larger funds wait for an official upgrade before they decide their investment strategy. India is the best stock market story in the world and there are not too many who can match the growth, stability and returns at this point.

The steep correction like the one that followed the cancellation of coal blocks by the Supreme Court provides an excellent buying opportunity of quality stocks. Such corrections may happen more frequently, but investors need not get perturbed by them and, rather, should use them to reshuffle their portfolios to add quality stocks. Such a correction may again be expected if the BJP doesn’t do well in the Maharashtra and Haryana assembly elections. Despite all this, India today looks more attractive than most emerging market peers and is more likely to ride out the next global shock that may emanate from an increase in US interest rates, Russian adventurism or political turmoil in West Asia. The political stability post-Narendra Modi’s election, coupled with developments such as declining oil and gold prices and on-track fiscal correction has helped a lot. However, the country has no reason to be complacent and should continue to work towards taming inflation, reviving the investment cycle,strengthening the banking sector and pursuing key structural reforms.

The aim to keep the fiscal deficit at 4.1 per cent of GDP compared to 4.5 per cent in the last fiscal year looks to be doable due to softening oil and commodity prices and the likely successful sale of assets by the government due to the current buoyancy in the stock market. The Cabinet has already approved stake sale of Coal India, ONGC and NHPC.

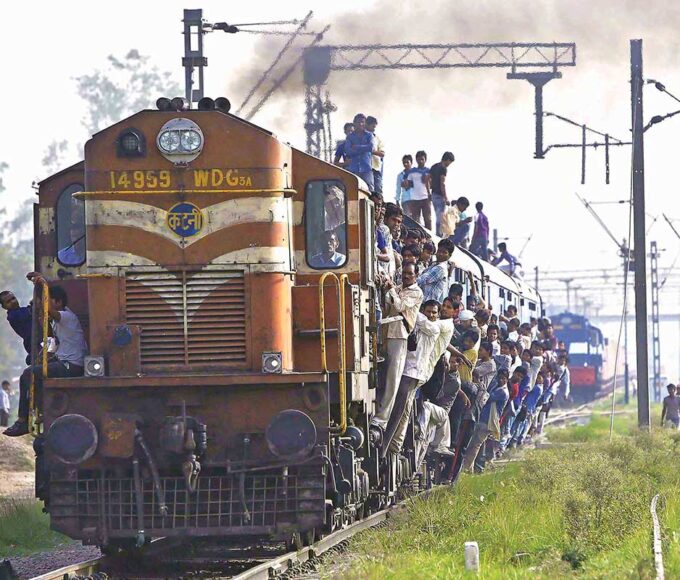

The Make India programme launched by the Prime Minister is likely to give a new thrust to the economy, helping it increase the share of manufacturing in the GDP. It will not only lead to employment-driven growth but also improve the ease of doing business in India. The GDP recovery will soon get reflected in corporate earnings, that will start improving by the second or, at best, third quarter of this fiscal year. Investors waiting on the sidelines will do well to use any future correction that may happen due to mega FPOs/IPOs of PSUs to add good growth stocks that may give decent returns in a couple of years from now.

The author has no exposure in the stock recommended in this column. gfiles does not accept responsibility for investment decisions by readers of this column. Investment-related queries may be sent to editor@gfilesindia.com with Bhardwaj’s name in the subject line.

Recent Posts

Related Articles

Stock DoctorStock Doctor : In a sweet spot

Written by GS Sood THE market is witnessing an unprecedented bull run post...

ByGS SoodApril 11, 2017Stock DoctorStock Doctor : Happy times to continue

Written by GS Sood THE Union Budget 2017 can well be viewed as...

ByGS SoodFebruary 14, 2017Stock DoctorStock Doctor : Shift to financial assets

Written by GS Sood THE market is likely to witness increased volatility as...

ByGS SoodJanuary 14, 2017Stock DoctorStock Doctor : Opportunity to buy

Written by GS Sood THE Prime Minister who believes in inclusive growth with...

ByGS SoodDecember 17, 2016 - Governance

- Governance