- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

- Cover Story

- Governance

- Globe Scan

- Corruption

- State Scan

- Talk Time

Recent Posts

© Copyright 2007 - 2023 Gfiles India. All rights reserved powered by Creative Web INC. Dr GS Sood, Business Editor gfilesWritten by GS Sood

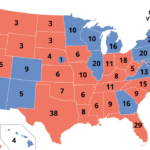

Dr GS Sood, Business Editor gfilesWritten by GS SoodBY the time you will read this column, the election process would be well under way. What is encouraging about the way this election is being fought is the dominance of issues relating to management of the economy and governance instead of caste and religion. How the market reacts may be a different matter altogether. In 2009, a UPA government minus the Left presented the best scenario and we know what happened. In 2004, the Left-supported UPA probably presented the worst scenario but what followed were some of the best years. Whereas the NDA government formed in 1999 did not produce encouraging results, the most fragile 1996-98 United Front government gave India some of the best remembered reforms and fastest growth during the 1990s.

Frankly speaking, the market is likely to keep going up regardless of the shape of government though there may be some temporary blips. What worries me is the high expectations of the investment community from a Modi government since it raises the risks of disappointment as well. A sharp turnaround in current account deficit, stable currency environment, improving macro indicators, bottoming corporate earnings downgrades, signs of reviving investment cycle and the possibility of a strong government post-elections have all led the markets to witness the current exuberance. That calls for caution by investors for even if the elections produce the best result of an NDA government led by Modi, it may still correct sharply due to the thumb rule of ‘buy on rumour (expectation) and sell on news (result)’. Investors should, therefore, keep booking profits and hold some cash for stability to return after the polls. Otherwise too, studies indicate that there is hardly any correlation between economic numbers and market performance. What matters most is sentiment and the liquidity to support that sentiment. Moreover, those expecting overnight changes from a Modi government may be in for a big disappointment because of the temperamental difference between Modi and Vajpayee when it comes to managing a coalition government with an added disadvantage of a lack of majority in the Rajya Sabha.

Stock Shop

BY RAKESH BHARDWAJGujarat State Petronet Ltd (CMP Rs. 65)

THOUGH the December quarter results were not very encouraging, the LNG capacities scheduled to come up by early FY15 could give the much needed fillip to GSPL’s gas volumes and substantially increase its long-term earning visibility. The Petroleum & Natural Gas Regulatory Board (PNGRB) raised the tariff for GSPL’s 2,239km high pressure gas grid network by 11 per cent to Rs. 26.58 per mmbtu, effective from July 2012 as per the order of Honourable Appellate Tribunal for Electricity (APTEL) dated January 6, 2014. This may get translated into revenue increase by Rs. 82 crore (post-tax impact of Rs. 0.95/share of FY15F EPS) and retrospective gains of Rs. 1,400 crore for the period July 2012-March 2014 (post-tax impact of Rs. 1.6/ share of FY15F EPS). An excellent bet on the possibility of NaMoled NDA coming to power and an otherwise safe bet.

More than national politics, global factors have started playing a dominant role with most of the major booms or bursts being caused by global events. The Fed’s trimming of the monthly bond buying programme may dry up easy liquidity by December this year followed with a rise in US interest rates that may witness repatriation of money by institutional investors. However, a gradual rate increase may not have major impact on India. A slowdown in China may also aid India’s cause due to softening commodity prices but the geopolitical risk emanating from Ukraine is a cause of concern.

Also, newer risks may emerge due to uncertain weather caused by the El Nino phenomenon. Hailstorms have already caused crop failure of about `12,000 crore. A bad monsoon could reverse the downtrend in retail price inflation which may not only delay rate cuts but also impact rural demand adversely. While the IIP has shown a steady decline, the Food Security Bill and Pay Commission recommendations may make the fiscal target slip further. The declining savings rate, companies with too much debt, piling up of bad loans especially with public sector banks, messed up public finances and imminent political risks are the factors that investors need to look at while investing in the Indian market.

The author has no exposure in the stock recommended in this column. gfiles does not accept responsibility for investment decisions by readers of this column. Investment-related queries may be sent to editor@gfilesindia.com with Bhardwaj’s name in the subject line.

Recent Posts

Related Articles

Stock DoctorStock Doctor : In a sweet spot

Written by GS Sood THE market is witnessing an unprecedented bull run post...

ByGS SoodApril 11, 2017Stock DoctorStock Doctor : Happy times to continue

Written by GS Sood THE Union Budget 2017 can well be viewed as...

ByGS SoodFebruary 14, 2017Stock DoctorStock Doctor : Shift to financial assets

Written by GS Sood THE market is likely to witness increased volatility as...

ByGS SoodJanuary 14, 2017Stock DoctorStock Doctor : Opportunity to buy

Written by GS Sood THE Prime Minister who believes in inclusive growth with...

ByGS SoodDecember 17, 2016 - Governance

- Governance